ASC 842 Software

A solution specific to your needs

Lease accounting has never been easier

Intuitive User Interface

Designed for accountants in mind

When excel is the alternative, the last thing you want your lease accounting software to be is a glorified spreadsheet. You want the data to be exportable to Excel, yes; however, you want everything to be neatly organized, easy to find and automated. Too many systems are overly complicated, difficult to use, and take a considerable amount of time for your team to learn. We are different.

To achieve this, we created an entirely new user experience explicitly geared towards accountants; this required building an accounting software entirely from the ground up. Our goal was for the user interface to guide you intuitively, which involved analyzing the steps the standard takes and using it as the base for how the software is to be used. It is a breeze to navigate through the life cycle of a lease, from initial recognition to modifications, to reporting.

Based on the results of our last customer satisfaction survey, we have achieved this feat. All of the respondents were able to use the software with little to no training. But instead of reading about it, why not try it for free. You will soon find that it is so easy to use that even non-accountants can traverse the application with ease.

Automate your lease accounting

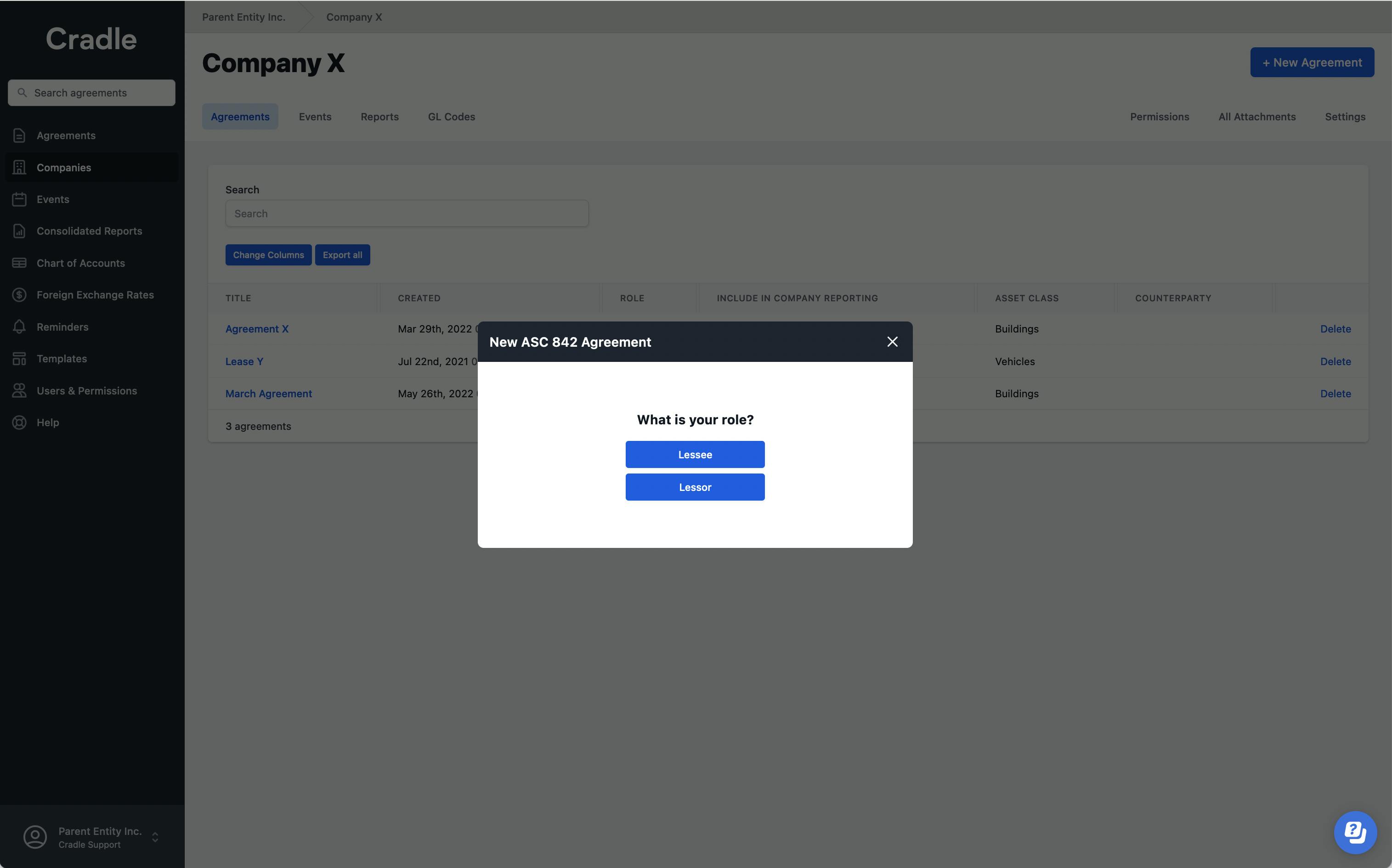

Lessee & Lessor

Whether you're the Lessee, Lessor, or both, Cradle has got you covered. It's no different with the classification of the lease. By using Cradle as a lessee, you don't have to worry about the nuances between calculating an Operating and Finance lease. Are you a lessor with a considerable amount of Sales-type or Direct Finance leases? The accounting isn't easy. With Cradle, it's done in seconds.

Sub-lease accounting? We've got that too.

Cradle has been engineered to handle all permutations that can occur when accounting in compliance with ASC 842.

Journals

The debits and credits

Imagine doing accounting where you don’t have to concern yourself with the debits and credits—this is the benefit of using accounting software like Cradle. Once you input the contractual data, Cradle can output the journal entries. All while supporting even the most esoteric and irregular payment schedule, reporting cycle, or time-frames. Doing it for the entire lease portfolio becomes another click.

Related lease accounting journal entries are taken care of, including asset retirement obligations, security deposits, leasehold improvements, and others as required when accounting for ASC 842.

Financial reporting at the month-end will be your new favourite task, no matter the size of your lease portfolio.

Modification Accounting

Keep track of all the changes

The most arduous task of the FASB ASC 842 lease standard is the accounting of contractual changes. At first, it might seem that this can be done in your favourite spreadsheet software. However, soon it becomes a web of enormous spreadsheets, overly convoluted file systems, and an overburdened accountant. Even simple lease management becomes unnecessarily tricky due to the disorganized lease data.

Once an agreement is added to our lease management solution, all these issues become a thing of the past. All of the agreements' lease components are separated and organized in chronological order. Hard copy documents are directly attached to each contract. And, most importantly, adding a modification becomes as easy as selecting the lease component you want to modify and adding the change. Our system is so advanced that you can even modify a modification; not that you would need to, but you can do it.

Made a blunder and added a fixed payment amount? It only takes a few clicks to correct it. We are so proud of our intuitive user experience for modifications that we encourage you to compare and contrast it to our competitors' in this space.

As you might have guessed, we support any modification as applicable under the lease accounting standard: e.g. impairment of the right-of-use asset, decrease in scope, lease reclassifications from an operating lease to a finance lease, and many more. You can try them out for free by signing up for our free trial. Finally, if you run your journals or financial reports before a modification event, those journals reflect the pre-existing contractual details at that time. Meaning you can run any reports retroactively without worrying whether you need to adjust your modifications.

Foreign Exchange Accounting

Remove the complexity

Lease accounting is complex enough without the added layer of accounting for a lease in a foreign currency. By doing your lease accounting in Cradle, this headache is completely removed.

It's so simple in Cradle. Enter your applicable foreign exchange rates, and our software will do the rest.

Disclosures

Everything you need to report

Traditionally an afterthought, disclosures might be the last thing an accountant thinks of when adhering to the accounting standards. Yet it can be one of the more time consuming financial statements.

Transitioning to an accounting-software like Cradle, this financial statement can now truly become an afterthought.

The disclosure report includes everything you need to be in compliance with ASC 842, including:

- Weighted average discount rate split by finance and operating leases

- Weighted average remaining lease term split by finance and operating leases

- Variable lease costs incurred for the period

- Right of use assets obtained in exchange for new finance leases' liabilities

- Right-of-use assets obtained in exchange for new operating leases' liabilities

- Interest incurred on finance leases' liabilities

- Amortization incurred on the right-of-use assets in relation to finance leases' liabilities

- Non-lease component expenditures for the period

- Maturity analysis of upcoming contractual cashflows

Financial Reports

Specific to your reporting requirements

Some lease solutions advertise that they are compatible with the 4-4-5, 5-4-4 and 4-5-4 calendars; others even have it on their roadmap of future updates. Yet, from your perspective, how could they not? It is, of course, one of the most common requirements for many firms in retail and manufacturing. And you might ask: "Why am I limited in the first place?". If the calculations are done to the day, then why can't one use any calendar they see fit? Why are you limited to the choices of the software vendor? What if they don't offer the calendar structure you use for your reporting?

Because all of our numbers are calculated to the day, we are truly agnostic when it comes to reporting calendars. You can run reports for any period. Not just 4-4-5, 5-4-4, 4-5-4, but even 2-2-3-5; we support any structure. Because our numbers are always done to the day, technically, we offer an infinite number of options.

This flexibility applies to all our reports, whether you are looking at the balance sheet, income statement, cash flow statement or even disclosures. You can also use it to forecast in the future. Whether you need to look at the future impact of the lease liability and ROU asset, the breakdown of the interest vs principal, or maybe the split between financing and operating, it can be done for any period.

Of course, all of this functionality applies to both individual agreement reports as well as company-wide. Because when you are managing an extensive lease portfolio under ASC 842, the issue isn't just the one agreement, it's all of them.

Custom Fields

Keep track of non accounting data

Many lease accounting software providers advertise themselves as being built for specific niches, e.g. real estate or airlines. The layout and structure of their lease agreement fields are set to a stringent design that you must adopt to use their solution. However, you are not your competitors; you have your own specific needs. Your structure. Your processes. Just because someone else decided they want to do it a certain way does not mean it will work for you.

We understand that you want to do it your way. Therefore our lease accounting solution is as flexible as possible. We only provide you with the fields you need for FASB ASC 842 compliance. The rest of the lease agreement can be configured in any way you see fit. You can add a multitude of different sections and fields, which you can then search, sort and export. Our software is not made for company XYZ; it's made for your company.

User Permissions

Accessible by your entire team

Password protecting spreadsheets—which can be quite insecure, i.e. passwords like "march2020" come to mind—is no longer needed. Instead, you can assign specific user permission roles. Do you need to give someone temporary read access? You can do that. Do you have a foreign entity that is managed by an external finance team? Why not add a superuser to that company and let them handle it all.

Our platform mirrors that of a corporate structure, i.e. parent-subsidiary. Every subsidiary can manage individual user access. Intuitive and straightforward, the way software should be.

Custom Reporting

Create reports you want

The information presented in a set of financial reports is what is required to comply with ASC 842. However, it doesn't provide a complete picture of your lease portfolio.

We understand this, and that's why we offer custom reporting. This allows you to compare and contrast different data sources from your lease portfolio. This can be any data input such as future events like expiry dates, income statement items such as the amortization expense incurred, or even custom fields created in Cradle. You can even filter the report by asset class, company, and even the currency of the agreement.

Transform your financial reporting

Features

Centralize, manage, and automate your lease accounting.

- Engineered compliance

- Manual effort is the number one bottleneck in the financial close process. Remove this problem with Cradle and have a unified, automated, and continuous solution for your lease accounting.

- Software you can count on

- No matter the agreement terms or the type of modification, you can rely on Cradle. Some companies claim they have tested thousands of scenarios. Unfortunately, that is ineffective; it's your specific scenario that counts. Here at Cradle, we've built the solution from the standards' logic, ensuring that our engineers follow solid programming practices and test-driven development.

- Cloud-based solution

- Collaborate with multiple teams in multiple locations. Drive accountability through visibility and allow access to critical information only when it is needed.

- Integration

- Complement your current accounting system with Cradle. Seamlessly recreate your general ledger environment in Cradle and export the data.

- Consolidated reporting

- Run reports and manage your portfolio at the agreement, company or consolidated level. Have a portfolio across multiple subsidiaries and currencies? Not a problem.

- Foreign exchange accounting

- No matter the scenario, enter your applicable foreign exchange rates, and all foreign-dominated leases will be converted to the applicable currency in accordance with ASC 830.

- Lease management

- When running a business, we understand that accounting is only part of the story. Capture additional information critical to your portfolio with custom fields. Manage all events in one place and set up email reminders. Never miss an important date again.

- Centralized documentation and search

- Attach and store all supporting documentation in one secure central location.

Calculation methodology

Attention to detail is of the highest importance to us at Cradle, and it starts with the numbers. One of the most fundamental calculations to comply with ASC 842 has to be the present value calculation. This calculation can be done using different day count conventions.

Microsoft Excel has a day count convention, and so does every other accounting software solution. Excel uses Actual/365 fixed, which means it slightly miscalculates interest on leap years. As mentioned above, we really care about the details, and hence we offer the user a choice. In addition to Actual/365 fixed, we also provide Actual/Actual ISDA. Want to match your Excel numbers? Use Actual/365 fixed. Want to be accurate to the cent? Use Actual/Actual ISDA. As far as we know, we are the only service provider to offer such exactitude.

Need more granularity? You can look at all the numbers by exporting them to a CSV file.

Implementation services

We know that switching to or implementing new processes can be a daunting task. Therefore we have partnered with Big 4 firms across the globe to ensure your transition is as smooth and easy as possible.

You can decide how hands-on, or off, you want to be. Want to send us your leases, log into Cradle and have it all—even the accounting judgements—ready? We can do that. ASC 842 compliance has never been easier.

Data migration

Data migration is the process of moving your leases from one location to another, one format to another, or one application to another. It includes digitizing a hard copy of a contract, moving from Excel to a full-fledged lease accounting solution like Cradle or, moving between different service providers.

We understand that moving data to a new system can be a significant and tedious undertaking. To make your transition as smooth and seamless as possible, we offer several ways to help with your migration.

You can:

- Do it yourself, with minimal help from us.

- Let us do all the work, onboard your current hard copy agreements, and extract the key lease accounting information

- If you already have it in Excel, provide us with your spreadsheets and let us do the rest, we can even add the applicable top-up journal entries.

- Get our engineering team come up with a custom solution—this is the preferred way to migrate if you have an unusually large amount of leases. Our data engineers have considerable experience dealing with large data sets and can turn an ordinarily cumbersome task into a cost-saving opportunity.

Customer success

Whether you are a small private company or a large public company, we want to provide you with the best possible support, because your success directly correlates to our success as a company.

If you hit a roadblock, for whatever reason, we provide knowledgeable 24/7 customer support—just ask our current customers! We have teams located around the globe with qualified accountants at hand to help you navigate this tricky new accounting standard. That’s in addition to a plethora of help material—which includes guides and videos—on how to use Cradle and accomplish your lease accounting tasks with ease.

Lease management and administration

With the material impact the new lease standard can have on a set of financial statements, ensuring your lease information is up to date is paramount. However, in many organizations, lease management is not only contained within the finance team. Much time can be spent on communication between different branches of the company. With Cradle's easy to use UI that has a clear divide between accounting and non-accounting inputs, you can give different teams access and collaborate more efficiently without having to spend much time on training.