GASB 96 Guide

Where to start

GASB 96 is the new accounting standard for IT software subscriptions. The accounting standard specifically refers to these arrangements as Subscription-Based Information Technology Arrangements (SBITA).

Given the increasing popularity of these arrangements where a government organization can benefit from IT software but is not required to purchase the software outright nor have a perpetual subscription. These arrangements are usually provided via the cloud and all that is required to access the software is an internet connection.

What Has Changed

Now for any Subscription-Based Information Technology Arrangements (SBITA) except short term arrangements (more on that later), the contract will now be brought onto the balance sheet. This is very similar to the accounting under GASB 87 for a lease.

Now at the commencement of the subscription term a government should recognize a subscription liability and intangible right to use assets also known as the subscription asset.

In other words your subscriptions come on the balance sheet. If a government has a Netflix subscription, that should now be recognized as a subscription liability and asset.

Improvements to Financial Reporting

First, the Statement is looking to enhance the relevance and reliability of a government’s financial statements by requiring a government to report a subscription asset and subscription liability for a Subscription-Based Information Technology Arrangements (SBITA) and to disclose essential information about the arrangement.

Second, the new accounting standard will reduce diversity and improve comparability in financial reporting by governments. The new disclosures will allow users to understand the scale and important aspects of a government’s SBITA activities and evaluate a government’s obligations and assets resulting from SBITAs.

Effective Date and Transition

GASB 96 is effective for fiscal years beginning after June 15, 2022, and all reporting periods thereafter. Early adoption is encouraged.

What does that mean? Organizations with a calendar year of December 31, you will apply the accounting standard from January 1, 2023.

Scope of GASB 96

So what contracts are in scope of the new accounting standard?

The standard first outlays the arrangements that this standard does not apply to. As per GASB 96.4

a. Contracts that convey control of the right to use another party’s combination of IT software and tangible capital assets that meets the definition of a lease in Statement No. 87, Leases, in which the software component is insignificant when compared to the cost of the underlying tangible capital asset (for example, a computer with operating software or a smart copier that is connected to an IT system)

b. Governments that provide the right to use their IT software and associated tangible capital assets to other entities through SBITAs

c. Contracts that meet the definition of a public-private and public-public partnership in paragraph 5 of Statement No. 94, Public-Private and Public-Public Partnerships and Availability Payment Arrangements

d. Licensing arrangements that provide a perpetual license to governments to use a vendor’s computer software, which are subject to Statement No. 51, Accounting and Financial Reporting for Intangible Assets, as amended.

The Definition of a Contract that Meets the Requirements of SBITA Arrangement

To identify a contract that in scope of GASB 96 and a SBITA arrangement must meet the following definition of the accounting standard which is outline in paragraphs 6 - 8:

6. For purposes of applying this Statement, a SBITA is a contract that conveys control of the right to use another party’s (a SBITA vendor’s) IT software, alone or in combination with tangible capital assets (the underlying IT assets), as specified in the contract for a period of time in an exchange or exchange-like transaction.

7. To determine whether a contract conveys control of the right to use the underlying IT assets, a government should assess whether it has both of the following:

a. The right to obtain the present service capacity from use of the underlying IT assets as specified in the contract

b. The right to determine the nature and manner of use of the underlying IT assets as specified in the contract.

8. SBITAs include contracts that, although not explicitly identified as a SBITA, meet the definition of a SBITA in paragraph 6. That definition excludes contracts that solely provide IT support services but includes contracts that contain both a right-to-use IT asset component and an IT support services component.

Short-Term SBITAs

Paragraph 13 defines short-term subscription-based information technology arrangements (SBITAs) as those with a maximum possible term of 12 months or less, including any options to extend, except for cancellable periods.

For SBITAs with cancellable periods, the maximum possible term is the non-cancellable period.

Paragraph 14 states that a government should recognize short-term subscription payments as expenses based on the payment provisions of the SBITA contract. Assets should be recognized if subscription payments are made in advance or a liability if payments are to be made subsequent to the reporting period. However, no outflow of resources should be recognized for the period during which the SBITA vendor grants the right to use the IT assets free of charge.

Contract Components

The government may enter into contracts with multiple components, such as subscriptions and non-subscription components, or contracts with multiple underlying IT asset components.

If a contract contains both a subscription component and a non-subscription component, the government should account for them separately unless an exception applies.

If there are multiple underlying IT asset components with different subscription terms, each component should be accounted for as a separate subscription component unless an exception applies.

The contract price should be allocated to the different components based on observable information, such as stand-alone prices, and professional judgement.

If a contract does not include prices for individual components or if the prices appear to be unreasonable, the government should use professional judgement to allocate the contract price.

If it is not practicable to determine a best estimate for price allocation, the government should account for those components as a single SBITA. If multiple components are accounted for as a single SBITA, the accounting should be based on the primary subscription component.

For more information, refer to paragraphs 44 to 49.

Initial Recognition

As per paragraph 15 at the start of a subscription term, the government should recognize a liability and an intangible asset called the subscription asset, unless it's a short-term subscription. The subscription term begins when the government gains control of the right to use the underlying IT assets, and at that point, the subscription asset is considered to be in use

Initial Recognition - Subscription Liability

Paragraph 16 states A government initially should measure the subscription liability at the present value of subscription payments expected to be made during the subscription term.

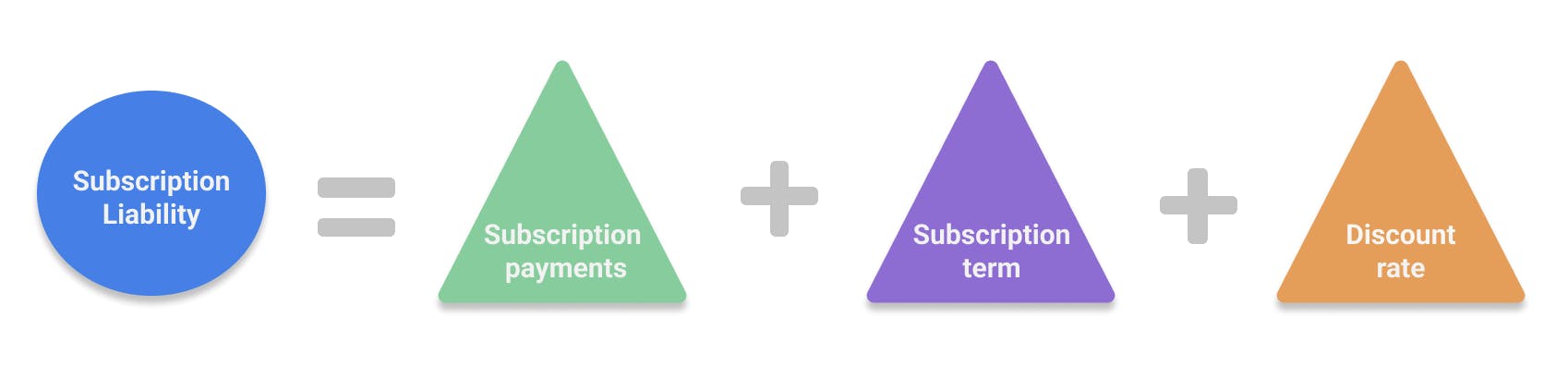

The subscription liability consists of three inputs:

- Subscription payments: these are the contractually agreed upon future payments the organization will pay to the vendor

- Subscription term: the most reasonably certain period of time a government expects to use the SBITA.

- Discount rate: the rate used to present value the future subscription payments

Subscription payments

One of the key inputs to the subscription liability is the present value of the future subscription payments known at initial recognition. They consist of:

a. Fixed payments

b. Variable payments that depend on an index or a rate (such as the Consumer

Price Index or a market interest rate), measured using the index or rate as of

the commencement of the subscription term

c. Variable payments that are fixed in substance, as discussed in paragraph 17

d. Payments for penalties for terminating the SBITA, if the subscription term

reflects the government exercising

(1) an option to terminate the SBITA or

(2) a fiscal funding or cancellation clause

e. Any subscription contract incentives (as discussed in paragraphs 42 and 43)

receivable from the SBITA vendor

f. Any other payments to the SBITA vendor associated with the SBITA contract

that are reasonably certain of being required based on an assessment of all relevant factors.

The above is information is what a government has at the commencement of the SBITA contract. Future market rent reviews, CPI & LIBOR increases cannot be accounted for at initial recognition as these increases are not known at the commencement of the contract.

Variable Subscription Payments

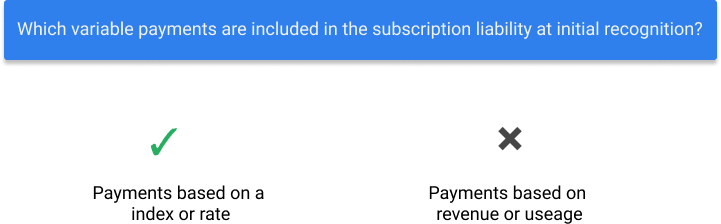

Known future variable payments are included in the initial recognition of the subscription liability.

As per paragraph 17 Variable payments other than those that depend on an index or a rate, such as variable payments based on future performance of a government, usage of the underlying IT assets, or number of user seats, should not be included in the measurement of the subscription liability. Rather, those variable payments should be recognized as outflows of resources (for example, expense) in the period in which the obligation for those payments is incurred.

However, any component of those variable payments that is fixed in substance should be included in the measurement of the subscription liability.

However before you start remeasuring the subscription liability due to a change in the indeed or rate, paragraph 21 clearly states the following – A subscription liability is not required to be remeasured solely for a change in an index or a rate used to determine variable payments.

Subscription Term

One of the key judgemental areas auditors will focus on is the subscription term. The subscription term starts when the the government takes control of the underlying asset. It also includes any rent-free periods provided under the subscription contract.

When determining “reasonably certain”, the organization also takes into consideration if there are any ‘economic incentives’ to exercise or not exercise an option.

The government does not reassess the subscription term unless a significant event or change in circumstances occurs that is within the government’s control.

Here’s the exact definition of from GASB 96 paragraph 9

- Periods covered by a government’s option to extend the SBITA if it is reasonably certain, based on all relevant factors, that the government will exercise that option

- Periods covered by a government’s option to terminate the SBITA if it is reasonably certain, based on all relevant factors, that the government will not exercise that option

- Periods covered by a SBITA vendor’s option to extend the SBITA if it is reasonably certain, based on all relevant factors, that the SBITA vendor will exercise that option

Periods covered by a SBITA vendor’s option to terminate the SBITA if it is reasonably certain, based on all relevant factors, that the SBITA vendor will not exercise that option.

Discount Rate

Paragraph 18 details what subscription payment should be used:

The future subscription payments should be discounted using the interest rate the SBITA vendor charges the government, which may be the interest rate implicit in the SBITA.

If the interest rate cannot be readily determined by the government, the government’s estimated incremental borrowing rate (an estimate of the interest rate that would be charged for borrowing the subscription payment amounts during the subscription term) should be used.

Cradle has a rate implicit in the contract calculator.

Subscription Asset

The above diagram is a great illustration of what values you input into the measurement of the subscription asset. We’ll now go through each of those inputs you need to consider when recognizing your subscription asset on the balance sheet.

As per paragraph 25 A government initially should measure the subscription asset as the sum of the following:

- The amount of the initial measurement of the subscription liability, as discussed in paragraph 16

- Payments associated with the SBITA contract made to the SBITA vendor at the commencement of the subscription term, if applicable

- Capitalizable initial implementation costs as described in paragraph 29b.

- Less any SBITA vendor incentives (as discussed in paragraphs 42 and 43) received from the SBITA vendor at the commencement of the subscription term.

Subscription Liability

This is what you’ve just worked out, the foundation of the is the NPV calculation of the subscription liability. As a result, if your subscription liability is wrong your ROU asset will be too!

Payments Made to Obtain the Contract and Implementation Costs

These are ancillary charges necessary to place the subscription asset into service

Prepayment less Incentives

Incentives received from the vendor at or before the commencement of the subscription term.

Amortization

Paragraph 27 states the subscription asset should be amortized in a systematic and rational manner over the shorter of the subscription term or the useful life of the underlying IT assets. Amortization should begin at the commencement of the subscription term as described in paragraph 15.

The amortization of the subscription asset should be reported as an outflow of resources (for example, amortization expense), which may be combined with depreciation expense related to other capital assets for financial reporting purposes.

Transition Options

If the SBITA starts after transition date, there’s no election to be made and you account for the SBITA following the above steps. For all SBITA that start before your transition date, GASB 86 is very clear of how those contracts should be accounted for.

Prior year numbers should be restated as if GASB 96 has always been applied.

Paragraph 63 explain that changes adopted to conform to the provisions of this Statement should be applied retroactively by restating financial statements, if practicable, for all prior fiscal years presented. If restatement for prior fiscal years is not practicable, the cumulative effect, if any, of applying this Statement should be reported as a restatement of beginning net position (or fund balance or fund net position, as applicable) for the earliest fiscal year restated. In the first fiscal year that this Statement is applied, the notes to financial statements should disclose the nature of the restatement and its effect. Also, the reason for not restating prior fiscal years presented should be disclosed

Required Disclosures

In paragraph 60 a government should disclose in notes to financial statements the following information about its SBITAs (which may be grouped for purposes of disclosure) other than short-term SBITAs:

a) general description of its SBITAs, including the basis, terms, and conditions on which variable payments not included in the measurement of the subscription liability are determined

b) The total amount of subscription assets, and the related accumulated amortization, disclosed separately from other capital assets

c) The amount of outflows of resources recognized in the reporting period for variable payments not previously included in the measurement of the subscription liability

d) The amount of outflows of resources recognized in the reporting period for other payments, such as termination penalties, not previously included in the measurement of the subscription liability

e) Principal and interest requirements to maturity, presented separately, for the subscription liability for each of the five subsequent fiscal years and in five-year increments thereafter

f) Commitments under SBITAs before the commencement of the subscription term

g) The components of any loss associated with an impairment (the impairment loss and any related change in the subscription liability, as discussed in paragraph 41).

Paragraph 61 notes that for disclosure purposes, subscription liabilities are not considered debt that is subject to the disclosure requirements in Statement No. 88, Certain Disclosures Related to Debt, including Direct Borrowings and Direct Placements.

Subsequent Measurement and Modifications

When Does Modification Accounting Occur?

SBITA contract may be amended while the contract is in effect. From a subscription liability perspective, the key inputs that can be modified are:

- Subscription payments

- Subscription term

Does the Modification Result in a Separate Contract

As per paragraph 54 a SBITA modification is a separate contract if both of the following conditions are present:

a. The SBITA modification gives the government an additional subscription asset by adding access to more underlying IT assets that were not included in the original SBITA contract.

b. The increase in subscription payments for the additional subscription asset does not appear to be unreasonable based on (1) the terms of the amended SBITA contract and (2) professional judgment, maximizing the use of observable information (for example, using readily available observable stand-alone prices).

How to Account for a Modification

As per paragraph 20, a government should remeasure the subscription liability at subsequent financial reporting dates if one or more of the following changes have occurred at or before those financial reporting dates, based on the most recent SBITA contract before the changes, and the changes individually or in the aggregate are expected to significantly affect the amount of the subscription liability since the previous measurement:

- There is a change in the subscription term.

- There is a change in the estimated amounts for subscription payments already included in the measurement of the subscription liability (except as provided in paragraph 21).

- Changes arising from amendments to a SBITA contract should be accounted for in accordance with the provisions in paragraphs 54–57 for SBITA modifications and terminations.

- There is a change in the interest rate the SBITA vendor charges the government, if used as the initial discount rate.

- A contingency, upon which some or all of the variable payments that will be made over the remainder of the subscription term are based, is resolved such that those payments now meet the criteria for measuring the subscrip- tion liability in accordance with paragraph 16. For example, an event occurs that causes variable payments that were contingent on the performance or use of the underlying IT assets to become fixed for the remainder of the subscription term.

Paragraph 21 states that a subscription liability is not required to be remeasured solely for a change in an index or a rate used to determine variable payments.

Also, as per paragraph 22 a government also should update the discount rate as part of the remeasurement if there is a change in the subscription term and that change is expected to significantly affect the amount of the subscription liability.

A simple way to understand modification accounting, as mentioned above there has been a change in the payments or terms. If yes, that is a remeasurement of the subscription liability and asset. Just don’t forget if the change in payments results from a change in the index or rate related to the payments, then that will not result in a remeasurement.

Next Steps

So you have a good understanding of how the accounting works, there’s still a lot to do. Your next considerations is how you're going to comply with the new standard. There are two choices, one of doing it manually in excel the other is use Cradle which can automate all compliance.