How Cradle compares to the IFRS 16 illustrative examples

Lucas Russell | 2019-12-15

The number one thing

Before signing up with your lease accounting software solution, some due diligence is encouraged. The most crucial aspect of any lease accounting software is the numbers it produces from the contractual data.

Here at Cradle, we are 100% transparent in calculating the lease liability and, in turn, the right-of-use asset.

To demonstrate the accuracy of Cradle's numbers, we thought there would be no better way to compare to figures produced by the standard setters themselves!

Given the complexity of the standard, The International Accounting Standards Board (IASB) has provided several calculation examples to demonstrate how to calculate the lease liability and right of use asset. This is ideal for Cradle as it allows us to display the work we have done to ensure we comply with these figures to the cent.

Cradle calculation methodology

The purpose of this document is to show you how Cradle’s lease calculation methodology works and how it’s 100% in compliance with that of IFRS, including all journal entries.

The IASB's IFRS 16 illustrative examples provide clarity on judgment areas such as:

- Is it a lease?

- Examples of control

- Substitution rights

- Right to substantially all economic benefits

- Lease term - How to allocate costs to components of the lease

From Cradle’s perspective, we’ll leave those judgemental areas to you.

What we've focused on are those IFRS examples that highlight the calculation methodology prescribed by IFRS. We’ve ensured our numbers are consistent with IFRS’s methodology to the cent unless there’s a logical reason for diverging. The benefit of using Cradle is you can be assured this methodology can be applied to your entire portfolio with no susceptibility to human error.

So we’ll walk you through each applicable IFRS example and compare Cradle’s numbers to those of IFRS, and we’re happy to say Cradle is actually more accurate than those writing the standard!

Day count convention

What is the day count convention? Unless you have intricate experience with investments such as calculating bonds, you're unlikely to have heard of day count conventions. All present value calculations, including those functions in Excel, apply a day count convention.

Investopedia defines it as

In finance, a day count convention determines how interest accrues over time for a variety of investments, including bonds, notes, loans, mortgages, medium-term notes, swaps, and forward rate agreements (FRAs). This determines the number of days between two coupon payments, thus calculating the amount transferred on payment dates and also the accrued interest for dates between payments.

This is important as the day count convention is the foundation of a present value calculation, which is how the lease liability is calculated.

When using Cradle, you can select which calculation method you prefer, Actual/365 fixed or Actual/Actual ISDA. Microsoft Excel uses Actual/365 fixed when using the built-in XNPV function, which means it slightly miscalculates interest on leap years because it assumes that every year is exactly 365 days. However, in Cradle, you can also use Actual/Actual ISDA. This convention takes into account the extra day when applicable. In short, if you would like our numbers to perfectly match yours in Excel, select Actual/365 fixed. If you want that extra accuracy, select Actual/Actual ISDA.

The difference would never be "material" enough to bother auditors, but we offer you the option so you can choose for yourself.

At Cradle, our biggest priority is the numbers we produce are correct. The IFRS examples we think are a great way to show you that our numbers are compliant. We also encourage you to perform your recalculations.

If requested, our demo accounts will come with the below examples to run the financial statement reports for yourself. The below is best read in conjunction with the IFRS Illustrative examples.

Example 13 - Measurement by a lessee and accounting for a change in the lease term

These are the following initial recognition details entered into Cradle:

- Commencement Date: 2019-1-1

- Contract Expiry: 2028-12-31

- Payment Timing: In advance

- Payment Frequency: Annually

- Payment Starts: 1 January 2019

- Fixed Payment Amount: $50,000

- Direct Costs: $20,000

- Lease Before Commencement: $5,000

- ROU Expiry: 2028-12-31

- Discount rate: 6%

Calculation methodology:

- Day count convention: Actual/Actual (ISDA)

- Add interest before/after payment: auto

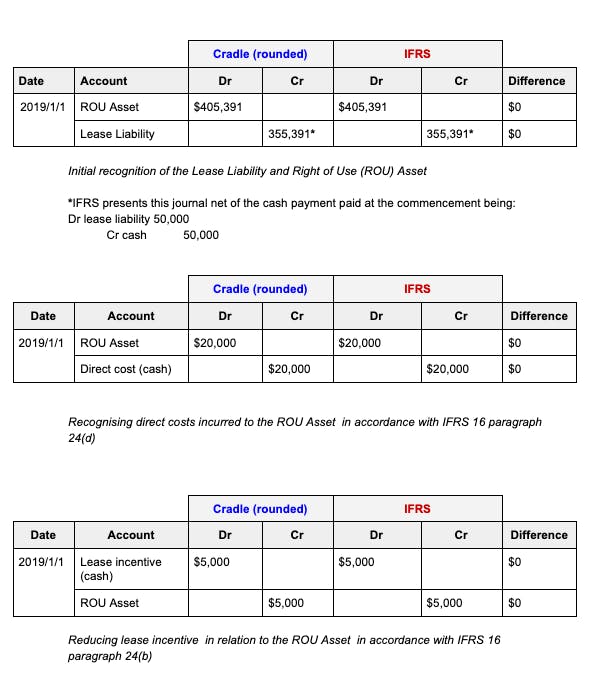

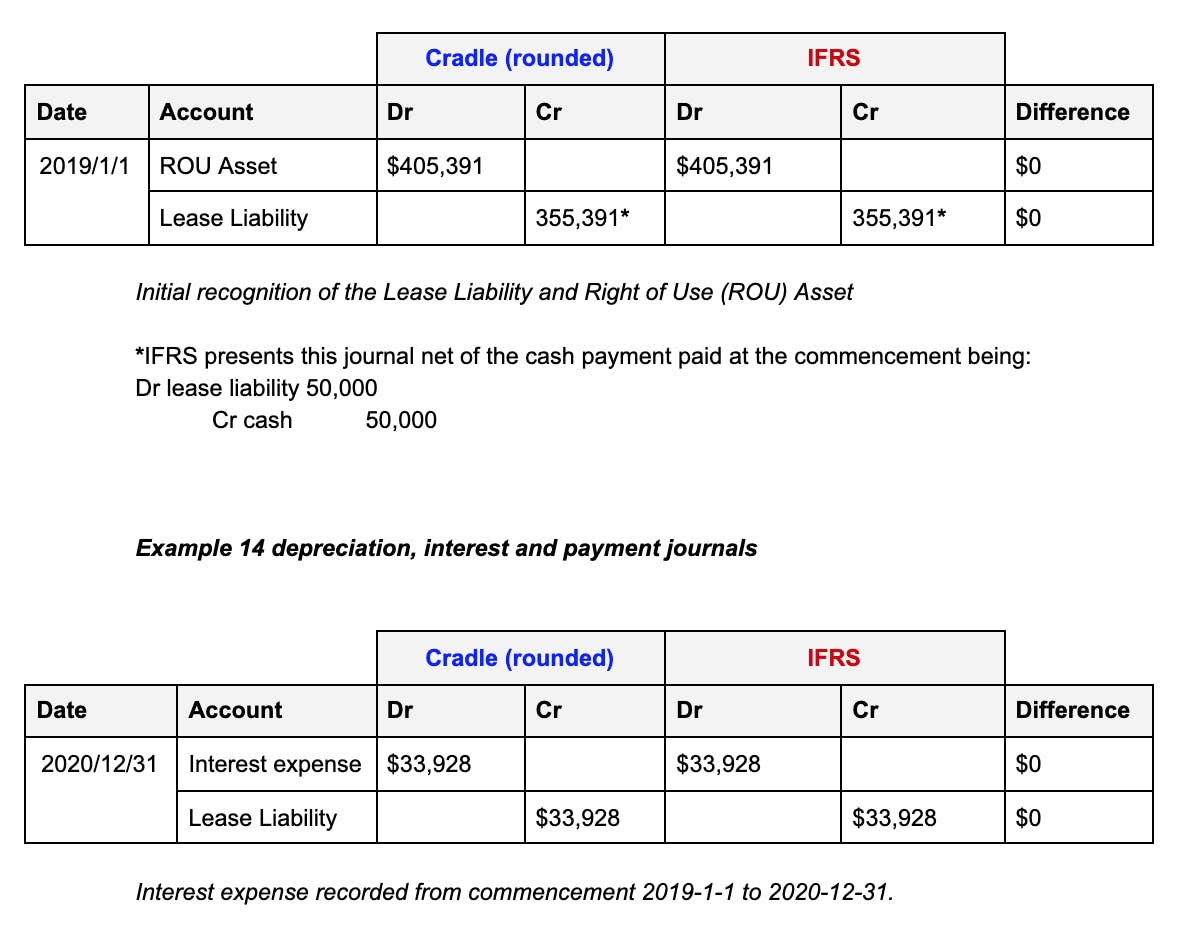

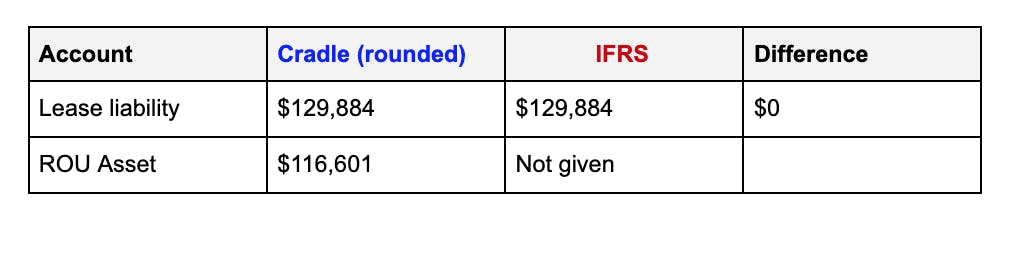

Example 13 initial recognition journals

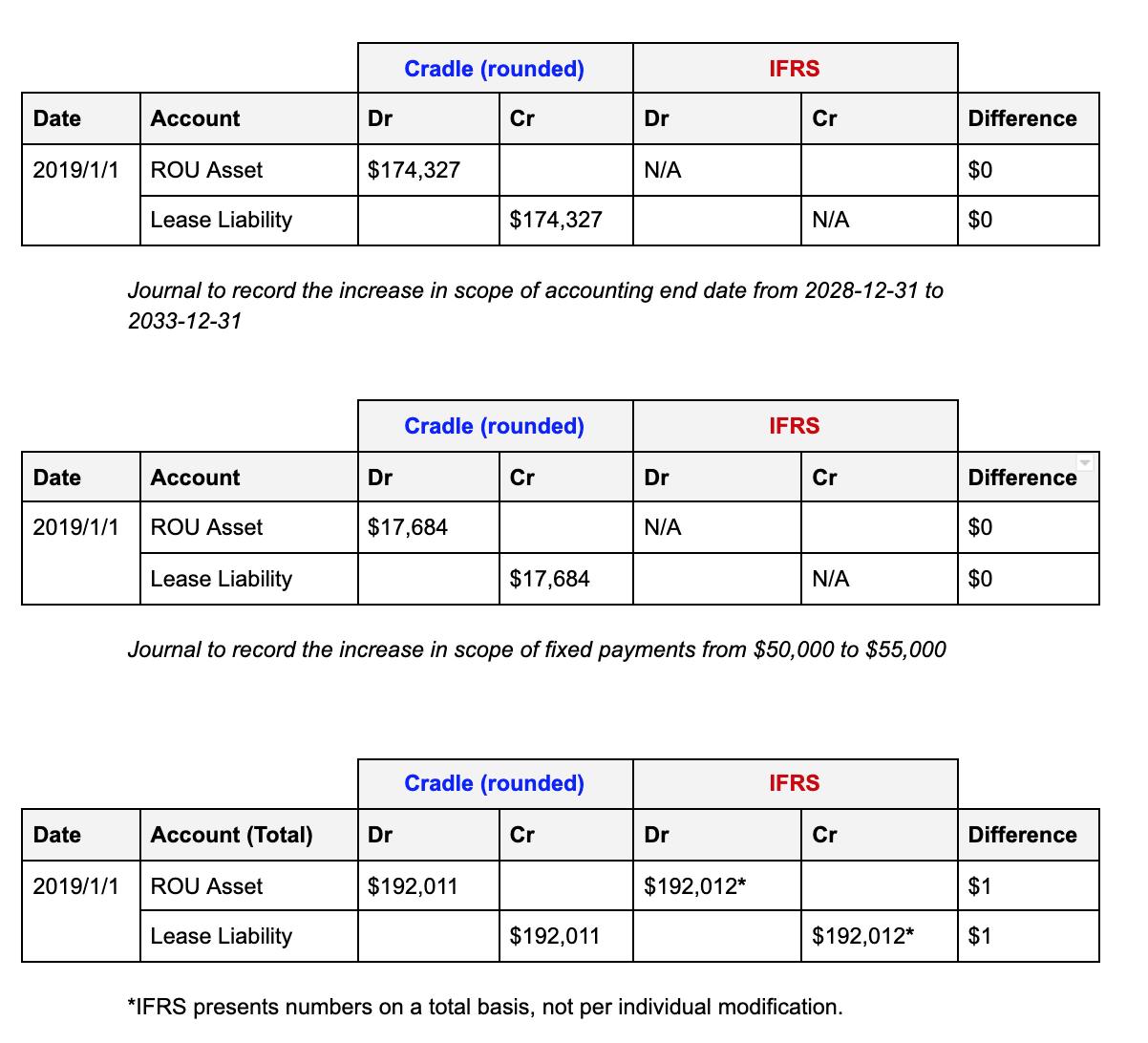

Part 2 - Subsequent measurement and accounting for a change in the lease term

To account for the modification the following information is entered into Cradle:

On 2025-1-1:

- update fixed payment from $50,000 to $55,000 and changed the discount rate from 5% to 6%

- Updated accounting & ROU Asset end date from 2028-12-31 to 2033-12-31

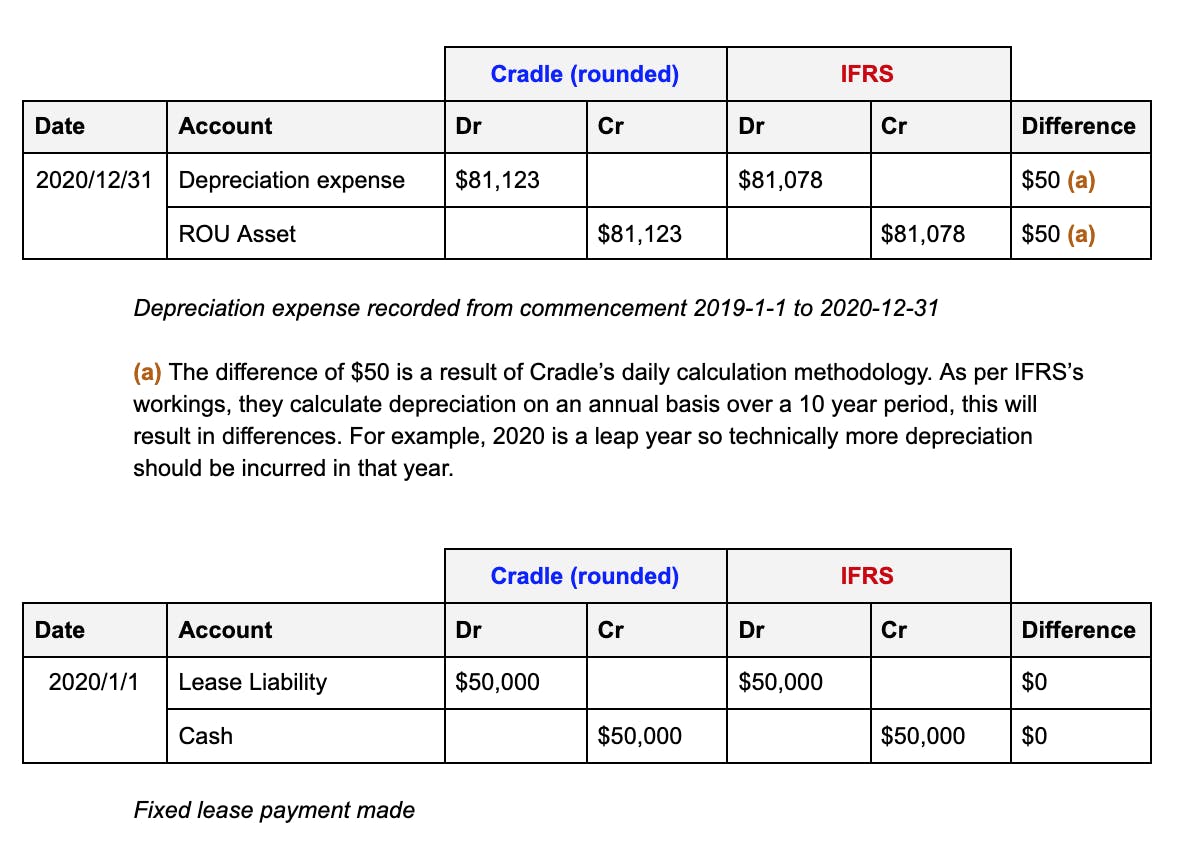

Example 14—Variable lease payments dependent on an index and variable lease payments linked to sales

These are the following initial recognition details entered into Cradle:

- Commencement Date: 2019-1-1

- Contract Expiry: 2028-12-31

- Payment Timing: In advance

- Payment Frequency: Annually

- Payment Starts: 1 January 2019

- Fixed Payment Amount: $50,000

- ROU Expiry: 2028-12-31

- Discount rate: 5%

Calculation methodology:

- Day count convention: Actual/Actual (ISDA)

- Add interest before/after payment: auto

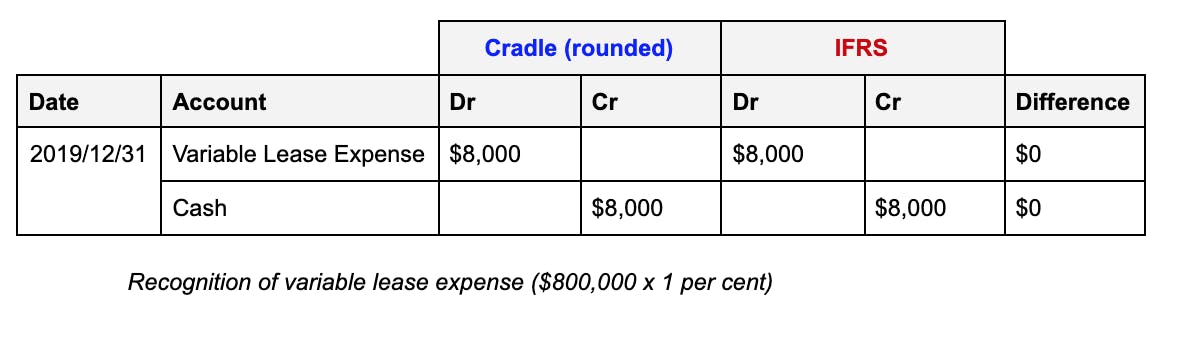

Part 2 —Variable lease payments dependent on an index and variable lease payments linked to sales

To account for the modification the following information is entered into Cradle:

On 2019-12-31:

- In modifications input a variable lease expense for $8,000

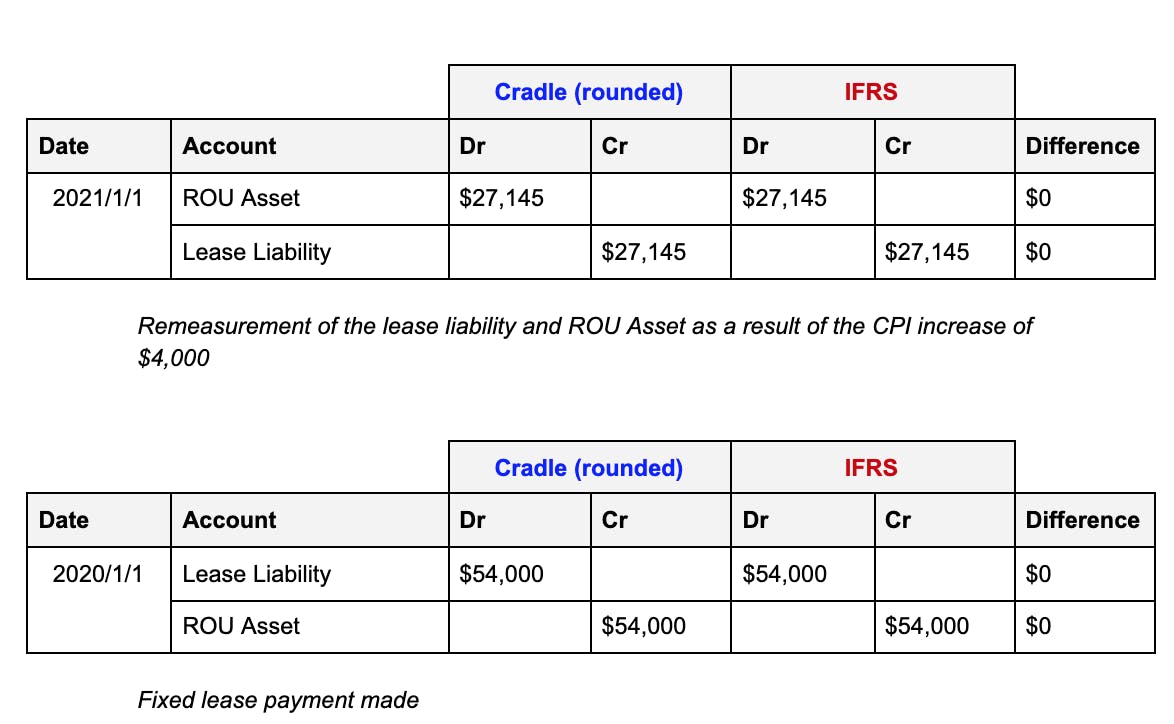

On 2021-1-1:

- In modifications input a CPI increase of 4% to the accounting end date which increases payments from $50,000 to $54,000

Example 15—Modification that is a separate lease

Example 15 provides an example of when a renegotiation of lease terms results in a new lease instead of applying modification accounting to the existing lease. Adding a new lease in Cradle is easier than saying “123”

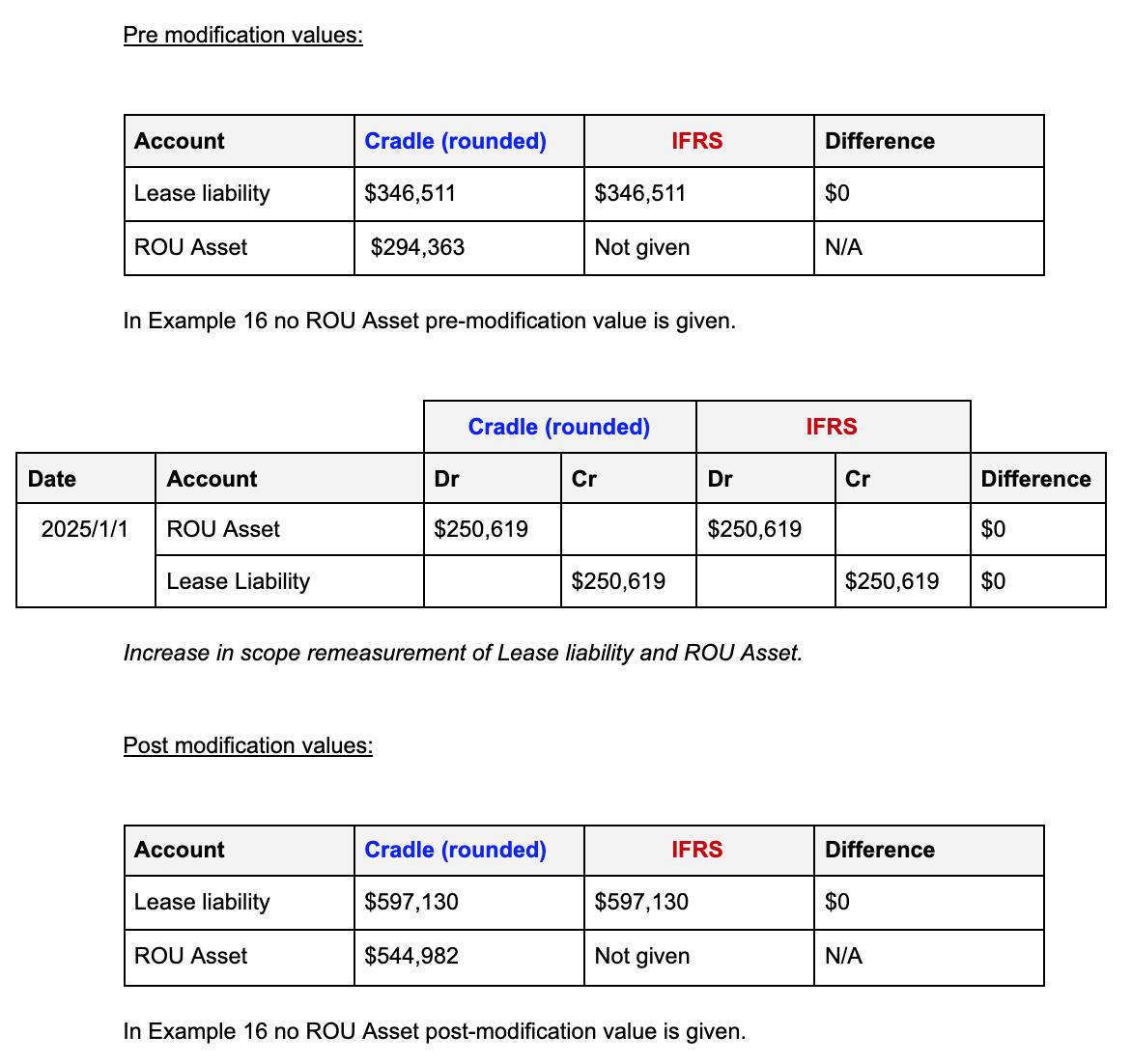

Example 16—Modification that increases the scope of the lease by extending the contractual lease term

These are the following initial recognition details entered into Cradle:

- Commencement Date: 2019-1-1

- Contract Expiry: 2028-12-31

- Payment Timing: In Arrears

- Payment Frequency: Annually

- Payment Starts: 31 December 2019

- Fixed Payment Amount: $100,000

- ROU Expiry: 2028-12-31

- Discount rate: 6%

Calculation methodology:

- Day count convention: Actual/Actual (ISDA)

- Add interest before/after payment: auto

To account for the modification the following information is entered into Cradle:

On 2025-1-1:

- Update the Accounting & ROU end date from 2028-12-31 to 2032-12-31with a discount rate of 7%

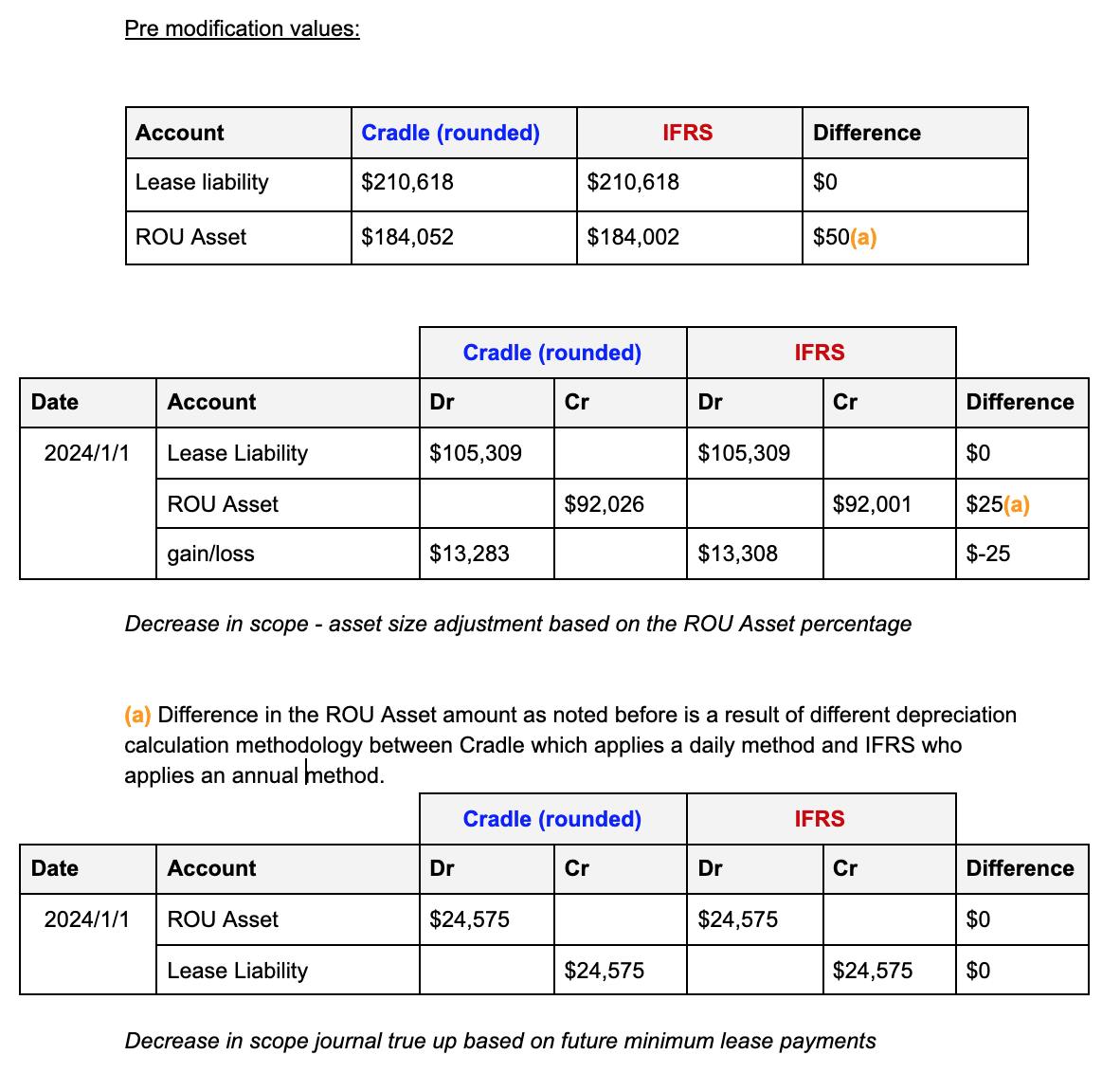

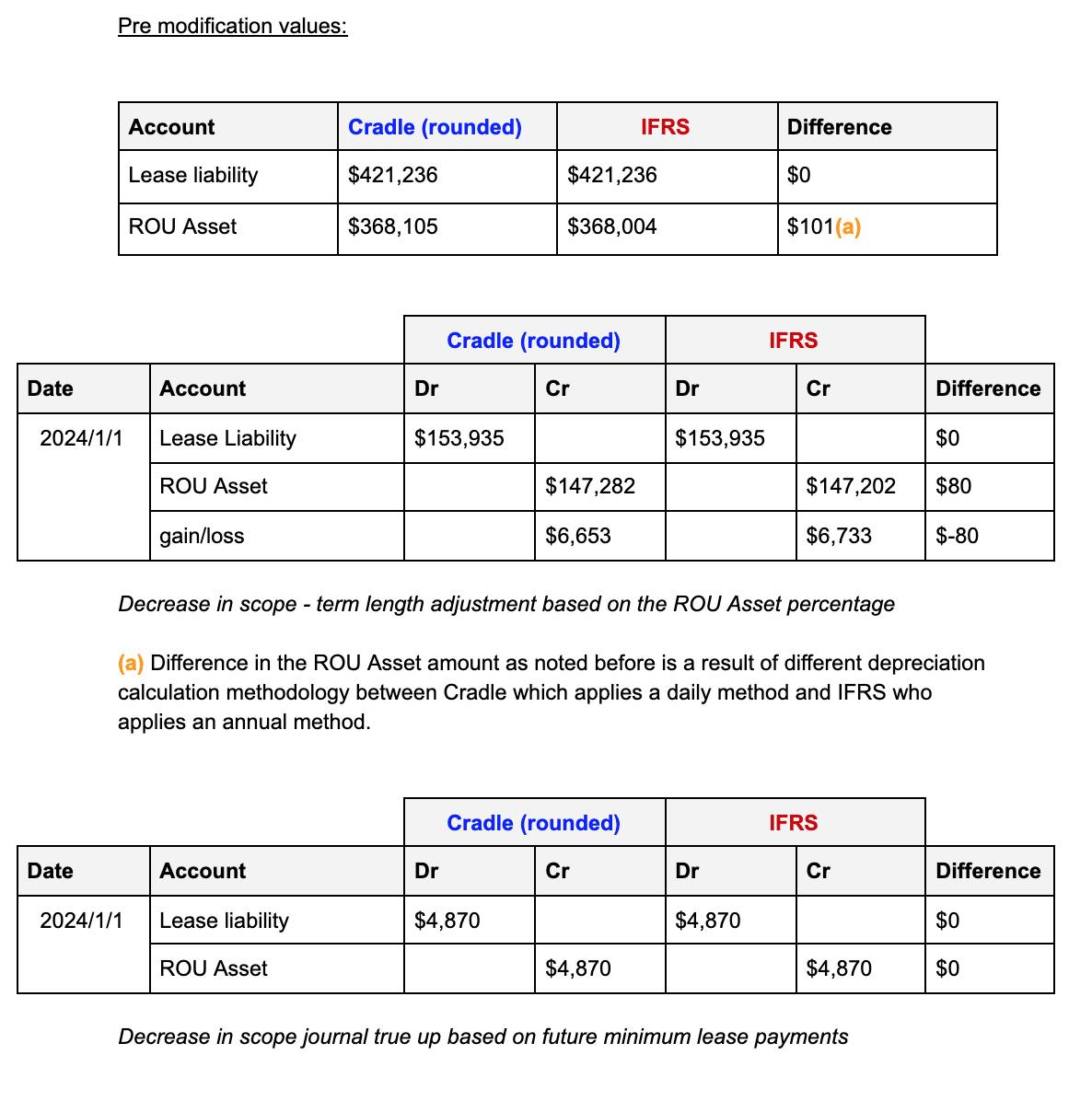

Example 17—Modification that decreases the scope of the lease

These are the following initial recognition details entered into Cradle:

- Commencement Date: 2019-1-1

- Contract Expiry: 2028-12-31

- Payment Timing: In Arrears

- Payment Frequency: Annually

- Payment Starts: 31 December 2019

- Fixed Payment Amount: $50,000

- ROU Expiry: 2028-12-31

- Discount rate: 6%

Calculation methodology:

- Day count convention: Actual/Actual (ISDA)

- Add interest before/after payment: auto

To account for the decrease in scope - asset size modification the following information is entered into Cradle:

On 2024-1-1:

- Update the fixed payment amount from $50,000 to $30,000, with an updated ROU Asset utilization percentage of 50% and a discount rate of 5%.

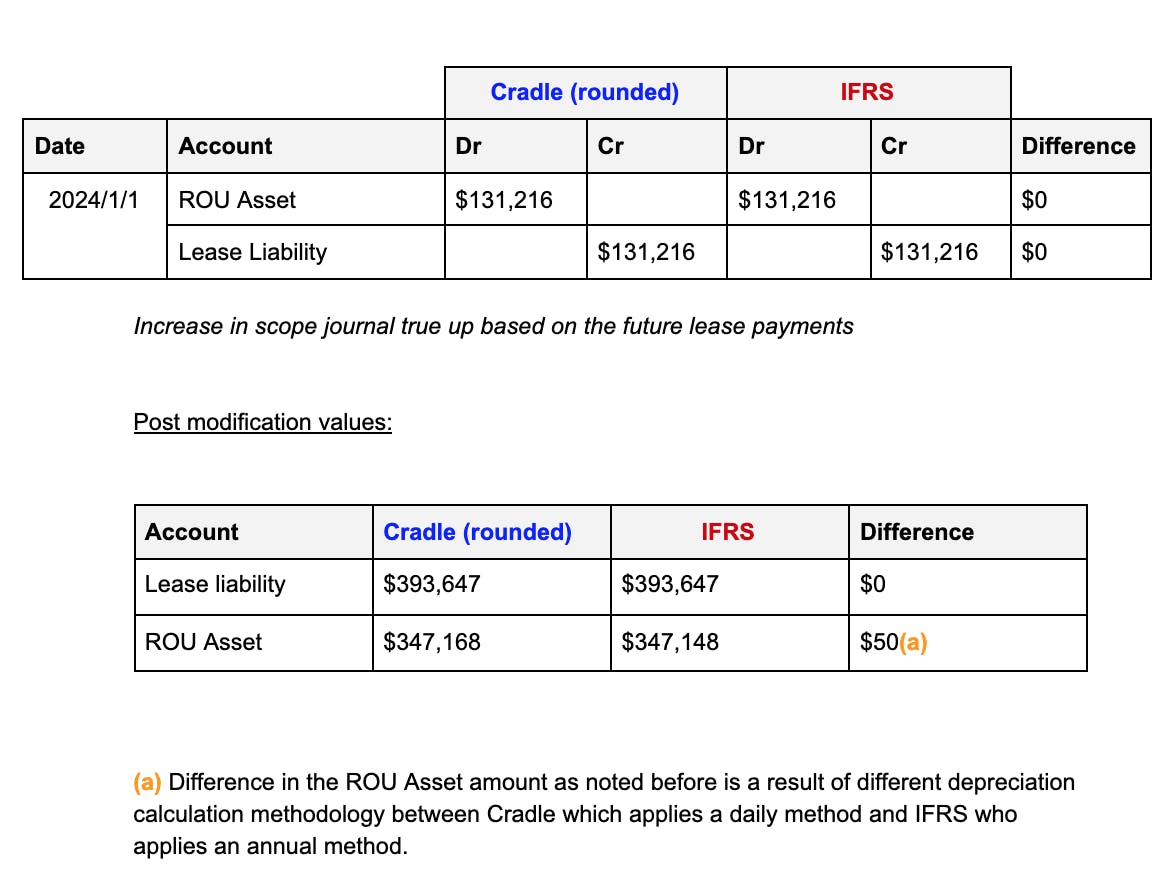

Example 18—Modification that both increases and decreases the scope of the lease

These are the following initial recognition details entered into Cradle:

- Commencement Date: 2019-1-1

- Contract Expiry: 2028-12-31

- Payment Timing: In Arrears

- Payment Frequency: Annually

- Payment Starts: 31 December 2019

- Fixed Payment Amount: $100,000

- ROU Expiry: 2028-12-31

- Discount rate: 6%

Calculation methodology:

- Day count convention: Actual/Actual (ISDA)

- Add interest before/after payment: auto

Decrease in the lease term

To account for the decrease in scope - lease term modification the following information is entered into Cradle:

On 2024-1-1:

- Update the Accounting end date from 2028-12-31 to 2026-12-31, with an updated discount rate of 7%

Increase in the leased space

To account for the increase in scope - lease term modification the following information is entered into Cradle:

On 2024-1-1:

- Update the fixed payment amount from $100,000 to $150,000, with an updated discount rate of 7%.

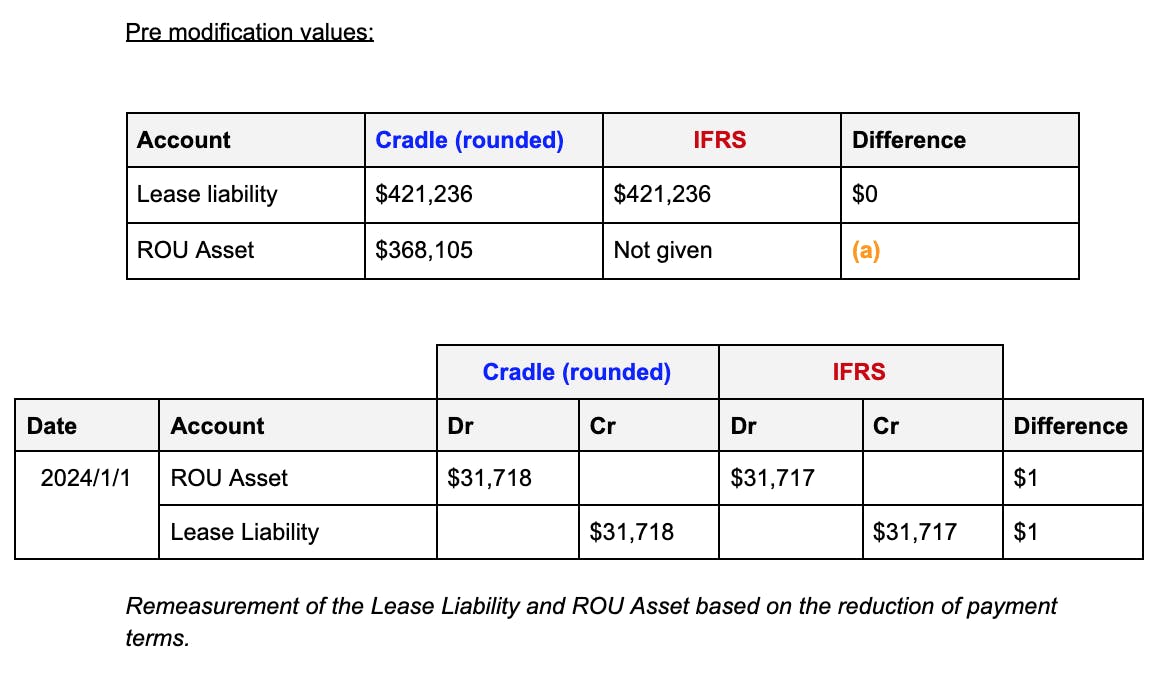

Example 19—Modification that is a change in consideration only

These are the following initial recognition details entered into Cradle:

- Commencement Date: 2019-1-1

- Contract Expiry: 2028-12-31

- Payment Timing: In Arrears

- Payment Frequency: Annually

- Payment Starts: 31 December 2019

- Fixed Payment Amount: $100,000

- ROU Expiry: 2028-12-31

- Discount rate: 6%

Calculation methodology:

- Day count convention: Actual/Actual (ISDA)

- Add interest before/after payment: auto

Modification that is a change in consideration only

To account for the modification the following information is entered into Cradle:

On 2024-1-1:

- Update the fixed payments from $100,000 to $95,000, with an updated discount rate of 7%

Example 20—Sublease classified as a finance lease

Unfortunately, the IFRS 16 Illustrative Example does not provide any figures to compare against. The prescribed treatment by the standard Cradle complies with. Which is:

- Derecognises the right-of-use asset relating to the head lease that it transfers to the sublessee and recognizes the net investment in the sublease;

- Recognizes any difference between the right-of-use asset and the net investment in the sublease in profit or loss; and

- Retains the lease liability relating to the head lease in its statement of financial position, which represents the lease payments owed to the head lessor.

During the term of the sublease, the intermediate lessor recognizes both finance income on the sublease and interest expense on the head lease.

Example 21—Sublease classified as an operating lease

Again, the IFRS 16 Illustrative Examples provide no figures to compare against. When accounting for an operating sublease in Cradle, it follows the prescribed guidelines:

During the term of the sublease, the intermediate lessor:

- Recognizes a depreciation charge for the right-of-use asset and interest on the lease liability; and

- Recognizes lease income from the sublease.