Automate your lease accounting today! Remove the guesswork, automate your lease accounting today!

IFRS 16 FAQ

What is IFRS 16?

If an arrangement meets the definition of a lease under IFRS 16, it will now be recognized on-balance sheet by Lessees, subject to a number of limited exceptions. This results in recognizing a lease liability which is the present value of all known future lease payments at inception. You then recognized a right of use asset to accompany the lease liability. This contrasts with the focus under IAS 17 on whether a lessee has the significant risks and rewards of the leased asset, that is whether the arrangement is a finance lease.

In other words, all leases are accounted like a “finance lease” using the old IAS 17 terminology but under IFRS 16 there are numerous differences.

For an in-depth look at how to account under the new leasing standard refer to our IFRS 16 Guide.

When is IFRS 16 effective?

You're in it! The earliest starting date was 1 January 2019, so it's more than likely your jurisdiction has transitioned if you're a listed company. If you're not listed, it will depend on your local jurisdiction and internally mandated financial reporting obligations.

For what purpose was IFRS 16 implemented?

Those at the IASB (people that set the IFRS accounting rules) wanted to bring the assets that companies have the right to use/lease on the balance sheet. They thought this would provide value to the users of the financial statements who make investment decisions (or that's what they tell themselves)

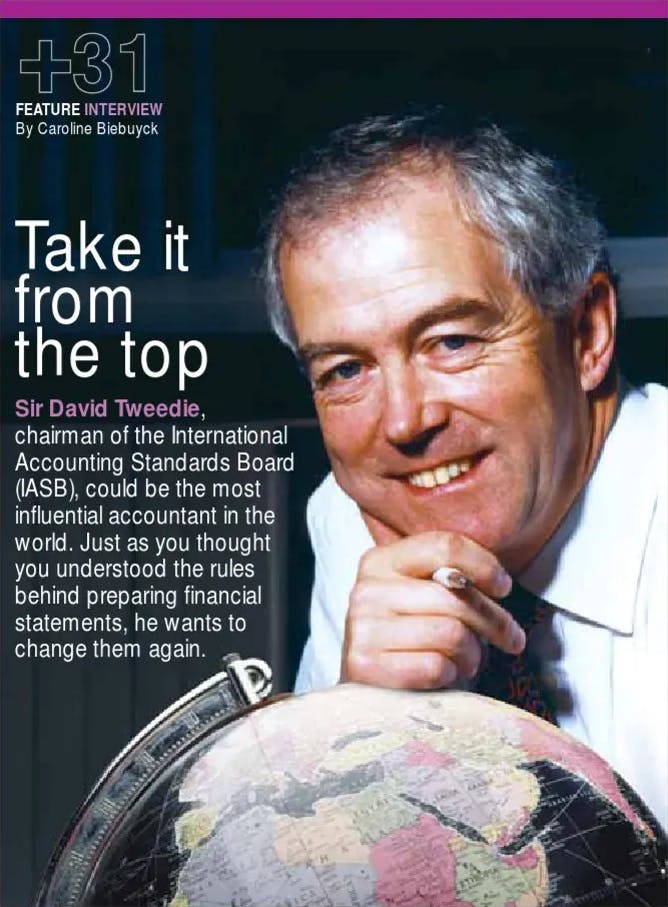

Here's a quote from the man himself Sir David Tweedy, who was the primary catalyst for the lease accounting change:

"One of my great ambitions, before I die, is to fly in an aircraft that is on an airline's balance sheet."

Most airlines do not own the aircraft they’re using, nor would a lot of the leased aircraft be captured on the balance sheet as a finance lease under the previous lease accounting standard. Mr. Tweedy didn’t like this, as using this leased asset is how airlines generate the majority of their revenue. IFRS 16 closes that disconnect and brings the leased asset on the balance sheet.

How is the interest expense calculated?

The first step to working out the interest rate is determining your discount rate. The discount rate is the critical factor to determine what portion of the lease payment split between the payment of principal and interest.

To be accurate, your calculation should be done daily to work out the daily interest portion. The formula used to work out the daily calculation of interest is:

(1+discount rate )^(1/365)-1

Apply the above percentage figure to the lease liability balance for the payment period, e.g. 30 days this will be added back to the lease liability as it's interest accrued.

For example, the interest incurred is $500 for the period, the lease payment is $2,000. You have then only reduced the principal amount of the lease liability by $1,500 as $500 is attributed to interest.

What has changed?

The fundamental changes are if you have leases that you have leases classified as "operating" leases under IAS 17.

You will now be bringing these leases on the balance sheet. A quick overview of this is:

- You will present value the known lease payments at contractual inception and recognized a lease liability

- The other side of the balance sheet is a right of use asset. This value can change depending on several factors.

- Your lease liability to unwinds to $0 based on the most likely period you're expected to be in the contractual arrangement.

- The right of use asset is depreciated to $0 based on the useful life.

What is IFRS 16 compliance?

Compliance is a term used by IFRS 16/ASC 842 software solutions that claim if you use their software, you'll comply with the new standard.

To comply with the standard, you need to do the following:

- Ensure your calculation methodology is in alignment with the standard. The IFRS 16 Illustrative Examples provide a great example of what the numbers should be.

- Ensure you treat all contractual permutations in line with the standard, e.g. residual value guarantee, modification accounting such as a decrease in scope.

- Ensure your disclosures comply with the requirements of the standard.

- Apply the correct accounting judgements, e.g. does this contract meet the definition of a lease under IFRS 16.

Who is affected?

That depends on your local jurisdiction if you're a listed company that adheres to IFRS you must comply with the new standard. For other companies, it will depend on your local financial reporting authority or internal financial reporting obligations.

How to implement?

To ensure the implementation is done correctly, the first step would is to ensure you have a clear understanding of the new IFRS 16 standard requirements.

This will help identify the shortcomings of your current lease accounting processes specific to your organization. Generally, one of the biggest challenges of IFRS 16 will be ensuring your company's processes and record-keeping are adequate. Previously under IAS 17, changes under operating leases didn't require much attention, the invoice was paid, and there was a lease expense recognized in the P&L.

This has all changed under IFRS 16, changes to lease contracts need to be tracked and accounted for (not just by accounts payable), as these changes can have a material impact on a company's financial statements. Who is going to manage the lease portfolio? Do you have a lease management team, or is the finance team going to do it?

Regardless, a member of the finance team will need to perform the initial recognition NPV calculations for all leases previously classified as operating leases under IAS 17, which isn't a step to take lightly.

To perform these tasks is going to require a significant amount of time, that's the reason why Cradle will do it all for you, literally.

How to calculate for IFRS 16?

It is a net present value calculation that is fundamental to the standard. The NPV of the lease payments results in the lease liability. The right of use asset also feeds from this value.

To do the net present value, you need the following information:

- Frequency of the lease payments, e.g. monthly or annually

- The timing of the payments is it before you use the asset - in advance or after you use the asset - in arrears

- How much are the payments

- The dates of the payments

- Discount rate

You then present value the identified payments which make up your lease liability. For a detailed guide of how the calculations work, refer to our IFRS 16 guide.

What is a ROU?

The ROU is an abbreviation for the right of use asset, which is recognized on the balance sheet at initial recognition of the lease. The point of this take-up is to reflect the right the lessee has to use the asset being leased. The right of use asset is straight-line depreciated, is subject to impairment, and when revaluations of the lease liability occur, the other side will go to the right of use asset.

For further detail of how to accounting for the right of use asset refer to our IFRS 16 guide.