ASC 842 Guide

Where to start

ASC 842 is the new leasing standard, superseding ASC 840. The new standard is effective from 1 January 2019 for public companies and 15 December 2021 for privates. ASC 842 has caused a lot of commotion, given it is a fundamental shift of how lessees account for operating leases.

What has changed?

The lessee & lessor classification has not changed. For lessors, the standard is relatively similar to ASC 840. A lessee won’t see a significant impact on their current accounting for capital leases under the previous standard. So what’s the catch? If you have an operating lease under ASC 840, you’re in for some significant changes in how you currently account for those contracts under ASC 842.

Operating leases now come on the balance sheet, a lessee must recognize:

- A right-of-use asset (ROU asset) - this represents the right to use the leased asset.

- Lease liability - the present obligation of the leased asset which is calculated by the present value of the minimum future lease payments

Those leases classified as capital leases under ASC 840 are now referred to as “finance leases.”

Compared to ASC 840, there’s much more work involved finance teams will have to overcome. The new accounting standard can have a tangible impact on how you run your business from:

- New internal processes required for contract management

- The finance teams increased communication with property & asset management teams.

- Increased staff time adhering to the financial reporting requirements.

- Significant impact on your financial statements and reporting ratios such as EBITA and debt covenants.

Most/if not all business decisions are made, and the accounting impacts are considered later, ASC 842 is no different. It is essential to understand how your finance team will continue to comply with US GAAP and the IASB’s new leasing standard.

Change of focus

Under ASC 842, your auditors will focus on whether the agreement meets the definition of a lease. Lease classification is still present under the new standard, but the impact of an operating lease compared to a finance lease on a set of financial statements is negligible given the balance sheet recognition of both classifications.

New lease definition

ASC 842 brings a new lease definition which you’ll have to wrap your head around. An arrangement contains a lease only when such an arrangement conveys the right to “control” the use of an “identified asset.” However, the standard setters have given adopters of the new standard the election to grandfather your previous assessments if the contract contains a lease. In other words, you don’t have to retrospectively go back over all agreements and decide if they meet the definition of a lease under ASC 842.

Practical expedients

Lessee’s have access to several practical expedients. Understanding the options can significantly reduce the burden of accounting under ASC 842.

Transition practical expedients - ASC 842-10-65-1

- A package of practical expedients to not reassess (used on an all or nothing basis):

- whether expired or existing contracts are or contain leases (and are therefore subject to Topic 842);

- to retain, without reassessment, the classification of their existing leases under Topic 840;

- not to reevaluate whether previously capitalized initial direct costs meet the revised requirements for capitalization under Topic 842

- A practical expedient to not reassess certain land easements

- To use ‘hindsight’ in determining the lease term and impairment of lessee ROU assets.

- Practical expedient for restating prior year financials.

For more information on the above practical expedients refer to transition options.

Lease accounting practical expedients

- A lessee may choose not to separate non-lease components from their related lease components. Refer to lease components for further details.

- Practical expedient for short-term leases: Under ASC 842, the lessee is not required to apply the lessee accounting model if the lease length is 12 months or less, this can be applied from the transition date.

- Practical expedient for private company discount rates. Refer to the section on discount rates on how to apply the expedient.

Exemptions to lease accounting

A reporting entity should consider the application of lease accounting in ASC 842 to all arrangements that meet the definition of a lease, except for the following:

- Leases of intangible assets subject to ASC 350

- Leases to explore for or use minerals, oil, natural gas, and similar nonregenerative resources subject to the guidance contained in ASC 930 and ASC 932.

- Leases of biological assets (such as plants and animals)

- Leases of inventory

- Leases of assets under construction

ASC 842 is in scope, what now?

Is it a lease?

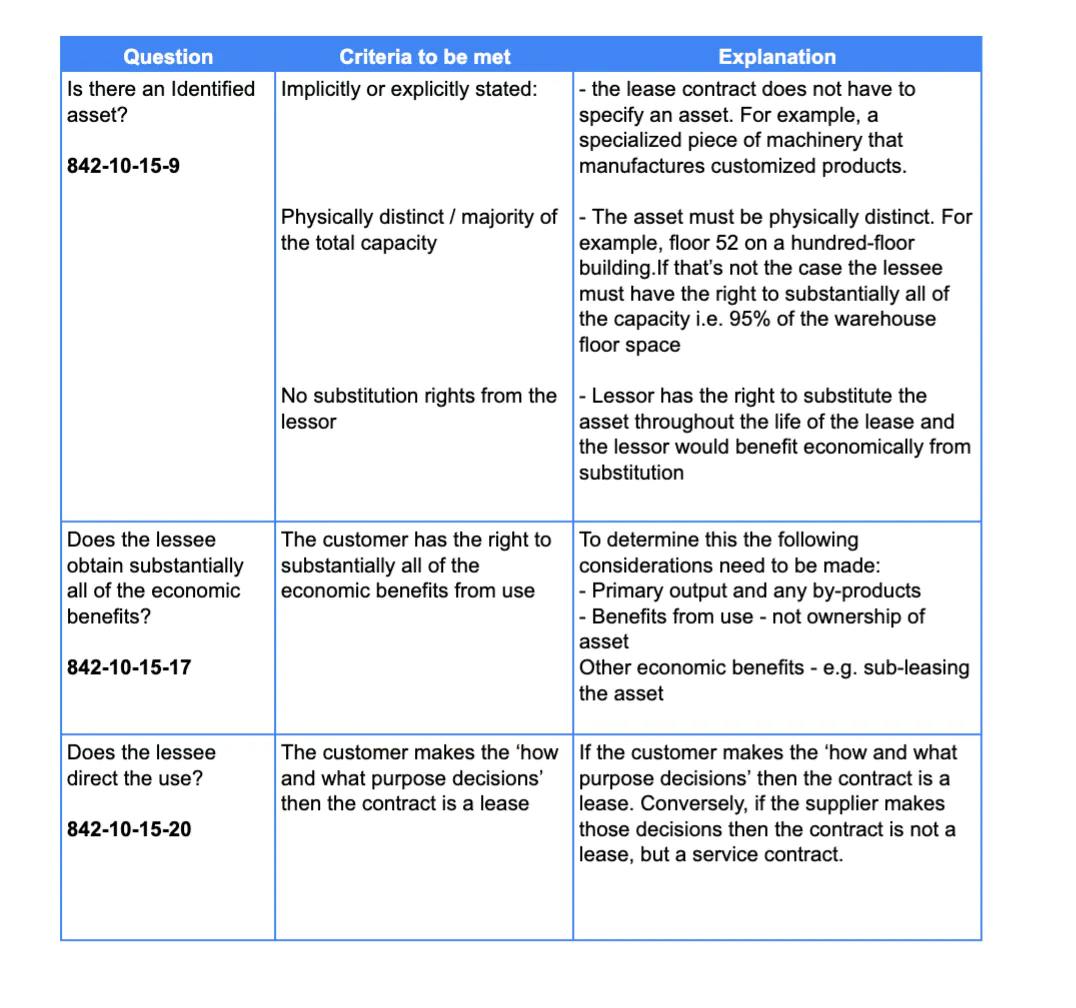

For all new lease agreements entered into post-transition date regardless of certain practical expedients, the following assessment will need to be made to determine if the contract meets the definition of a lease under ASC 842.

Lease components

Lessees will often enter into a contract with lessors that includes a right to use multiple underlying assets. So when the underlying asset is considered a ‘separate lease component,’ that is, a separate lease.

ASC 842 842-10-15-28 states both of the above criteria must be met to be considered a separate lease component.

Portfolio exemption

A lessee can account for multiple leased assets as one using the portfolio exemption. For example, an entity may apply this exemption if the leases share several common characteristics, such as start date, extensions, and lease term. In addition, using the portfolio exemption should not result in a material difference if the lessee were to account for the leases as one or individually.

Non-lease components

It is not uncommon for a lease to contain a non-lease component. The non-lease component can be seen as a component of the lease that does not meet the definition of a lease. For example, a cleaning service offered in the renting of a building. There is no right of use asset available to the lessee for that service.

842-20-50-9 states as a practical expedient, the lessee can elect, by class of underlying asset, to not separate the non-lease components from lease components, and instead account for the entire arrangement as a single lease component (lease). This practical expedient can provide relief to lessees by reducing cost and complexity in some cases. However, it will also result in higher lease liability, and ROU asset as the lessee will capitalize the service component into the lease liability, which would otherwise remain off-balance sheet until the lessor fulfils its obligation.

Operating or Finance lease?

Once you assess the contract is in the scope of ASC 842, the next significant accounting judgement in deciding if the lease is an operating or finance lease.

The guidance on classification is essentially the same as that under the previous standard. If any of the five criteria in ASC 842-10-25-2 are met, a lessee should classify the lease as a finance lease:

If no to all of the above questions, the lease is deemed to be an operating lease. If yes to any of the questions, it meets the definition of a financial lease.

The above areas are judgemental, ensuring you have appropriate supporting documentation to justify your decision will keep your auditors happy.

Difference between operating and finance leases under ASC 842

So once the classification between operating and finance lease has been made, what’s the difference?

Not that much, as mentioned previously, a right of use asset and lease liability is recognized regardless of the lease classification.

The differences between the two classifications are quite nuanced, the differences are as follows:

1. P&L classification

How the lease expenses are classified in the profit and loss differ depending on the lease classification. With finance leases:

- Interest incurred is classified as “interest expense,” while an operating lease it’s “lease expense.”

- Amortization expense under an operating lease is classified as a “lease expense.”

2. Cashflow statement

ASC 842 requires lessees to report the single expense associated with an operating lease as an operating activity. For finance leases, lease payments are reported as financing or operating in the statement of the cash flow statement based if the amount is related to principal or interest.

3. Amortization calculation methodology

The calculation methodology of how the amortization of the ROU Asset differs once the right of use asset value has been calculated.

For finance leases, the calculation is straightforward. ROU Asset recognition value / useful life, which will result in your straight-line amortization expense. The expense is calculated independently of the lease liability.

For operating leases, the amortization charge is related to the lease liability. The standard provides two different methodologies of how to calculate the amortization.

Method 1

The carrying amount of the ROU asset is derived from the carrying amount of the lease liability at the end of each reporting period.

Method 2

Amortization is calculated as the difference between the straight-line lease cost for the period (including amortization of initial direct costs) – and the periodic accretion of the lease liability using the effective interest method.

Method 1 may not be practicable for entities other than those with a smaller volume of relatively straightforward leases. Method 1 is a manual process that likely will be unwieldy when applied to an extensive portfolio of leases, especially in the context of the more complex circumstances that will arise under the guidance in Topic 842 – e.g. modifications, remeasurements, impairments and foreign currency translation adjustments.

We’d recommend using Cradle, and it will automatically be calculated for you.

4. Debt classification & Covenants

Operating lease liabilities are considered operating liabilities, rather than debt, under ASC 842. Categorizing operating lease liabilities as operating liabilities, rather than debt, may mean that ASC 842 will not have a significant effect on debt-based ratios such as the:

— debt-to-capital ratio (total debt / (total debt + total equity)) and debt-to-equity ratio (total debt / total equity); and

— the weighted-average cost of capital (WACC).

Finance leases are classified as debt. Companies should be aware this could have a material impact on applicable ratios. This is one of the most significant implications of the lease classification between operating and finance lease liabilities.

Initial recognition

The contract is in the scope of ASC 842, and you’ve decided on the lease classification. There are several considerations to now make, and this is when the debits and credits begin! The first aspect we’ll focus on is the lease liability, which is also the key input into the right of use asset value, so it’s the first place to start.

The standard states how to measure a lease liability:

The above diagram summarises how a lease liability is calculated. The lease liability is the net present value of three inputs:

- Lease payments: these are the contractually agreed upon future payments the lessee will pay to the lessor

- Lease term: the non-cancellable period of the contract plus termination or renewal options if ‘reasonably certain.’

- Discount rate: the rate used to present value the future lease payments

Lease payments

The standard specifically details what lease payments are included in the lease liability net present value calculation:

The standard details explicitly what lease payments are included in the lease liability net present value calculation:

- Fixed payments less incentives

- Variable lease payments - this only includes index (CPI), market rent review (MRR) or rate (LIBOR)

- Residual value guarantee

- The exercise price of the purchase option - if reasonably certain

- Termination penalties - if reasonably certain

The above information is what the lessee has at the commencement of the lease that they are reasonably certain to exercise. Future market rent reviews, CPI & LIBOR increases cannot be accounted for at initial recognition as these increases are not known at the commencement of the lease.

Variable lease payments

The standard is confusing as it names variable lease payments to be included in the future payments of the lease liability. At initial recognition, you include known payments. If the payments are truly variable, e.g. % of sales, or based on a future index increase, the lessee will not know these payment amounts until communicated by the lessor. Subsequent accounting of these payments is discussed further in modification accounting.

Lease term

To determine the lease term the standard states:

The lease term is one of the critical judgemental areas your auditors will bother you on. The lease term starts when the lessee takes control of the underlying asset. It also includes any rent-free periods provided under the lease contract.

The term also consists of the non-cancellable period plus the periods the lessee is “reasonably certain” to renew if the lessee is reasonably certain to terminate the lease that would mark the end date of the lease.

When determining “reasonably certain,” the lessee also considers whether there is any ‘economic incentive’ to exercise or not exercise an option. For example, in a property lease, significant leasehold improvements were undertaken at inception that has a significant economic benefit for the lessee over the period covered by the option period.

The lessee does not reassess the lease term unless a significant event or change in circumstances occurs that is within the lessee’s control.

Discount rate

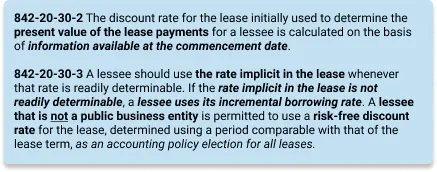

The final input to the lease liability is the discount rate to present value the future payments. The standards states the following:

The discount rate is highly judgemental. The standard tells you to use the "rate implicit in the lease" if you can't figure that out, you then use the "incremental borrowing rate." These are the same definitions found in ASC 840.

The rate implicit in the lease for the lessee is pretty much impossible to figure out. The lessee will need to understand within the lease payment you're making what portion is for using the actual asset and what portion is the interest (as you didn't pay all upfront).

For further information refer to How to Calculate the Discount Rate Implicit in the Lease

The lessee's incremental borrowing rate is the rate that a lessee would have to pay on the initial recognition date of the lease for a loan of a similar term and with similar security to obtain an asset of similar value to the ROU asset in a similar economic environment.

For further details refer to How to Calculate the Incremental Borrowing Rate under ASC 842.

As noted above, ASC 842-20-30-3 provides a practical expedient for nonpublic business entities, which allows a lessee to use a risk-free rate for a period comparable to the lease term. Since a risk-free rate is lower than an incremental borrowing rate for a specific entity, it will result in a higher lease liability and right-of-use asset. Refer here for the U.S. Department of the Treasury yield rates.

On September 15, 2021, FASB updated the rules where previously an entity had to apply the risk-free rate as an accounting policy election, and once elected, it must be utilized consistently for all leases. This has now been changed, with the risk-free rate practical expedient can be applied at an asset class level. This gives an entity far more flexibility when determining the discount rate to be used in a lease.

In addition, an entity has the ability to apply a single discount rate to a portfolio of leases if they can conclude that its application does not create a material difference when compared to individually determined discount rates applied to each of the leases in the portfolio. To prove this, the lease agreements should share similar inputs such as lease term and lease payment amount.

With the three above inputs, you get a lease liability. You're now ready to tackle the right of use asset.

Initial recognition

The standard is very clear of how to calculate the value of the right of use asset:

The above diagram is an excellent illustration of what values you input into the measurement of the right of use asset. We’ll now go through those inputs you need to consider when recognizing your right-of-use asset on the balance sheet.

Lease liability

This is what you’ve just worked out; the foundation of the ROU asset is the NPV calculation of the lease liability. As a result, if your lease liability is wrong, your ROU asset will be too.

Initial direct costs

A lessee’s initial direct costs are the incremental costs of obtaining a lease that would otherwise not have been incurred. These include, For example:

- commissions;

- legal fees (if contingent on the origination of the lease);

- costs of negotiating lease terms and conditions (if contingent on the origination of the lease);

- costs of arranging collateral

Items that are not considered to be an initial direct cost include:

- allocation of internal overhead costs, e.g. those incurred by a sales or marketing;

- costs of evaluating a prospective lessee’s financial condition and

- costs to obtain offers for potential leases

Prepayments and Incentives

Any payments made to the lessor before the commencement of the lease are added to the ROU Asset.

The lessor may offer incentives to the lessee to sign the lease agreement. Incentives before commencement are subtracted from the right of use asset. These lease incentives include both of the following:

- Payments made to or on behalf of the lessee in relation to a lease; and

- A lessor incurring costs on behalf of the lessee. For example, assuming a lessee’s pre-existing lease with a third party.

Once the above considerations have been made, you then have calculated ROU Asset.

Asset Retirement Obligations (ARO) and Leasehold Improvements

An asset retirement obligation is the costs to dismantle and remove an underlying asset at the end of the lease term that is imposed by the lease agreement. For example, the lessee is obliged to return the underlying asset to the lessor in a specific condition or restore the site on which the underlying asset has been located.

The accounting for these obligations is covered under FASB ASC 410, or Accounting Standards Codification Statement No. 410. For example, under US GAAP, if a company enters into a lease for office space, constructs leasehold improvements such as company branding and kitchen fit-outs. If the company based on the provisions of the lease that it is legally obligated to remove the leasehold improvements at the end of the lease, then the company has ARO.

The same principle applies to environmental obligations. If an ARO is applicable, recognize the present value of the obligation, and the other side will be the asset.

The ARO value will be accreted to its present value when the obligation is due, and the Leasehold Improvement depreciated to $0 based on the ROU Assets' useful life.

Transition to ASC 842

When deciding on how to transition to the new standard, the lessee’s decisions fall into two categories:

- What practical expedients to apply

- What transition method to use

Before jumping into what transition method you’re going to use, we’ll first go through the practical expedients available to aid the transition to ASC 842.

Practical expedients

We’ve previously touched on what transition practical expedients a lessee can apply. The standard states:

The first three practical expedients allow the lessee not to have to apply the new guidance to existing accounting judgements. For example, a lessee will not have to apply the new definition of a lease to those contracts deemed a lease under ASC 840. Using this package of practical expedients allows the lessee to save a significant amount of time.

As mentioned previously, the above practical expedients must be elected as a ‘package of practical expedients’ used on an all or nothing basis.

The final practical expedient included in the package is to apply hindsight, again this allows the lessee to save a considerable amount of time when transitioning to the new standard. For example, at the commencement date, the lessee had no intention of exercising a purchase option; this subsequently changed in year three of the lease. With this expedient, you will use hindsight and recognize the lease with the intention of exercising the purchase option, saving the need for additional modification accounting during the lease term.

Transition options

What transition method the lessee adopts has a material impact on the numbers calculated in a set of financial statements.

The lessee must apply the decision to the entire lease portfolio. The lessee has two choices being the comparative method or the effective date method.

Comparative method

The first transition method available is to use a modified retrospective transition method, which we refer to as the comparative method. Entities that use the comparative method record the cumulative-effect adjustment to the opening balance of retained earnings as of the beginning of the earliest comparative period presented in the financial statements. From that date to the effective date, an entity applies ASC 842 transition guidance to new and existing leases. If the lessee selects the comparative transition option, it assumes you have always accounted for ASC 842 in effect. The application date for companies that choose to adjust comparatives periods is later of:

- the earliest comparative period presented in a set of financial statements, e.g., 1/1/2017 for a calendar year-end public business entity and;

- The commencement date of the lease.

The most complicated aspect of adopting this transition method is you will have to reverse all accounting under ASC 840.

To here's a useful diagram to illustrative when it is required to calcualtion the opening balances of the right of use asset and lease liability:

If reference to the above diagram, the lease liability and right of use asset for Lease A would be calculated as at January 1, 2020. In comparison, Lease B would be based on the commencement date because ASC 842 is in scope from the commencement of the lease.

Why would you want to adopt the comparative model? It’s the most accurate transition method. It does require more work, but it means your lease data has been captured from commencement for all active leases. Furthermore, users of financial statements will have “apples to apples” for historical-comparative information.

Effective date method

This section discusses the ‘effective date method,’ which is the additional transition method introduced in ASU 2018-11. Under this new method, the cumulative-effect adjustment to the opening balance of retained earnings is recognized on the date of adoption – e.g. January 1, 2019, for calendar year-end public business entities that do not early adopt Topic 842.

If a calendar year‑end public business entity adopts Topic 842 following the mandatory effective date under the effective date method, it records a cumulative-effect adjustment on January 1, 2019. In the entity’s December 31, 2019, financial statements, comparative reporting periods are presented in accordance with Topic 840, while the current period (2019) is presented in accordance with Topic 842 and its transition provisions.

Adopting this method is the easiest way to get ahead of ASC 842. As per the diagram, the Lease Liability and ROU asset are calculated from the transition date. What does this mean? You only need prospective lease information from the date of transition, so no digging through files to find modifications for a lease that commenced several years ago.

So what are the drawbacks of adopting the effective date approach:

- accuracy: the comparatives will be different, given the prior year comparison accounted under ASC 840. One could argue that not having consistent comparative information will not provide as much value to users of the financial statements.

The positives are:

- No historical data required: account for all of your leases prospectively with the information you have at hand, at the transition date.

- Cost: no need to dig up historical records, to do any other method you need to know what was happening between commencement and the transition date

- Uncomplicated: no need to start modification accounting until after the transition date.

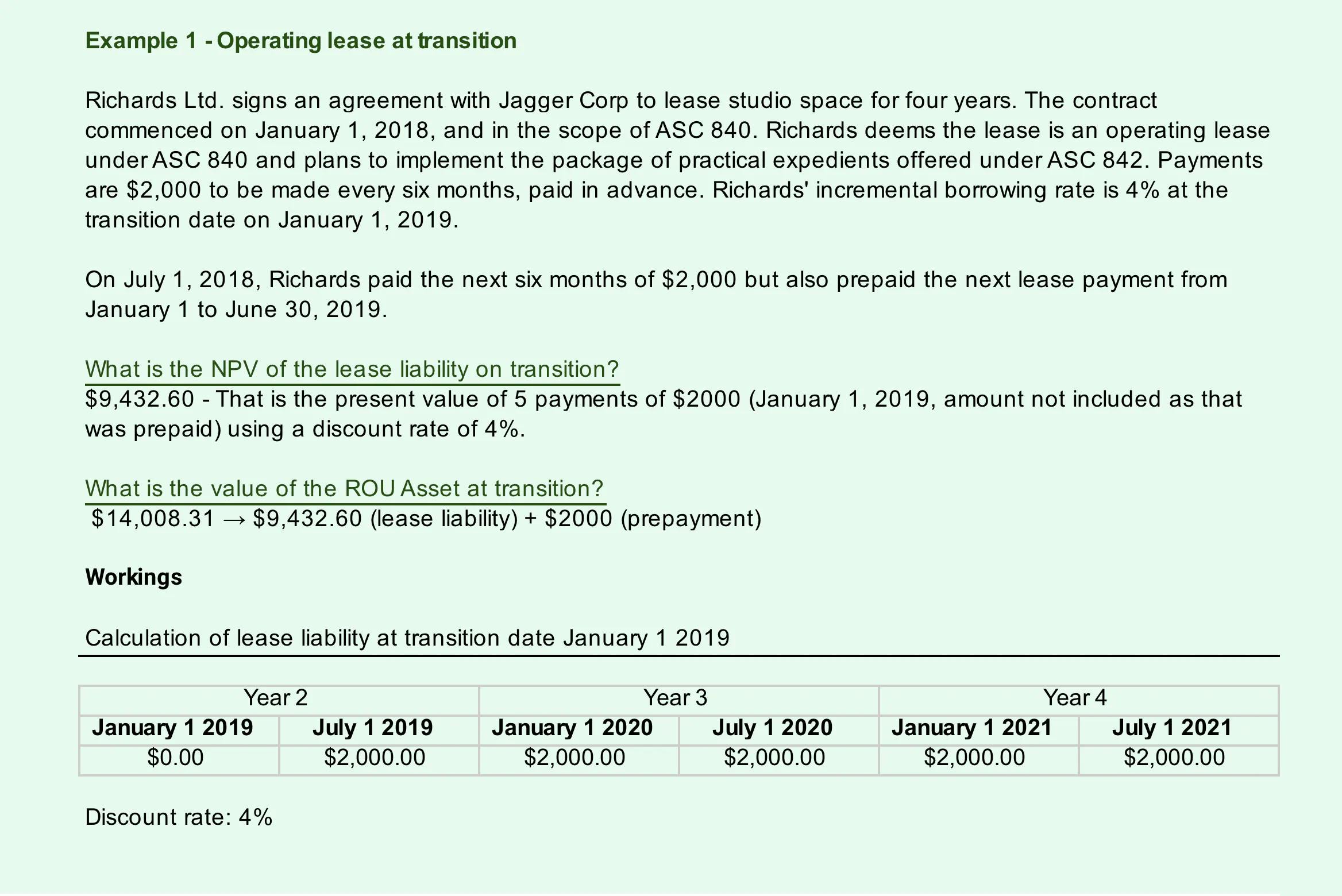

Operating leases at transition

For operating leases under ASC 840, ASC 842 prescribes:

The treatment of operating leases under ASC 840 will slightly differ depending on the practical expedients elected. Regardless of the practical expedients, the lessee will recognize an ROU asset and lease liability.

The lease liability as described previously will be calculated as the present value of the sum of the remaining minimum rental payments and any amounts probable of being owed by the lessee at the end of the lease, e.g. residual value guarantee.

A lessee should measure the operating lease right-of-use asset at an amount equal to the lease liability adjusted for the following:

- Prepaid or accrued rent

- The remaining balance of any lease incentives

- Unamortized initial direct costs

- Any impairment

- The carrying amount of any liability related to the lease recognized in accordance with ASC 420 Exit or Disposal Cost Obligations

If none of the above is applicable, all you need to do is work out the NPV of the lease liability at the transition date, and you’ve got your ROU Asset as well.

The above is assuming the lease is not applicable for the short-term lease exemption. If elected, the lessee will continue to account for the lease on a straight-line basis akin to ASC 840.

Example 1 - Operating lease transition using the effective date method

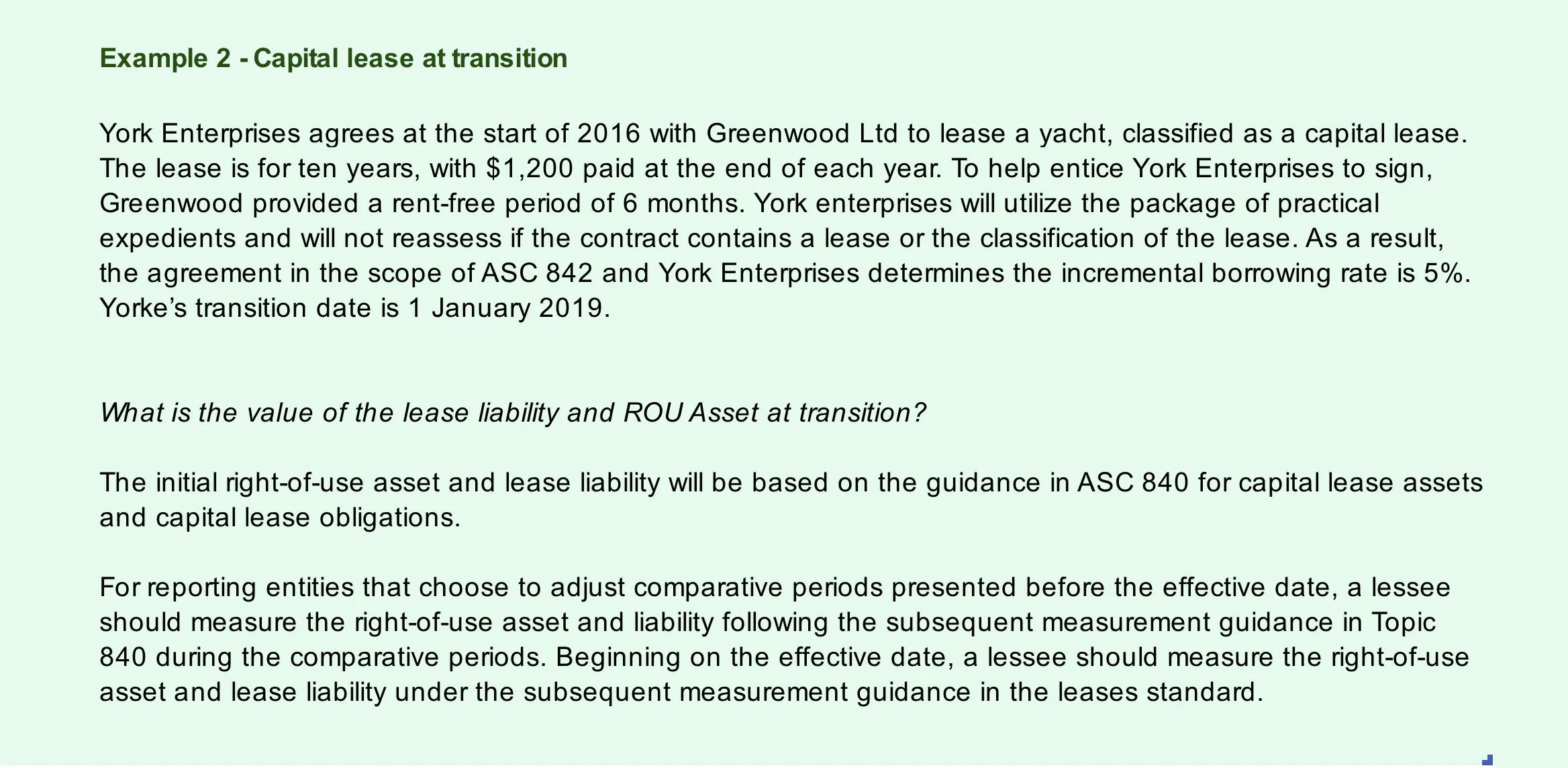

Capital leases at transition

Like operating leases at transition the standard has prescriptive guidance for finance leases under ASC 840:

If a lease was classified as a capital lease under ASC 840, the lessee should reclassify the existing capital lease asset as a right-of-use asset and the existing obligation as a lease liability for each period the lease was outstanding beginning with the earliest period presented or the effective date (depending on the transition method selected)

On the effective date, a lessee should measure the right-of-use asset and lease liability under the subsequent measurement guidance under ASC 842.

Example 2 - Capital lease transition

Subsequent measurement and modification accounting

When does modification accounting occur

When there is a change to the contractual terms, the lessee must assess if those changes apply to modification accounting.

The standard defines a lease modification as:

The standard goes into detail about what would constitute a modification for a change of lease payments:

The standard provides a lot of detail when modification accounting occurs. The lease liability is the present value of future payments stipulated in the contract. In other words, a modification is a contractual change to those future payments.

That can result in either:

- The renegotiation of the contract, e.g. lessee and lessor, agree to extend the lease term.

- Lessee exercising an option it previously was not reasonably likely to do, e.g., exercise a purchase option.

Does the modification result in a new lease?

Before applying modification accounting a key judgement needs to be made, does this result in a new lease?

The standard states:

The following diagram summarises the accounting for lease modifications by a lessee.

Not a new lease - remeasurement of the lease liability and ROU asset

If it’s not a new lease, the lease liability will either increase or decrease based on the future cash flow amounts. The lessee before commencing lease modification accounting should reassess the classification of the lease.

Reassess the lease classification

The lessee shall reassess the classification of the lease based on the facts and circumstances (and the modified terms and conditions, if applicable) on the modification date.

The same lease classification criteria, as previously discussed, will be applied to the modified facts and circumstances of the lease. If a reclassification occurs, the difference between the ROU asset value and lease liability is carried forward and applied against the new classification of ROU asset. For further details on reclassification accounting refer to Reclassification of a lease.

Update the future cash flows in the NPV lease calculation

The first step before calculating the lease modification is to identify if the modification is a partial termination, which can also be referred to as a decrease in scope. Excluding a specific decrease in scope scenario, all modifications follow the same principles.

Update the discount rate

When any modification occurs, the standard states (842-10-25-11) you must update the discount rate when present valuing the modified future cashflows. This will be determined by the same principles used when determining the discount rate at initial recognition.

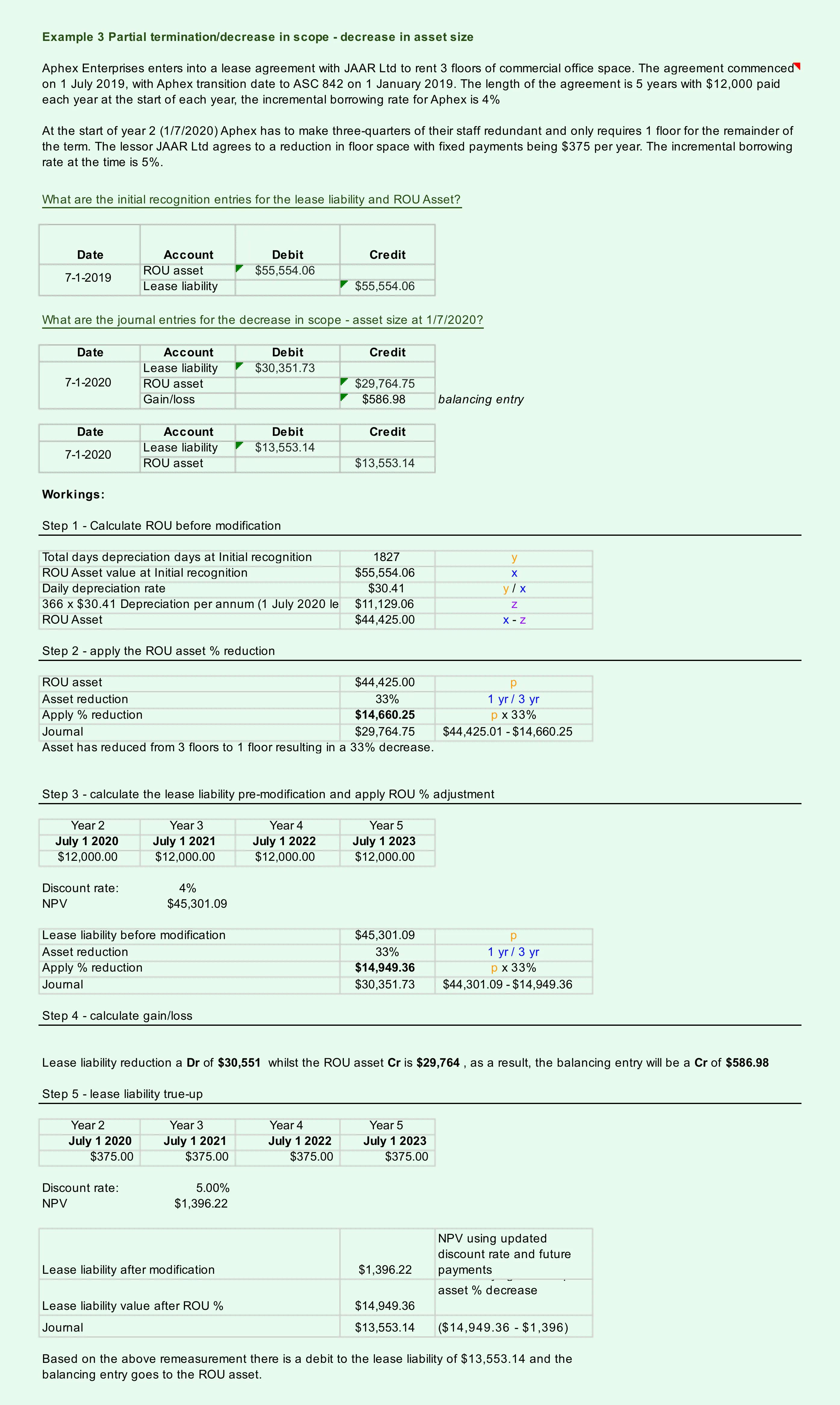

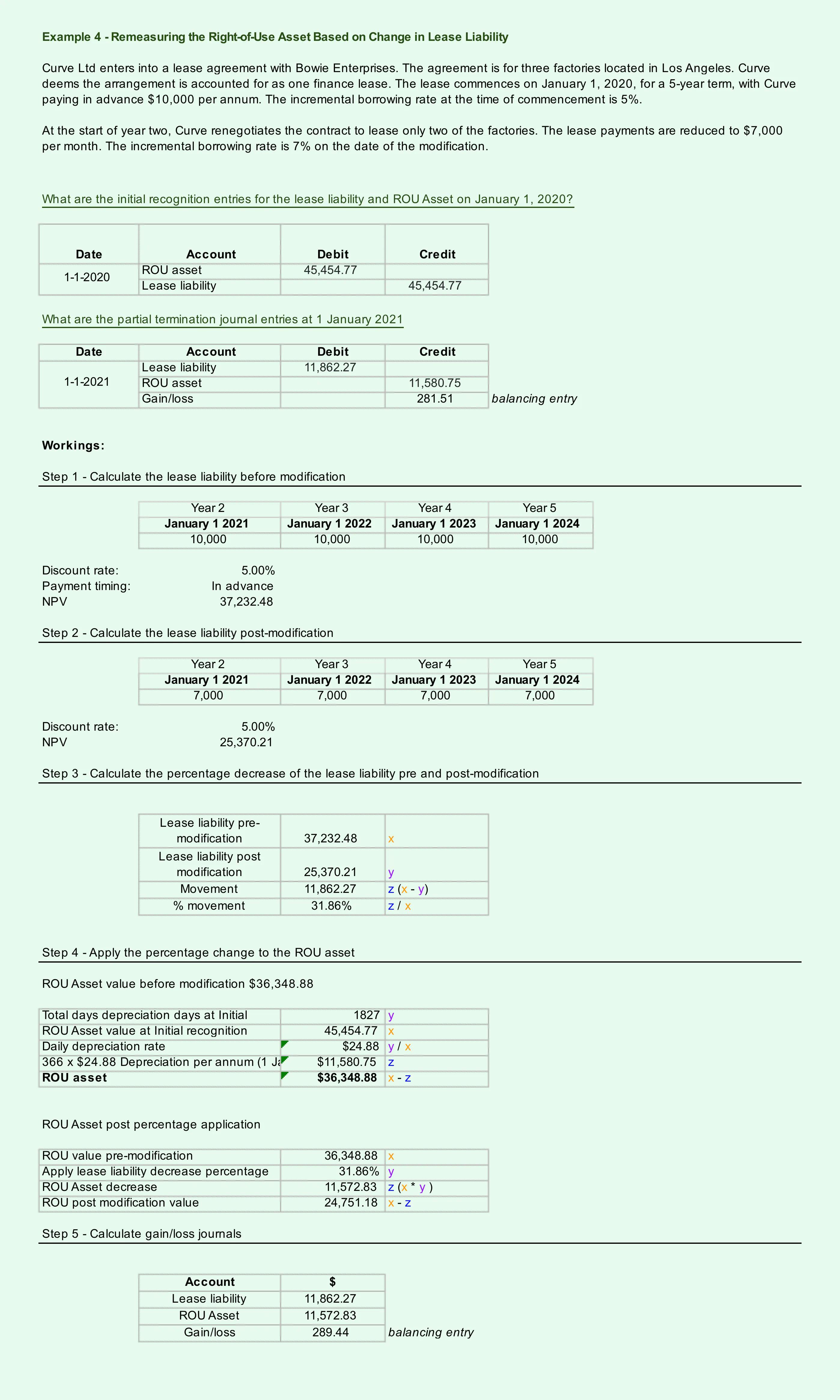

Partial termination/decrease in scope

For example, the original lease agreement was for two floors of office space in a building. It turns out the lessee only needs one floor and renegotiates new terms with the lessor to remove the additional floor.

The above scenario is a partial termination. The standard prescribes two calculation methodologies when calculating a partial termination. Which is either:

- the percentage reduction in the ROU asset, in this case, a 50% reduction

- The percentage reduction in the lease liability based on the future lease payments

Both methodologies result in a gain/loss being recognized in the profit and loss as detailed in the standard in paragraph 842-10-25-13.

For an example of how the partial termination calculation works, refer to examples 3 & 4.

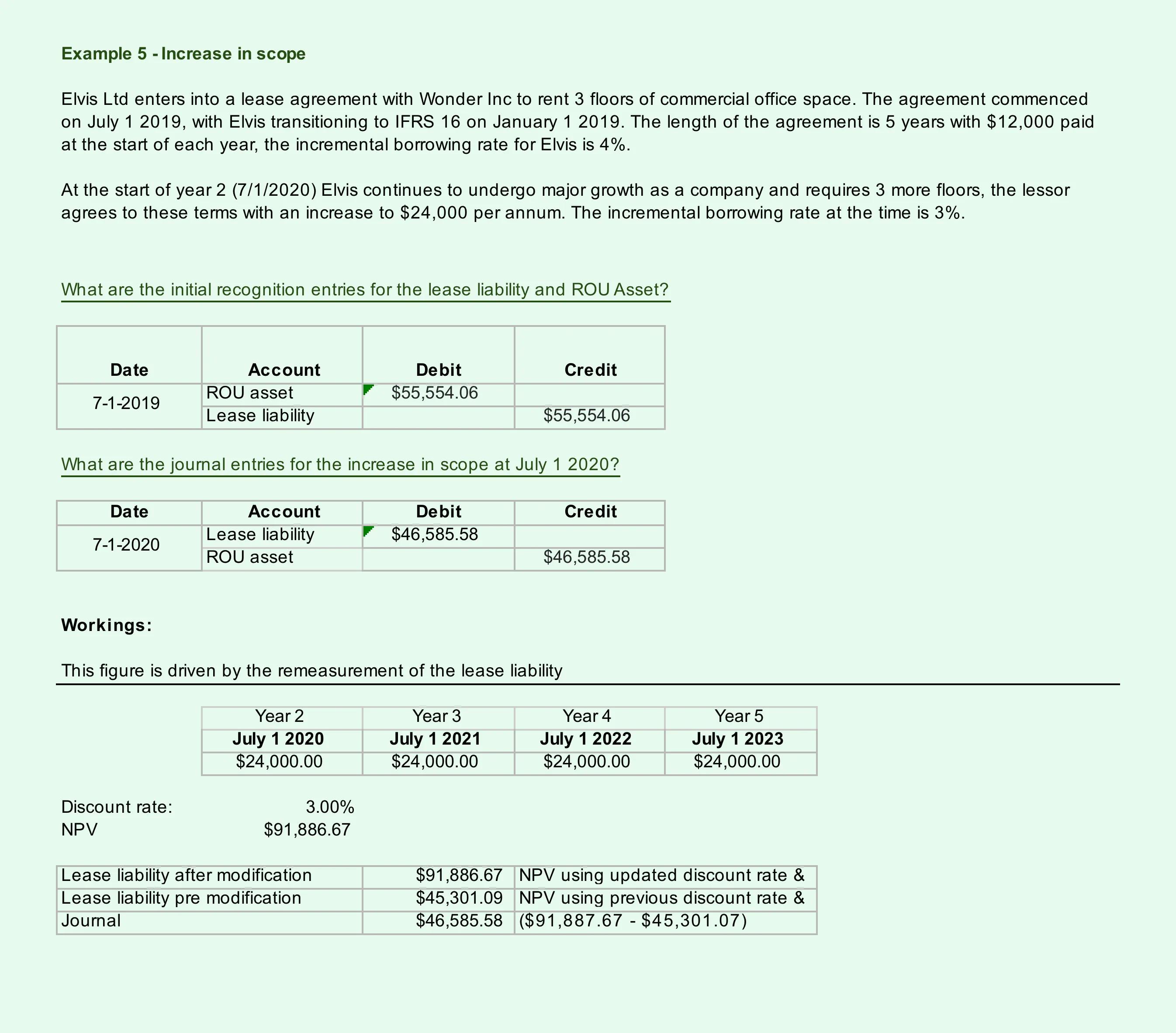

All other modifications

For all other modifications, there is no profit and loss impact. A modification by nature will change future cashflows of the NPV lease liability calculation. Firstly, the lessee will need to capture the current balance of the lease liability and ROU asset before modifying the lease.

Secondly, the lessee will update the future cash flow NPV calculation, driven by a change in payments. For example, there will be a higher frequency of payments to the future cash flow model for an increase in term length. For a decrease in term length, the opposite will occur.

The following examples are classified as finance leases. Each specific example will highlight a particular difference in the measurement of the lease liability depending on the type of modification.

Example 3 - Partial termination/decrease in scope - decrease in asset size Based on the remaining right of use asset

Example 4 - Remeasuring the Right-of-Use Asset Based on Change in Lease Liability

Example 5 - Increase in scope

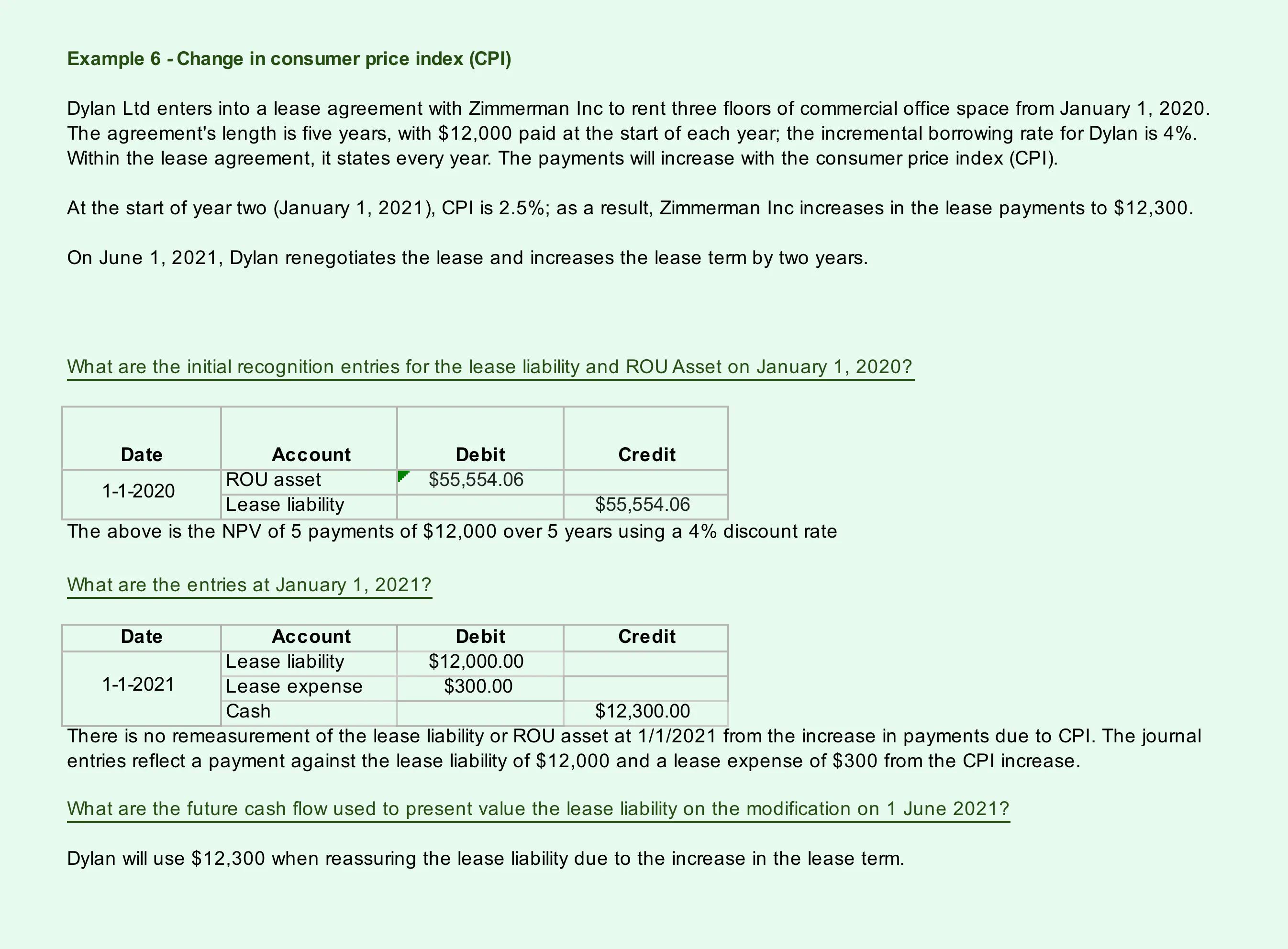

Subsequent changes to a rate or index and variable payments

The lessee does not remeasure the lease liability when there has been a change to lease payments driven by rate or index. Furthermore, the lessee does not remeasure the lease liability for variable payments. This portion of the lease payments is expensed to the income statement.

However, if a modification occurs after that rate or index change, the present value future cash flows include the applicable rate or index change when calculating the lease liability.

Example 6 - Change in consumer price index (CPI)

Reclassification of a lease

Finance lease upon remeasurement

If a lease is classified as a finance lease upon remeasurement (regardless of the classification before remeasurement), a lessee should calculate interest expense on the lease liability based on the discount rate at the remeasurement date. The right-of-use asset amortization expense should be determined by calculating a new straight-line amortization amount using the revised asset value and lease term.

When the lease liability is reassured, and the right-of-use asset is adjusted, the amortization of the right-of-use asset should be adjusted prospectively from the date of remeasurement.

Operating lease upon remeasurement

If a lease is classified initially as a finance lease is remeasured and classified as an operating lease. 842-10-25-14 states any difference between the carrying amount of the right-of-use asset after recording the remeasurement adjustment and the carrying amount of the right-of-use asset that would have resulted from initially classifying the lease as an operating lease should be accounted for like a rent prepayment or a lease incentive.

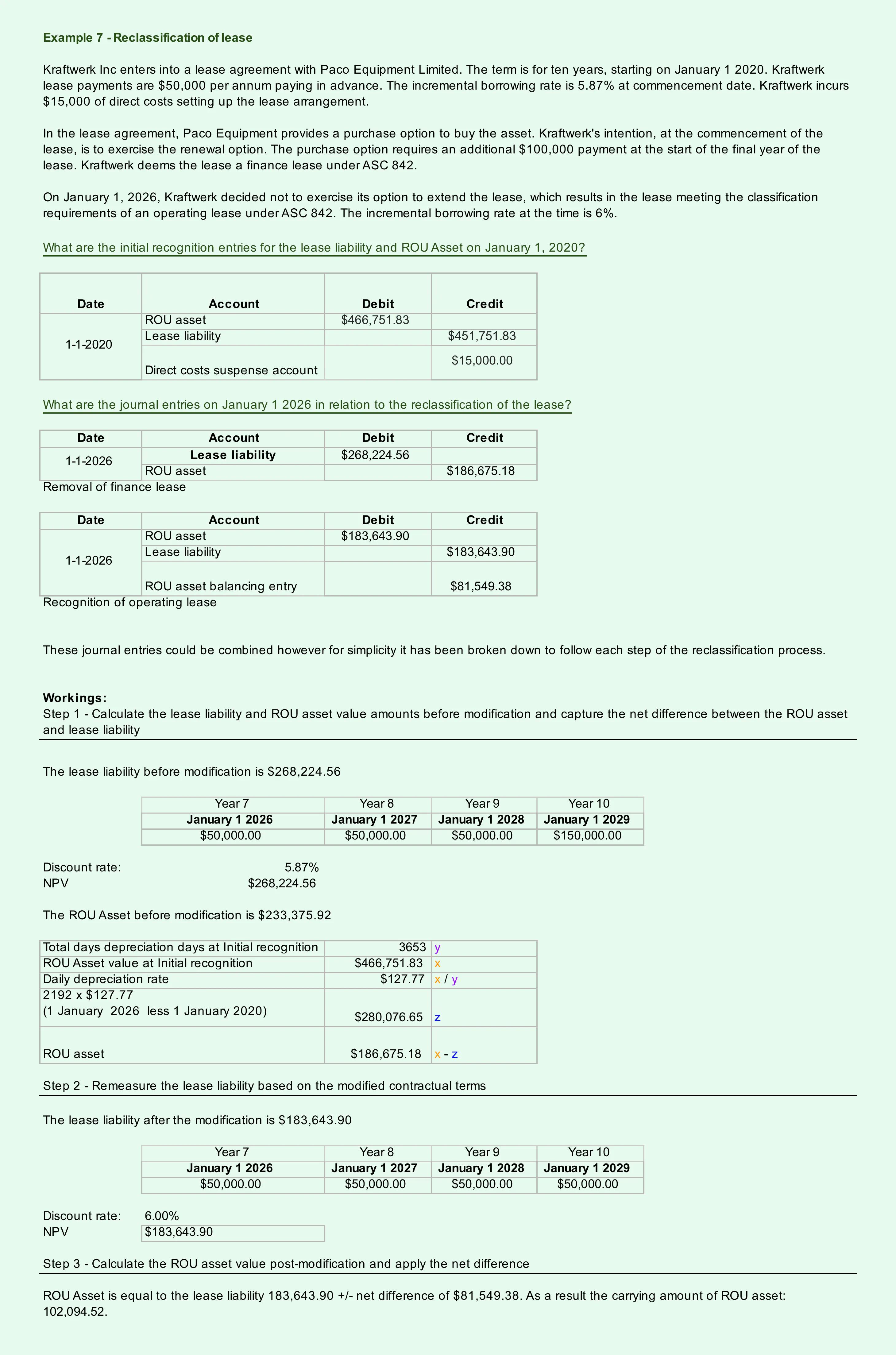

Example 7 - Reclassification of lease

ASC 842 adoption process

After digesting the information above, you may have even more questions than answers. The first question might be where to start and what to do with all my leases currently under ASC 840 as operating leases?

Where to start

The first thing you'll need to do is select your transition method. If the effective date method is adopted, you'll need no historical information. Compared to the comparative transition option where the lessee requires historic leasing details to account under ASC 842 correctly.

Process and record-keeping

One of the biggest challenges of ASC 842 will be ensuring your company's processes and record-keeping are adequate. Previously under ASC 840, changes under operating leases didn't require much attention, the invoice was paid, and there was a lease expense recognized in the P&L, simple.

This has all changed under ASC 842. Changes to lease contracts need to be tracked and accounted for (not just by accounts payable), as these changes can have a material impact on a company's financial statements. Who is going to manage the lease portfolio? Do you have a lease management team, or is the finance team going to do it?

Regardless, a member of the finance team will need to perform the initial recognition NPV calculations for all leases previously classified as operating leases under ASC 840, which isn't a step to take lightly.

The sooner, the better.

Due to COVID-19, private and government entities have another year to prepare for the transition to ASC 842 now effective in 2022. That should be indication enough from the FASB that transitioning to ASC 842 will be no easy task. With the additional time use this to your organization's advantage:

- schedule a time in your organization when things are quieter to do transition

- leverage industry experts, e.g. Cradle to assist with the transition to the new standard

Early adoption is permitted, so it now gives you the flexibility to transition on an organization terms rather than a mad rush on transition date.

After the transition ASC 842, the accounting does not stop. That is why we built Cradle to make your lease accounting more straightforward than ever before. We'll literally do it all for you.