How to Account for Leasehold and Tenant Improvements under ASC 842 & IFRS 16

What is a leasehold/tenant improvement?

The lease accounting standards do not explicitly define what a leasehold/tenant improvement is. It's not uncommon within a lease portfolio with certain leased assets the lessee will make payments for improvements to the underlying asset. The accounting for this transaction can significantly differ depending on the circumstances between the lessor and lessee.

For example, how does the lessee account for a scenario when they make improvements to the leased asset and are subsequently reimbursed by the lessor?

Before going further, it's essential to understand the interplay between lease incentives and leasehold improvement.

IFRS 16 defines a lease incentive as:

Payments made by a lessor to a lessee associated with a lease, or the reimbursement or assumption by a lessor of costs of a lessee.

ASC 842 defines a lease incentive as:

a. Payments made to or on behalf of the lessee

b. Losses incurred by the lessor as a result of assuming a lessee's pre-existing lease with a third party.

As we explore this topic further, the accounting theory starts as relatively straightforward becomes complex very quickly. As a result, there is a diversity of practice of how lease incentives and leasehold improvements are accounted for.

Reimbursement of leasehold improvements

One of the most common examples of a lease incentive is when the lessor reimburses some or all costs the lessee has incurred for a leasehold/tenant improvement.

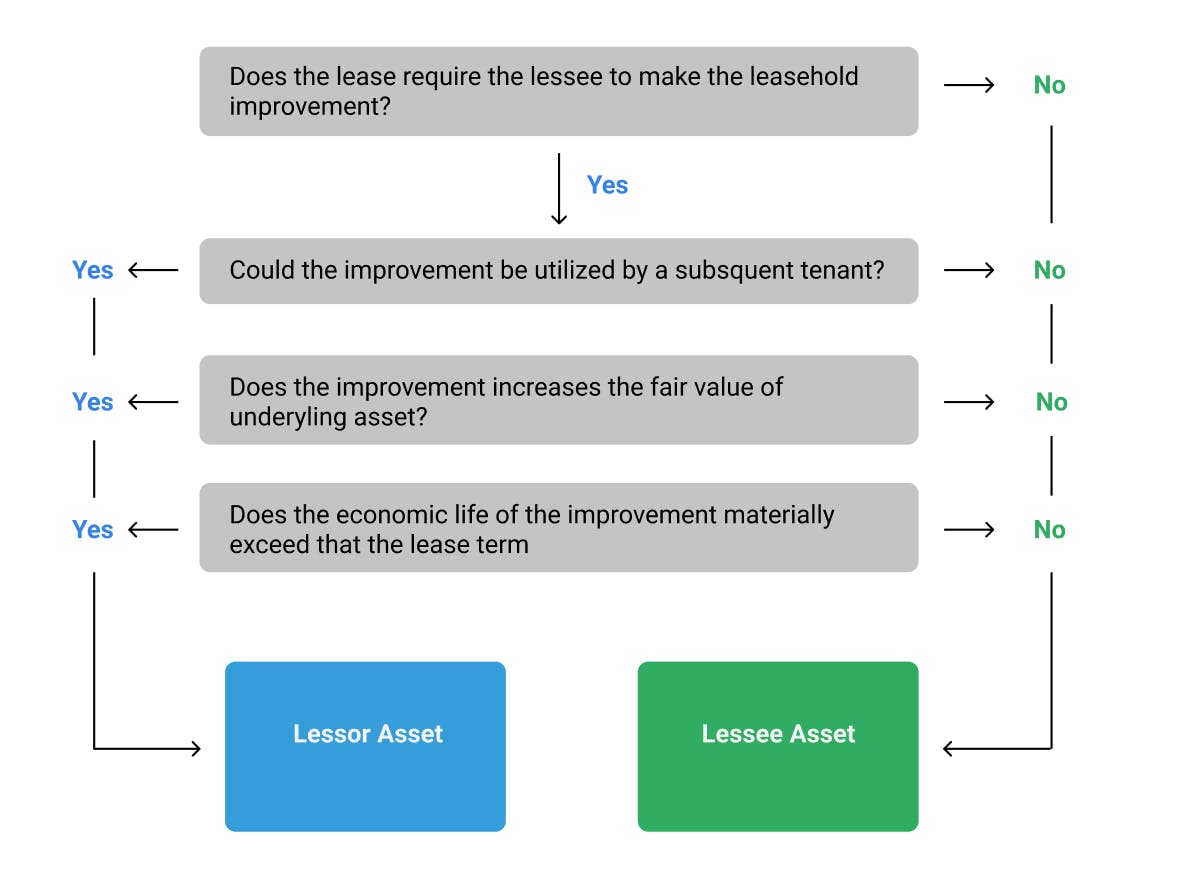

When deciding on how to account for the above scenario, the lessee must determine whether the leasehold improvement is the asset of the lessee or lessor. See below for the decision indicators when deciding whether it’s a lessee or lessor asset:

Lessee Asset

Lessee not required to make leasehold improvements

Lessee not required to make leasehold improvements

Generally, if a lease does not explicitly require a lessee to make an improvement, the improvement should be considered an asset of the lessee. Payments for lessee assets should be excluded from lease payments when evaluating lease classification and measuring the right-of-use asset and a lease liability.

Accounting

The lessee should account for the leasehold/tenant improvement inline with the applicable property, plant and equipment standard IAS 16 or Topic 360

Dr PPE

Cr Cash

The useful life will require judgment and will depend on:

- Is the leasehold improvement removable

- For non-removable leasehold improvements, the lease term will need to be considered

Lessee required to make leasehold improvements

If the lease requires the lessee to make an improvement, the uniqueness of the improvement to the lessee's intended use should be considered.

Improvements that are not specialized and a subsequent tenant could probably utilize them would likely be would likely be considered assets of the lessor.

Other factors include whether the improvement increases the fair value of the underlying asset from the lessor's standpoint and the economic life of the improvement relative to the lease term.

An example of a lessee asset is if a lessor agrees to pay a fixed or formula-based amount to the lessee once the lessee provides evidence of the expenditures. The contract does not specify the nature of the improvements to be completed; it is reasonable to conclude that the improvements represent lessee assets.

Fixed or variable lease incentive?

When the lessor reimburses the lessee for an asset (i.e. a lease incentive) after lease commencement, the lessee and lessor must determine whether the lease incentive is considered fixed or variable.

Fixed incentive

Assume the incentive is subject to a cap, and it is reasonably certain the lessee will use some or all of the amount available for reimbursement by the lessor. In that case, the portion of the incentive that is reasonably certain to be used should be treated as an in-substance fixed lease payment (i.e., reduction to lease payments).

A leasehold improvement allowance negotiated between a lessee and lessor creates an economic incentive for the lessee to use the full amount of the allowance. Therefore, negotiated lease incentives are generally considered reasonably certain of use because a lessee is economically incentivized to use the entire incentive that is negotiated.

For lessees, at lease commencement, if an allowance for lessee assets represents an in-substance fixed lease payment, a lessee should estimate the timing and amount of the payments not yet received and include them in lease payments when classifying the lease and measuring the lease liability, which in turn would get reflected in the right-of-use asset.

Variable incentive

If an incentive is determined to be variable at lease commencement. In that case, we believe both a lessee and lessor should account for the lease incentive as a period item when the contingency is resolved.

Accounting

For a fixed incentive, the lessor payment is a lease incentive that should be recorded as a reduction to fixed lease payments. Following IFRS 16, paragraph 27 and ASC 842-10-15-35, it will reduce the lease liability and right-of-use asset value.

Accounting for a variable incentive will be expensed when incurred. There is no impact on the lease liability, following the same logic as variable lease payments.

Lessor Asset

When a lessee pays for an improvement that is a lessor asset, the expenditure is prepaid rent rather than a lease incentive; the reimbursement is a reduction to prepaid rent. If a lessee were not fully reimbursed, the difference between the costs incurred and the reimbursements received would be included in lease payments.

If a lessee is required to complete a lessor asset improvement, but the improvement has not been completed as of the lease commencement date, an estimate of the costs to construct the asset, net of any funding to be provided by the lessor should be included in lease payments for purposes of classification and measurement.

Accounting

Lessor asset before commencement:

Dr Prepiad Rent

Cr Cash

To record the leasehold improvement before lease commencement.

Dr Cash

Cr ROU Asset

When the lessee is reimbursed for the leasehold improvement (incentives received before commencement)

Dr ROU Asset

Cr Prepaid Rent

If a portion of the leasehold improvement is not reimbursed (payments made before commencement date)

Lessor asset after commencement:

The lessee will calculate the additional cost of the leasehold improvement (the amount they will not get fully reimbursed for). This will be added to the fixed payments, which form the present value of the lease liability.

Practical example

Now if you’re unfamiliar with basic concepts of how to present value and calculate the lease liability it’s recommended you read this article first.

Some fundamental inputs into the methodology of the calculation will be:

- Calculations are done daily: that’s right interest and amortization/depreciation is calculated for every day in the lease. This gives ultimate flexibility when modification accounting occurs.

- XNPV present value formula: we use the XNPV formula in excel, this takes into consideration the date of payments and therefore gives a more accurate present value amount

- ROU asset is calculated as an operating lease under ASC 842

If you would like the excel file of the calculation please reach out to contact@cradleaccounting.com

Part A

Based on the above concepts we’ll now go through an example:

- Start date: 2020/1/1

- End date 2030/12/31

- Discount rate: 3%

- Lease classification: Operating

- Fixed payments: $150,000

- Frequency: Annual

- Payment timing: In Arrears

- Incentive: $70,000 paid to the lessee for the lessor leasehold improvements

- Lease payments before Part Commencement: $20,000 not reimbursed by the lessor for the lessor leasehold improvements.

Solution:

Initial measurement:

Step 1: Calculate the lease liability value:

The present value of $150,000 paid in arrears, over 10 years with a discount rate of 3% using an XNPV formula is: 1,279,536.85

Step 2: Calculate the ROU Asset value:

Lease liability value: 1,279,536.85

add Lease payments made before commencement date: $20,000

less Incentives received before commencement date: $70,000

ROU Asset value: 1,229,537

Step 3: record journals for the month of January (2020/1/1 to 2020/1/31)

2020/1/1

Dr ROU Asset 1,279,536.85

Cr Lease liability 1,279,536.85

Recognition of the lease liability and right of use asset

2020/1/1

Dr ROU Asset $20,000

Cr Lease prepayment $20,000

Recording the portion of the leasehold improvement not reimbursed by the Lessor

2020/1/1

Dr Lease prepayment $70,000

Cr ROU Asset $70,000

The leasehold improvement reimbursed by the Lessor

2020/1/1 to 2020/1/31

Dr interest expense $3,216.28

Cr lease liability $3,216.28

Interest charge relating to the right of use asset (2020-01-01 to 2020-01-31)

2020/1/1 to 2020/1/31

Dr lease expense $9,092.05

Cr ROU Asset $9,092.05

Amortization charge relating to the right of use asset (2020-01-01 to 2020-01-31)

Part B

Modification Accounting - Incentive

On January 1 2025 the lessor and lessee modifies the agreement in which:

- The lessee can incur a maximum $50,000 of expenditure in relation to leasehold improvements starting 1 January 2026

- All expenditure must be incurred by 1 July 2026 and will be offset against the future lease payment on 31 December 2026

- The lesse deems it reasonably likely to incur $50,000 of expenditure. As a result the future lease payment on 31 December 2026 will be $100,000

- The improvements will benefit future lessee’s of the leased asset

- Lessee deems this a lessor asset and will account for the leasehold improvement as a incentive resulting in a future reduction

- Discount rate at the modification date for the lessee is 2%

Solution:

The above arrangement in relation to the reimbursement of funds from the lessor meets the definition of a lease incentive therefore the lessee will reduce the future payments on 2026-12-31. The remeasurement will occur on 2025-1-1, the date the lessee and lessor agree to the contractual change.

Step 1: Update the future lease payments.

The payment on 2026-12-31 is adjusted from 150,000 to 100,000.

Step 2: Record the lease liability movement based on the updated cash flow payments using the updated discount rate

Pre modification lease liability: 812,613.08

Post modification lease liability: 792,177.06

Remeasurement amount: 20,436.02

Step 3: Update the ROU Asset:

- The ROU Asset amount is decreased by $20,436.02 to $762,097.65

- Update the amortization based on the update ROU Asset value and future lease expenditure

- Average daily rent: $374.22

Journals for 2025-1-1 to 2025-1-31:

2025-1-1

Dr Lease liability $20,436.02

Cr ROU Asset $20,436.02

Remeasurement of the Lease liability and ROU Asset as a result of lease incentive modification

2025-1-1 to 2025-1-31

Dr Lease expense (Operating Lease) 10,267.43 USD

Cr ROU asset (Operating Lease) 10,267.43USD

Amortization charge relating to the right of use asset (2025-01-01 to 2025-01-31)

2025-1-1 to 2025-1-31

Dr Lease expense (Operating Lease) 1,333.46 USD

Cr Lease liability (Operating Lease) 1,333.46 USD

Interest expense on the unwinding of the lease liability (2025-01-01 to 2025-01-31)

If you would like to understand how the calculations work please reach out to contact@cradleaccounting.com and we will provide an excel spreadsheet with all applicable workings and formulas.