How to Calculate the Journal Entries for an Operating Lease under ASC 842

by Lucas Russell | 2021-04-13

Introduction

To start, if you're not familiar with the principles of the new lease accounting standard ASC 842, I'd recommend first familiarizing yourself with the following material:

- A summary of the new lease accounting standard

- How to Calculate the Lease Liability and Right-of-Use Asset for an Operating Lease under ASC 842

Once having read the above, you should have a clear understanding of the new lease accounting standard. You should be aware that leases now come on the balance sheet in the form of a lease liability and right of use asset. If this is still not entirely clear, our ASC 842 guide takes you through the new lease accounting standard step by step, including numerous calculation examples.

This article is the sequel to How to Calculate the Lease Liability and Right-of-Use Asset for an Operating Lease under ASC 842. If you can't do the calculations, you will not be able to do the journals. For consistency, we'll use the calculation examples from that article and use that as the starting point to do the journals.

Generating accurate journal entries for each lease every reporting period requires precise calculations. Lease Accounting Software automates journal entry generation for both initial recognition and ongoing measurement.

To be able to follow along with the article I highly recommend requesting the excel calculation.

If you would like a copy of the lease calculation and linked journal entries in Excel, please reach out to contact@cradleaccounting.com.

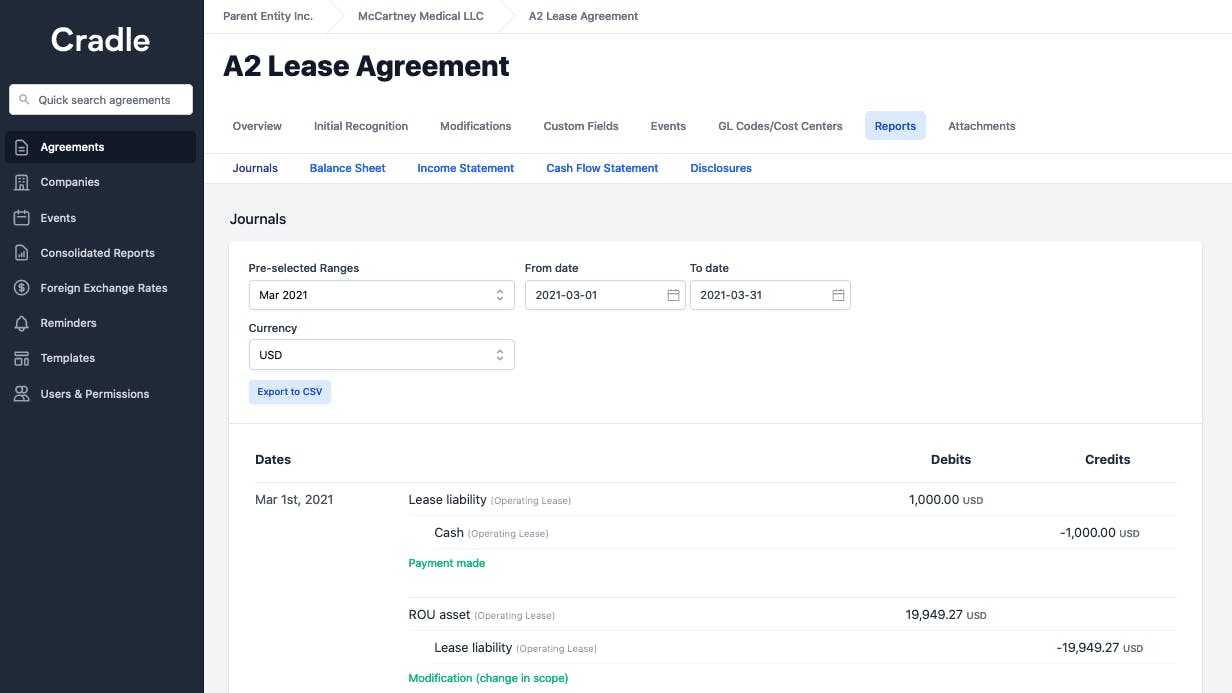

Step 1 Recognize the lease liability and right of use asset

In reference to calculation Example 1 from How to Calculate the Lease Liability and Right-of-Use Asset for an Operating Lease under ASC 842, the initial recognition values on 2020-01-01 are:

- Lease liability $116,357.12

- Right of use asset $116,357.12

As a result, on the commencement of the lease, you will recognize the following journal entries:

Consistent with the journal description, the lease liability and right of use asset are recognized on the balance sheet.

Step 2 Recognize the unwinding of the lease liability and amortization of the right of use asset

Whatever your reporting frequency is, you will recognize the following*:

- Any payments made

- Interest accrued on the lease liability

- Amortization of the right of use asset

*this assumes there are no modifications, which we’ll cover later.

Given most companies report monthly, the journals below will follow that reporting frequency. Using Example 1 from How to Calculate the Lease Liability and Right-of-Use Asset for an Operating Lease under ASC 842, the journals for the month of January are:

Within the Excel file, all the numbers are linked directly to the calculation. The journals posted do the following:

- Payment made: There was one payment made on January 1 for $10,000. This payment will reduce the lease liability value by $10,000 when the payment is made on 2020-01-01.

- Amortization charge: this will reduce the right of use asset amount for the month. For January, the amortization charge is $9,551.01.

- Interest expense: this will increase the value of the lease liability. For January, the interest incurred was $612.92.

For those curious why the journals are being charged to “lease expense” instead of interest and amortization, I’d recommend reading this article, The Difference Between Calculating an Operating Lease and a Finance Lease Under ASC 842.

Step 3 Continue to record journal entries until the expiry of the lease

If there are no changes to the lease agreement, aka modifications, you’ll continue to post journal entries at your reporting frequency until the expiry of the lease. Those journals posted will result in both the lease liability and right of use asset going to zero.

Step 4 Ensure to account for any modifications

On the date effective of a modification, there will be a remeasurement of the lease liability and the right of use asset. To understand why journal entries are required for modification accounting, refer here to our guide and select "Subsequent measurement and modification accounting".

Concerning the calculation Example 2 of How to Calculate the Lease Liability and Right-of-Use Asset for an Operating Lease under ASC 842, the following modification occurs:

- On 2020-10-16, the fixed payment amount increased to $12,000 on 2020-11-1. The appropriate discount rate at modification is 6.00%

As a result, on October 16, a remeasurement journal will be required as that specific contractual modification impacts the future cash flows resulting in the present value of the liability. The difference between the pre and post-modification amounts is the remeasurement journal.

As noted in the calculation:

- Lease liability pre modification: $19,885.48

- Lease liability post modification: $23,881.59

- movement : $3,996.11

The other side of the journal goes to the right of use asset.

For October, the journals would be:

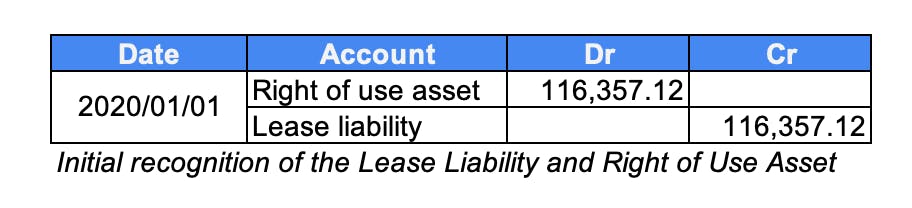

On November 1, 2020, the payment journal will be:

The remainder of the journals will continue using the same logic as the previous month-ends.

The above modification was an increase in scope. As noted above, the journals and calculations are relatively straightforward. Please be aware when there is a decrease in scope modification, the journal entries do not follow the exact logic. There are some additional steps. An example of a decrease in scope modification is the lessee negotiate the lease from leasing three floors of office space to one floor of office space. Firstly, there are some additional calculation steps when there is a decrease in scope modification resulting in additional journal entries. For an example of a decrease in scope, refer to our ASC 842 guide Example 3 - Partial termination/decrease in scope - decrease in asset size based on the remaining right of use asset.

Transition

You may be curious what the journal entries are when transitioning to ASC 842 from ASC 840. The journals follow the exact principles as above. When using the effective date method, on the day of transition, you will recognize the lease liability and right of use asset on the balance sheet, from there it's business as usual. With the comparative method, it's exactly what we just went through. For more information on accounting for the transition from ASC 840 to ASC 842, refer to our article Transition Guide to ASC 842.

Journals entries in relation to a finance lease

Another question you may have is, are the journal entries for a finance lease different? The short answer is yes. For more information, refer to The Difference Between Calculating an Operating Lease and a Finance Lease Under ASC 842.

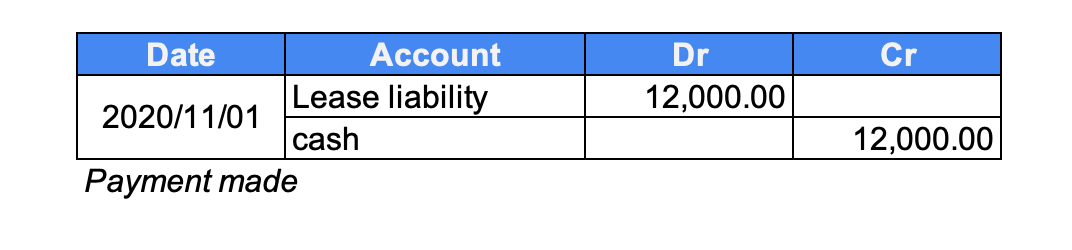

An easier way to do lease accounting

An alternative to the time-consuming manual NPV calculations and journal entries is Cradle's lease accounting software. Schedule a 30-minute demo to see how all these tasks, and more, can be automated.