Lease Accounting Software Selection Guide

by Lucas Russell | 2020-12-22

Where to start

The new lease accounting standards IFRS 16 (worldwide) and ASC 842 (USA) have entirely changed the principles of lease accounting.

Once adopted, companies must record all leases on the balance sheet, this including operating leases.

For public companies, the effective date was January 1, 2019. However, for private companies depending on your local reporting regulations, the standard may not be effective—for example, with ASC 842, the effective date for U.S. private companies is from January 1, 2022.

The number of leases in a company's portfolio is indicative of the impact of the new lease standard. One or two leases can be handled manually without overwhelming the finance team. The higher the number of leases, the more cumbersome the standard becomes. PwC stated, "For most companies, the significant changes to lease accounting mean that spreadsheet-based calculations will not be reliable or accurate enough."

Accuracy is not the only issue. Companies will need to ensure the completeness of lease data while providing a centralized and accessible lease database. This may have been overlooked when accounting for operating lease under the previous lease accounting standards due to its straightforward nature. An embedded lease classified as an operating lease can have a material impact on a company's balance under ASC 842 and IFRS 16.

Additionally, because of the material impact of the new lease accounting standard, lease administration is now crucial to ensure modifications are not overlooked and appropriately accounting for.

For further information on why the new standard was introduced, refer here.

How to account for a lease under the new standards?

A lessee must now recognize a right of use asset and a lease liability. The exemption to this rule is if the lease is shorter than 12 months or deemed low value (IFRS only).

There are several nuances when calculating the lease liability. The lease liability is the present value of the known future lease payments at a certain point in time. It also the starting point for the right of use asset valuation.

For a detailed guide of how to calculate the lease liability and right of use asset, refer here for ASC 842 and here for IFRS 16.

Why use lease accounting software?

With the implementation of the new lease accounting standard, there is the opportunity to leverage technology to:

- Minimize the number of manual tasks required to comply with the standard requirements.

- Increase the accuracy of financial reporting by removing manual errors.

- Enhance the visibility over critical data, be it financial or portfolio characteristics, e.g., renewal option.

The lease accounting software solutions available in the market can automate the financial reporting requirements prescribed by ASC 842, IFRS 16 and GASB 87.

So how does lease accounting software work:

1) The user inputs the necessary contractual details such as payment frequency, payment amount, and other payment-related information.

2) Input the applicable accounting judgments, such as the discount rate and lease term.

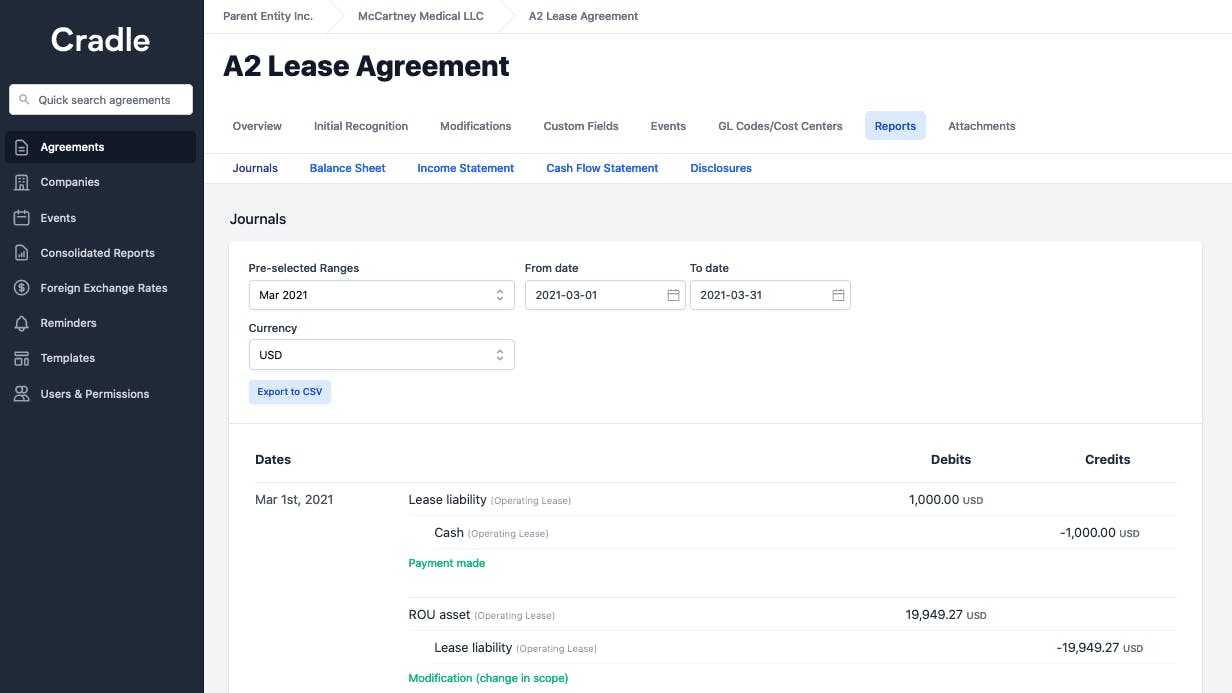

From this data, the lease accounting software will calculate the value of the lease liability and right of use asset and generate your required journal entries for your accounting system. Another benefit of using lease accounting software is the ability to run all financial statement reports, including the necessary quantitative disclosures for your financial statements, instantly.

What features should the lease accounting software provide?

It's hard to differentiate between many of the solutions on the market. Pricing is incredibly opaque. Few companies provide actual screenshots and videos of their product. The easiest way to assess the software will be by requesting a product demo.

Given that demos are timely exercises, the first thing to do is shortlist your potential vendors. This decision will be based on two main inputs:

- Functionality requirements applicable for all lease portfolios

- Features specific to your portfolio requirements

Functionality requirements applicable for all lease portfolios:

- Engineered to meet the lease accounting standard calculation requirements: No matter if you're a listed multinational company with thousands of leases across multiple currencies and multiple finance teams or a company with 15 leases and one user. First and foremost, the software needs to have a robust calculation engine. From that engine, you should be able to:

- Input data for any payment scenario. That includes different types of payment frequencies, ad hoc payments, rent holidays, etc. Furthermore, the software should be able to handle reports being run for any date range.

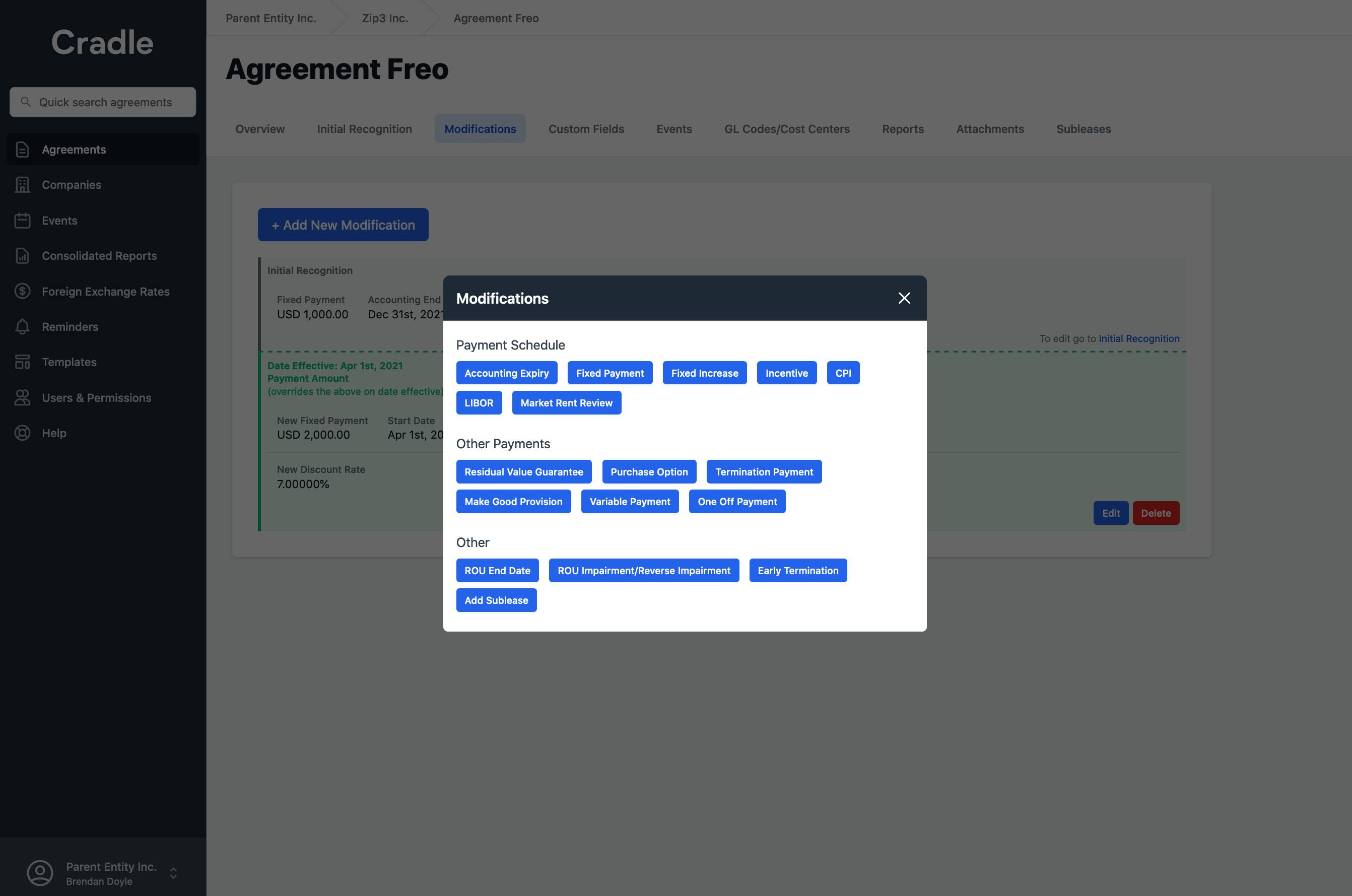

- Modification accounting: Are you able to modify the initial data input? The lease accounting standards are prescriptive of how to account for a lease modification. Can you modify any of the inputs initially entered? For example, the payment amount, the lease's end date, or impair the right of use asset. Is there an option to adjust the discount rate when the modification occurs?

Furthermore, is the decrease in scope calculation in-line with the prescribed calculation methodology with a gain/loss being captured in the profit and loss statement in addition to the re-measurement of the lease liability and right of use asset? Are the modifications to the agreement easy to track to ensure no duplication?

- Exportable journal entries: For most companies, this is how you will migrate the accounting information into your applicable accounting system's general ledger. An essential feature is setting up general ledger codes within the lease accounting software to mirror your general ledger environment.

- Financial statement reports - The balance sheet and income statement are apparent inclusions. Do not overlook the statement of cash flows. A lessee needs to separate cash payments between the principal and interest portions. For ASC 842, this only applies to finance leases.

- Disclosures: The disclosure requirements of the new lease accounting standards are incredibly prescriptive. Ensure the disclosure report generated includes all required quantitative information prescribed by the standard.

Specific features for a company's lease accounting

If you're comfortable that the lease accounting software can handle the fundamentals, you're ready to consider additional portfolio requirements. Not all companies will require all of these features, but the primary considerations should be the following:

- Foreign exchange accounting: If you have leases denominated in foreign currencies, this will be essential to your functionality requirements. Accounting for foreign currencies manually can be incredibly time-consuming and prone to error.

- Consolidated reporting: If you have lease portfolios across multiple entities, it will be vital that you can run consolidated reports but also company-level reports. For example, the parent entity will want to run the consolidated numbers, but the subsidiary may wish to see their figures.

- Lessor and sublease accounting: Given the current economic climate, a lessee entering into subleases will only become more prevalent. If your portfolio includes a large number of subleases, you will want to ensure the requirement can be met.

- Dual reporting: Are you looking for just ASC 842 software or IFRS 16 software? Some companies are required to dual report under both lease accounting standards.

Lease asset management

All lease transactions are entered into to address a commercial need. For some companies, lease management software is imperative to staying on top of the commercial requirements of managing the lease portfolio. Given that lease management has been a problem companies have faced longer than the new lease accounting standards ASC 842 and IFRS 16, there are many more lease management software solutions on the market.

Some solutions have initially been created as a lease management tool and realized that accounting functionality is an important feature to offer. On the other side of the coin, you have solutions predominantly built for lease accounting and offer tools to manage a lease agreement.

Unlike lease accounting functionality, in which the accounting standards provide a clear guide of the features needed and the expected behavior, there are no set requirements for lease management.

If lease management is an essential aspect of the organization, some useful features will be:

- Notifications: If the portfolio information is not kept up to date, the accounting information will be incorrect as a result. The software should allow you to search for upcoming events, whether a payment or CPI review. Furthermore, you should have the ability to set email notifications to ensure no key date is missed.

- Custom Fields: Mandatory fields are required from a lease accounting perspective to perform the necessary calculations. However, from a lease management perspective, what information a company captures is specific to that portfolio—the more flexibility offered on capturing the data, the more valuable the software to the organization.

- Custom reporting: Versatility of being able to run reports specific to the data you've entered. Able to drill down on applicable data will allow you to stay on top of each commitment throughout the portfolio.

- Workflow analysis: The ability to track changes to agreements and send potential changes for approval.

Features of cloud-based enterprise software

If the software is well-engineered, it should come with the following features that you would see for any cloud product:

- User permissions: Ability to control what information users can access and edit at various levels, for example, ensure a specific user only has access to a particular company.

- Validations: You don't want your lease accounting software to be a glorified spreadsheet. If you input nonsensical data, your software should provide an alert and highlight the input error.

- Accessibility: For ease of use, the software can be accessed anywhere with an internet connection.

- Search: Ability to search for events, agreements and find the information you want efficiently.

- Centralized documentation: Capable of uploading and organizing documents.

- Usability: This is an essential aspect of the software that should not be overlooked. The software may have all the required features, but if you don’t know how to use them, they’re redundant. This can be exasperated when lease accounting is one of many tasks for the accounting team. You don’t want to spend hours reacquainting yourself with the software to perform a simple modification of a lease agreement.

One of the best aspects of software is that it continually improves. When deciding on the appropriateness of the software it’s good to get an understanding of what features are on the development roadmap, the release date and how significant that feature will be to your portfolio. The timeliness of rolling out new features can vary widely depending on the company and its complexity.

Pricing

Pricing for lease accounting software is incredibly opaque. As you have probably realized, very few companies put their pricing pages on their website. Fewer options offer a turnkey solution to sign up and get going like you would using other SaaS products such as email.

Once you've established your functionality requirements, the next step is to select vendors you believe meet these requirements and schedule a demo. It would be nice to include pricing into the selection criteria, but at the very least, you'll have to reach out to the applicable vendor to get a price estimate.

Once you've narrowed it down to a particular vendor, get a trial account, onboard some agreements, and ensure the software is appropriate for your lease portfolio.

From there, you'll need to weigh up the value offering and determine if the price warrants the additional features or other inputs that go into your selection criteria. There are numerous ways vendors charge for using their lease accounting software. Some of those are:

- Subscription-based on number of users

- Subscription-based on number of leases

- One-off fee

- Annual subscription

- Freemium: free of charge until a certain quota is reached, generally with limited functionality as well

- Implementation fee

- Customer support charges

Due diligence is always recommended to understand the costs and potential for those costs to increase in the future.

Conclusion

The new lease accounting standards aren't going anywhere soon, so you will want to make sure you make the right decision. A little more time spent during the procurement process, such as getting a trial account and getting the buy-in from different departments, will pay dividends in the long run.

Lease accounting software you want

Cradle's lease accounting software has been precisely engineered to automate your compliance with ASC 842. With Cradle's transparent pricing and ease of use, skip the drawn-out sales calls and sign-up for a free trial.