The Required Disclosures for IFRS 16

Introduction

IFRS 16: Leases replaced IAS 17 (the previous standard for leases). It governs the accounting for leases by lessee and lessor.

Broadly speaking, now under IFRS 16 lease accounting for lessees is as if every lease classified now classified Finance lease under the old accounting standard. The only exception to that is low-value assets and short-term leases.

The lessor, on the other hand hasn't changed significantly.

Learn more about lease accounting under IFRS 16 by reading our article here.

This article focuses on the disclosure requirements set out by IFRS 16. There are many of them, and we will cover them all. But why does the standard even require these disclosures? The standard setters have a very clear objective behind these disclosure requirements. Para 51 from the standard defines this objective as follows:

The objective of the disclosures is for lessees to disclose information in the notes that, together with the information provided in the statement of financial position, statement of profit or loss, and statement of cash flows, gives a basis for users of financial statements to assess the effect that leases have on the financial position, financial performance and cash flows of the lessee.

The ultimate objective comes down to the disclosure of information that enables better decision-making by the users of financial statements.

Each disclosure is very thoughtfully required with the same objective in mind. The standard requires two main types of disclosures:

- Qualitative Disclosures – These will mostly come from your lease agreement.

- Quantitative Disclosures – Mostly the breakup of numbers coming in your financial statements.

With this, guess we are ready to delve into further details of the IFRS 16 disclosure requirements.

Where to Start

The disclosures required by IFRS 16 are a blend of both, qualitative and quantitative disclosures.

- Qualitative

Qualitative disclosures are usually in a narrative form and are aimed at providing the users of financial statements with more information about the company’s leasing practices.

IFRS 16 has a handsome list of qualitative disclosures to be given by a company in respect of leases. For example, Para 59 requires the lessee to disclose the nature of the leasing activities of the company. This would be a general paragraph (or maybe just one sentence) broadly describing the assets leased by the company.

Most of the IFRS 16 qualitative disclosures will come from your lease agreement. Additionally, some qualitative disclosures might require the disclosure of information about the policies and significant judgments adopted by the entity.

- Quantitative

Quantitative disclosures mainly include the disaggregation of the transactions and balances appearing in the financial statements. These are all about numbers and reconciliations.

The quantitative disclosures required by IFRS 16 can predominantly be distributed into the following categories:

- Incomes/expenses related to the leases

- Movement in ROU Asset

- Lease Maturity Schedule

- Lease-related Cashflow

Half of these disclosure requirements will be met only if you prepare an ROU Roll forward schedule and a lease liability maturity schedule.

How to calculate a lease liability and right-of-use asset under IFRS 16? Read it out here.

- Cross-Referencing

As a general guideline, IFRS 16 states that all disclosures related to leases should be put together under one note of your financial statements.

Para 53 of the standard says that a lessee shall disclose information about the leases for which it is a lessee in a single note or separate section in its financial statements. However, a lessee need not duplicate information that is already presented elsewhere in the financial statements, provided that the information is incorporated by cross-reference in the single note or separate section about leases.

So, if a user is interested in knowing more about the leasing activities of an entity, he doesn’t need to sift through the entire report to pick up bits of information. All the lease-related disclosures should be collated together in one section of the notes.

However, if some information related to leases is already included in some other portion, do not duplicate it again. Instead, add a cross-reference to that information in the Lease section.

For example, an entity chooses to describe all of its accounting policies in a single note (including the lease policy of a company).

Within the note of Leases, a cross-reference can be included to this note as “For lease accounting policy, refer to Note XYZ” instead of duplication.

Quantitative Disclosures required by IFRS 16:

First we will cover the quantitative disclosures required for IFRS 16. Paragraph 53 of IFRS 16 details the quantitative disclosures a lessee is required to make:

| Item | Disclosure |

|---|---|

| (a) | Depreciation charge for right-of-use assets by class of underlying asset |

| (b) | Interest expense on lease liabilities |

| (c) | The expense relating to short-term leases. This expense need not include the expense relating to leases with a lease term of one month or less |

| (d) | The expense relating to leases of low-value assets. This expense shall not include the expense relating to short-term leases of low-value assets included in (c) |

| (e) | The expense relating to variable lease payments not included in the measurement of lease liabilities |

| (f) | Income from subleasing right-of-use assets |

| (g) | Total cash outflow for leases |

| (h) | Additions to right-of-use assets |

| (i) | Gains or losses arising from sale and leaseback transactions |

| (j) | The carrying amount of right-of-use assets at the end of the reporting period by class of underlying asset |

Most of these disclosures relate to the right of use asset and lease liability by preparing a roll-forward schedule of your right of use asset and lease liability that will cover most of the required disclosures.

But now, let's explain each one of the required quantitative disclosures.

(a) depreciation charge for right-of-use assets by class of underlying asset;

IFRS 16 requires lessees to book a right of use asset for all leases they enter into (unless that is a short-term or low-value asset lease). A right-of-use asset is just like other normal assets booked by a Company that must be depreciated over its useful life.

The depreciation charge booked by the lessee during the year on all the Right of Use Assets in its lease portfolio must be disclosed. The key here is to disclose the correct depreciation figure attributable to the leased assets only.

This figure is readily available in the ROU asset schedule and can be further broken down into each class of assets and individual assets. An example of this is here.

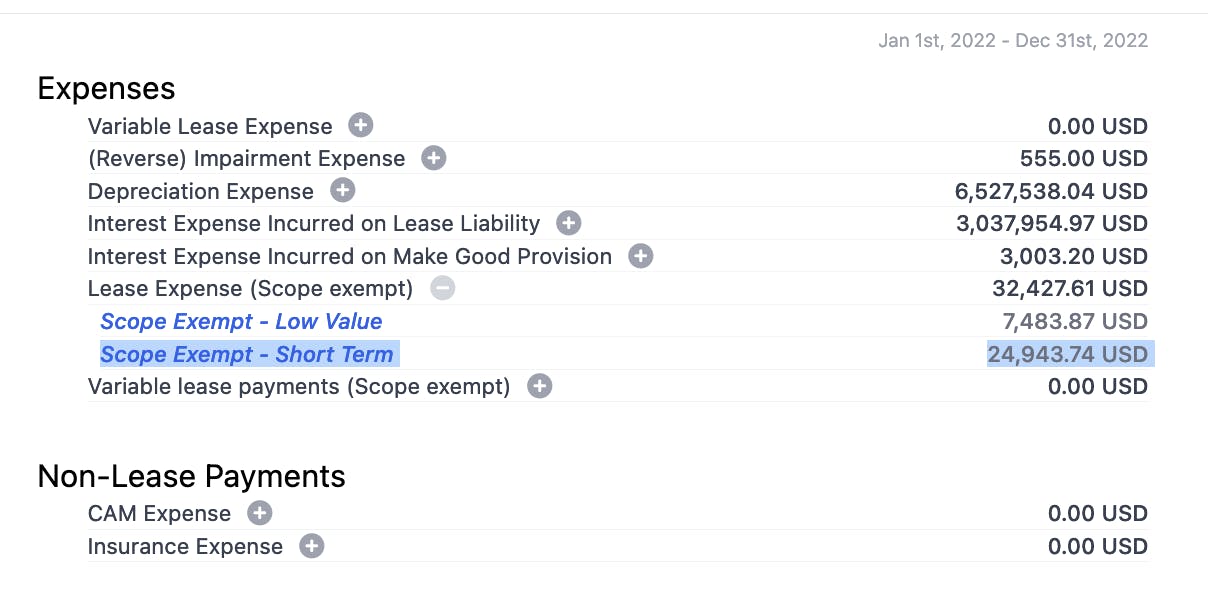

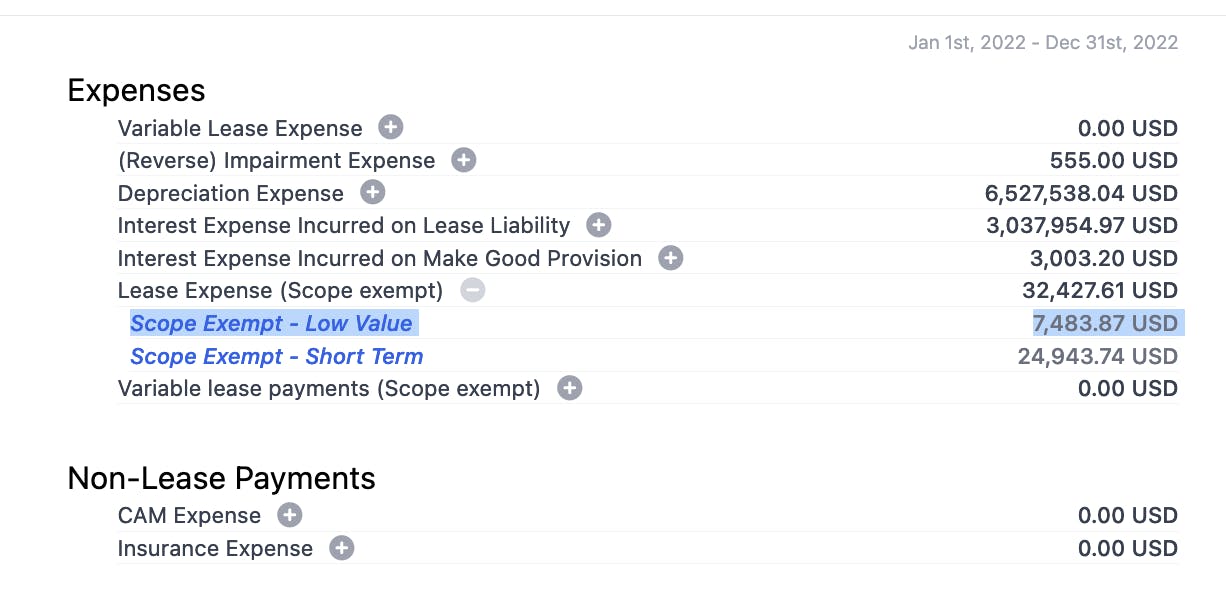

You can go to the ROU asset roll forward schedule in Cradle's lease accounting software to get the figure for depreciation. Also, you can drill down to get the depreciation charge for each lease in your portfolio. Like here:

(b) interest expense on lease liabilities

The entire interest expense recorded on the lease liability must be disclosed separately. The is the total amount of interest calculated on each lease liability.

An example of this disclosure is below:

(c) the expense relating to short-term leases. This expense need not include the expense relating to leases with a lease term of one month or less;

IFRS 16 discusses two instances where the lessee is not required to follow lease accounting:

- Short-term leases (for leases less than 12 months)

- Low-value assets (where the total value of the ROU ASSET is too immaterial, i.e., less than < $5,000)

The scope-exempt leases are booked as a simple expense in the Profit & Loss Statement.

The expenses incurred on short-term leases (more than one month and less than 12 months) must be separately disclosed.

(d) the expense relating to leases of low-value assets. This expense shall not include the expense relating to short-term leases of low-value assets included in paragraph 53(c);

Like short-term leases, any expense charged to the P&L statement during the year on account of low-value assets must be disclosed separately.

Here’s an example of this:

Pro Tip!

As a lessee, what if you have a lease agreement that meets both the conditions of a short-term lease and a low-value asset? That’s possible with a photocopier leased only for eight months.

It will be taken as a short-term lease, and the lease payments made against it should be disclosed as “Expenses relating to short-term leases” under 53 (c). Do not include it in expenses relating to low-value assets.

(e) the expense relating to variable lease payments not included in the measurement of lease liabilities;

If the lease agreement includes a variable charge, for example, a percentage of revenues, for example, 10% of the revenue will be calculated as lease payment. These are variable lease payments (that cannot be foreseen beforehand) that are expensed when incurred. These are not included in lease liabilities.

IFRS 16 requires lessees to disclose the amount relating to variable payments expensed during the year.

(f) income from subleasing right-of-use assets;

A Sublease is a transaction where the lessee re-leases all or a portion of the right of asset to another party. The lessee becomes an intermediate lessor, and the third party becomes a sublessee.

As a result, the lessee generates lease income from the sublease. This income is required to be disclosed.

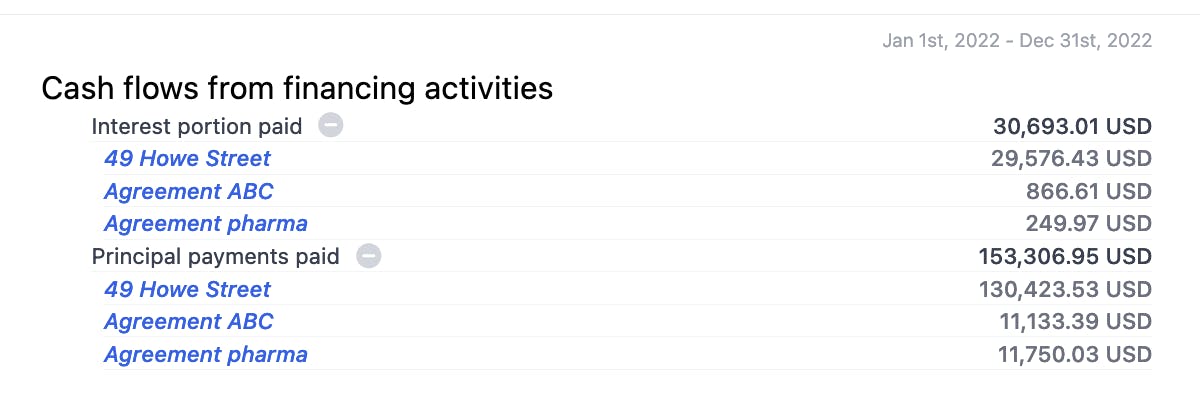

(g) total cash outflow for leases;

All the cash outflow in respect of leases – this will mainly include three components:

- Principal lease liability repayments (classified in financing activities in the Statement of Cashflows)

- Interest payments on lease liabilities (classified in financing / operating activities in the Statement of Cashflows)

- Payments made in respect of low-value assets and short-term leases (classified in operating activities in the Statement of Cashflows)

If you do it manually, this is a lot of work, as you must revisit each lease liability calculation and separate the interest and principal portion of each lease payment.

Cradle makes this very easy:

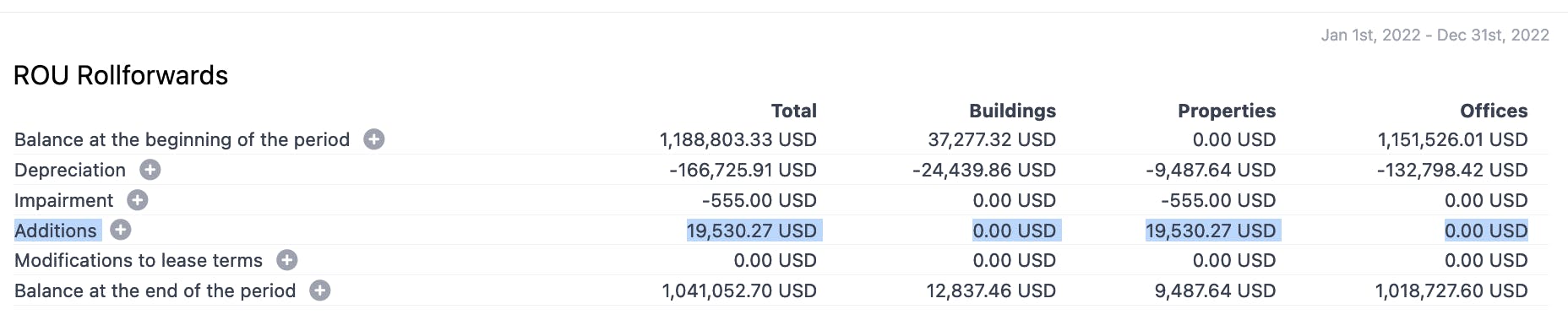

(h) additions to right-of-use assets;

This requirement refers to the new leases related to your lease portfolio. Naturally, by doing a roll-forward schedule, the additions form a part of the roll-forward schedule.

(i) gains or losses arising from sale and leaseback transactions; and

A sale and leaseback transaction is where an entity sells its asset to another entity and leases it back immediately after the sale materializes. This way, the entity can unlock a block of cash (in the form of sale proceeds) and continue to use the asset in their business (by leasing it back).

An entity would often end up making a gain or a loss on the sale of the said asset – this is in case the entity sells it for more or less than the asset's fair value as of the sale date.

(j) the carrying amount of right-of-use assets at the end of the reporting period by class of underlying asset.

This requirement again relates to the preparation of the ROU asset roll-forward schedule. As we reconcile the opening and closing balances of the ROU Asset, we automatically end up disclosing the carrying amount of ROU Asset at the end of the reporting period.

However, we must note that IFRS 16 requires the lessee to make these disclosures by asset class. All the above disclosures have been taken from Cradle's lease accounting software. As a result, your IFRS 16 disclosures take a second.

Tip!

Most of the disclosures that we’ve seen until now come stated in a tabular format. That’s because IFRS 16 requires these disclosures to be presented in a tabular format.

Para 54 of IFRS 16 states that a lessee shall provide the disclosures specified (in Paragraph 53) in a tabular format unless another format is more appropriate.

A lessee is given the choice to adopt a different approach for preparing the above disclosures. However, a tabular approach is the most appropriate for the understanding of the users of financial statements.

For example, you make a roll forward schedule of the ROU asset and lease liability provide a great way to meet the required disclosure requirements.

Additional Disclosures

Here are some other requirements of IFRS 16 that must be disclosed as a lessee.

Revalued ROU Assets

IAS 16 allows an entity to opt for either the cost or revaluation model of accounting for each class of assets.

As a lessee, if you follow the revaluation model of accounting for any of your ROU Assets, make sure to apply the disclosure requirements of IAS 16 too.

As per Para 57 of IFRS 16, If a lessee measures right-of-use assets at revalued amounts applying IAS 16, the lessee shall disclose the information required by paragraph 77 of IAS 16 for those right-of-use assets.

This information mostly includes details of:

- the independent valuer;

- the date of revaluation;

- the cost had there been no revaluation; and

- the revaluation surplus booked.

Lease Maturity Schedule

Paragraph 58 of IFRS 16 requires that A lessee shall disclose a maturity analysis of lease liabilities separately from the maturity analyses of other financial liabilities.

A lease maturity schedule is a summarized breakup of when the lease payments are due. This schedule is undiscounted lease payments, so it gives users of the financial statements of committed spending related to the lease portfolio.

If you were to use Cradle, preparing the maturity analysis takes about a second:

That’s all about the quantitative disclosures required by IFRS 16.

Qualitative Disclosures Required by IFRS 16

Let's now move on to the qualitative disclosures required from lessees. Paragraph 59 of IFRS 16 details the required qualitative disclosures:

| In addition to the disclosures required in paragraphs 53–58, a lessee shall disclose additional qualitative and quantitative information about its leasing activities necessary to meet the disclosure objective in paragraph 51 (as described in paragraph B48). This additional information may include, but is not limited to, information that helps users of financial statements to assess: |

| (a) The nature of the lessee’s leasing activities; |

(b) Future cash outflows to which the lessee is potentially exposed that are not reflected in the measurement of lease liabilities. This includes exposure arising from:

|

| (c) Restrictions or covenants imposed by leases; and |

| (d) Sale and leaseback transactions (as described in paragraph B52). |

Qualitative disclosure refers to non-numerical information in a company's financial report. This type of disclosure provides insights on how a company's lease portfolio impacts their strategies, risks, management, and more.

Now we'll break down each of IFRS 16's qualitative disclosures.

a. the nature of the lessee’s leasing activities;

This is a brief description of the nature of the leasing activities of the lessee. For example, here is an exemplary paragraph that explains the said.

“XYZ Company leases buildings and factories. These leases typically run for 8 to 10 years, with an option to renew/extend the lease after the expiry date. Lease payments are renegotiated after every 3 years to reflect the market rentals. However, for some leases, the company is not permitted to enter into sub-lease arrangements.

These leases are entered into as a combined lease of land and buildings. During the year, the company has sublet two buildings.”

b. future cash outflows to which the lessee is potentially exposed that are not reflected in the measurement of lease liabilities. This includes exposure arising from:

i. variable lease payments;

ii. extension options and termination options;

iii. residual value guarantees; and

iv. leases not yet commenced to which the lessee is committed.

All the potential lease outflows are presently valued and booked as lease liability. However, some potential lease payments might not be booked as a lease liability. These payments are usually those that are contingent upon an uncertain future event. For example, a lease agreement may have an extension option exercisable at the end of the lease term.

Such potential lease payment exposures (that are yet not certain to occur) should be disclosed.

For example, an extension option included in a lease agreement may be disclosed as follows.

“A few building leases entered into by the XYZ Company contain extension options exercisable by the Company up to two years before the end of the non-cancellable lease period. These extension options are only exercisable by the Company and not by the lessor.

The Company assesses whether it is reasonably certain to exercise the extension option at the commencement of the lease. It reassesses the same whenever a significant event or significant change in circumstances occurs. The Company has estimated that the potential future lease payments if it exercises the extension option, would result in an increase in the lease liability by $4,000.”

c. restrictions or covenants imposed by leases;

Often lease agreements will impose some restrictions or covenants on the lessee. For example, restriction on subleasing the leased asset forward. You’d have to go through your lease agreements to identify any such restrictions (imposed by the lessor).

For example:

“XYZ Company leases buildings and factories. These leases typically run for 8 to 10 years, with an option to renew/extend the lease after the expiry date. However, the company is restricted from entering into any sub-lease arrangements as per the terms of the lease agreement.”

This disclosure will generally form a part of the company’s nature of lease activities.

d. sale and leaseback transactions.

Under this requirement, IFRS 16 requires the seller-lessee to briefly narrate any sale and leaseback transactions entered into during the year. This disclosure should include the main terms and conditions (including a gain/loss arising on the sale) of the said transaction.

For example:

“During the year, XYZ company entered into a sale and leaseback transaction with ABC Company to sell its Building No. 123 and lease it back for 10 years. The sale and leaseback transaction resulted in a loss of USD 3,000 which is the net difference between the right of use asset and the lease liability recognized to account for the portion retained by the Company.”

Here concludes the list of qualitative disclosures required by Para 59.

e. Additionally, Para 60 requires lessees to disclose any leases accounted for as short-term leases or low-value assets.

We know about the exemption available to lessees in respect of short-term leases / low-value assets. The lessee may choose not to treat them as finance leases.

In respect of the qualitative disclosures on short-term leases / low-value assets, IFRS 16 only requires a brief explanation of these transactions. Like an exemplary disclosure reproduced below.

“The Company leases certain machinery with a contract term of less than one year. These leases are short-term leases. The Company elects not to recognize an ROU Asset or lease liability in respect of these leases.”

Disclosures related to COVID-19 Lease Concessions

When the world was battling one of the biggest pandemics of all time; COVID-19, the International Accounting Standards Board (IASB) issued amendments to IFRS 16 to not account for rent concessions as a lease modification if they’re a result of COVID-19 and meeting certain conditions.

Read more about what the standard has to say in light of the pandemic-related rent concessions here.

In addition to the revised accounting for covid related lease concessions, the standard also requires some disclosures to be given by the lessee in this respect.

What does the standard say about it?

As the practical expedient is optional to apply, IFRS 16 requires lessees to disclose:

- That they have applied the practical expedient of not treating rent concessions as lease modifications to all the concessions that meet the stipulated conditions;

- Or if the lessee has not applied the practical expedient to all the eligible rent concessions, information about the leases or concessions to which the practical expedient is applied.

Additionally, the lessee is also required to:

- Disclose the amount recognized in the profit and loss statement to reflect the changes in lease payments resulting from rent concessions to which the practical expedient is applied.

In this case, there would be a negative variable payment (an income) recognized in the Profit & Loss statement. Make sure to disclose it separately from other variable lease payments.

Example IFRS 16 Disclosures

Example 1: Quantitative Disclosures

We are now going to see an example of some lease agreements (from the perspective of a lessee) and disclosures to be given in respect thereof.

Assume the year-end for our financials to be 31 December 2023.

Lease 1: Land & Buildings

- Lease commencement date: 1 January 2020

- Lease end date: 31 December 2025

- Payments: $1,000 annually (paid at year-end; accruals)

- Discount Rate: 10%

- Lease Term: 6 years

- ROU Asset Value:

undefinedundefined

Lease 2: Machinery & Equipment

- Lease commencement date: 1 January 2023

- Lease end date: 31 December 2030

- Payments: $1,500 annually (paid at year-end; accruals)

- Discount Rate: 10%

- Lease Term: 8 years

- ROU Asset Value:

undefinedundefined

Other Information:

- Lease payments made against short term leases during the year: $1,500

- Lease payments made against low-value asset leases during the year: $2,500

- Variable lease payments made during the year: $200

- Lease income on subleasing of assets: $3,000

- Gain on Sale & Leaseback transactions entered during the year: $250

ROU Asset Roll Forward Schedule

Making an ROU Asset Roll Forward will automatically meet most of the quantitative disclosure requirements of IFRS 16.

We have prepared an right of use asset roll forward schedule for the year ended 31 December 2023 below here.

The lease for Machinery & Equipment commenced in 2023 and is shown as an Addition. IFRS 16 details the way to calculate depreciation and the closing balance of the Right of Use Asset based on the shorter useful life of the asset or the lease term.

To learn more about how to calculate the Right to Use Asset under IFRS 16, read out our article here.

Other Quantitative Disclosures

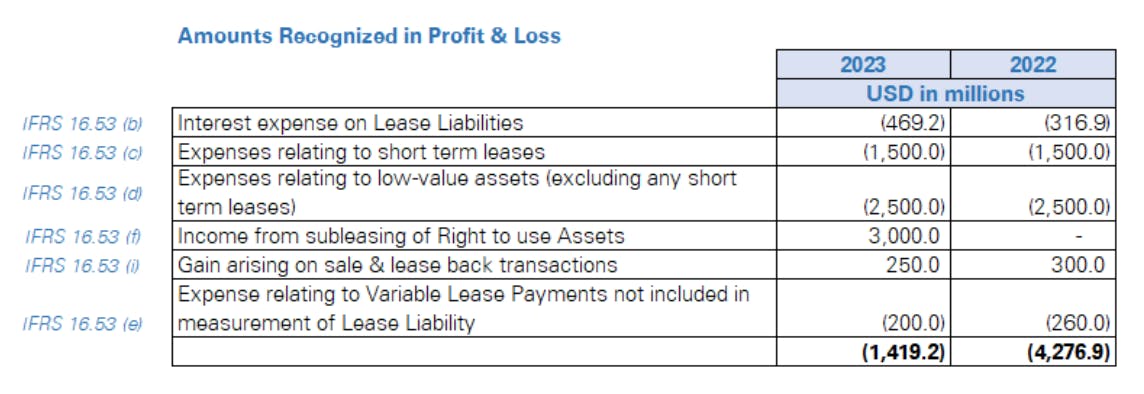

To meet the remaining quantitative disclosure requirements, the expenses/incomes booked during the year in the Statement of Profit & Loss should be disclosed as follows.

P.S: The figures for the comparative year are assumed for illustrative purposes only.

Other Quantitative Disclosures

To meet the remaining quantitative disclosure requirements, the expenses/incomes booked during the year in the Statement of Profit & Loss should be disclosed as follows.

P.S: The figures for the comparative year are assumed for illustrative purposes only.

This table will include all the lease-related expenses/incomes that take a hit on the profit and loss of the Company during the year. From recurring incomes/expenses (like interest) to one-off ones like any gain or loss on sale and leaseback.

How do you compute interest on Lease Liabilities? Find detailed guidance in our article linked here.

Lastly, we are missing out on one requirement of Paragraph 53. The total cash outflow in respect of leases.

Lessees are also required to prepare a Lease Maturity Schedule in accordance with the requirements of Paragraph 58 of IFRS 16. This also bifurcates the current and non-current portion of the outstanding Lease Liability.

Example 2: Qualitative Disclosures

For the qualitative disclosures to be given by a lessee, let’s refer to the Annual financial statements of Qantas Airways Limited for the year ended 2022.

| Nature of Leasing Activities: | The Group predominantly leases passenger aircraft and engines, freighter aircraft, domestic and international properties, and equipment. Lease contracts are typically entered into for fixed periods but may have extension options. [Ref: Note 38 (I)] |

| Future Cash Outflows | N/A |

| Restrictions / Covenants imposed by leases: | N/A |

| Sale & Leaseback | The Mascot land sale transaction included the leaseback of certain areas of land and buildings for between two to ten years with options. The net gain on sale of $686 million arising from the sale is net of the difference between the ROU Asset and lease liability recognized to account for the portion of the asset that is retained by the Group. The Group recognized investing cash inflows of $789 million from the transaction during the 2021/22 financial year. [Ref: Note 16 (D)] |

| Other Qualitative Disclosures: | N/A |

Conclusion

We have discussed all the disclosures that you’d have to prepare as a lessee.

As you can see it's a lot especially if you have to extract the numbers for indiviudal excel spreadsheets. An alterative is Cradle, just enter the lease details and the rest is done by the software including your required disclosures.