How to Reconcile Non GAAP Lease Accounting with ASC 842 for an Operating Lease

Lucas Russell 12/10/2022

If you're a finance team that has been too busy to implement ASC 842 from the company's transition date, this article has been specifically written to get your lease accounting up to date and in compliance with ASC 842.

First, if you're still trying to understand the changes in lease accounting that ASC 842 brings, I would recommend reading the following articles:

- ASC 842 summary

- How to Calculate the Present Value of Future Lease Payments

- How to Calculate the Lease Liability and Right-of-Use Asset for an Operating Lease under ASC 842

- History of Lease Accounting - Why we have the new lease accounting standards

This article will cover the steps to get your lease accounting up to date for year-end financial reporting.

Step 1 - Apply the required accounting under ASC 842

This is no easy feat and is the first step to getting your lease accounting compliant with ASC 842.

The key here is to apply the accounting under ASC 842 from the transition date of ASC 842. For many companies, a year-end of December 31 will mean calculating the lease accounting balances from the transition date of January 1.

This article explains this process step by step - How to Calculate the Lease Liability and Right-of-Use Asset for an Operating Lease under ASC 842.

Please note a shortcut cannot be taken here. For example, starting the calculation from December 31, 2022, will result in an incorrect right-of-use asset value.

Step 2 - Compare the non-GAAP accounting to ASC 842

Once you have calculated the balances for ASC 842, the next step is to compare that to the current non-GAAP accounting and make the necessary adjustments.

When making the comparison, you should consider the following:

1 You will have to recognize the right of use asset and lease liability: The first thing you will realize is if you want to post a simple journal entry about debiting the right of use asset and crediting lease liability. The two balances will not be equal. This is to be expected. That's because the amortization schedules are different. The difference is due to one of the balances incurring a higher lease expense. This difference is the balancing entry.

2 If you have booked the lease payments as an expense, they will not tie to the lease expense under ASC 842. It is a common area of confusion to think the lease payments made for the period, e.g. year, will equal the lease expense. However, as per the requirements of ASC 842 and accounting for an operating lease, that's not the case.

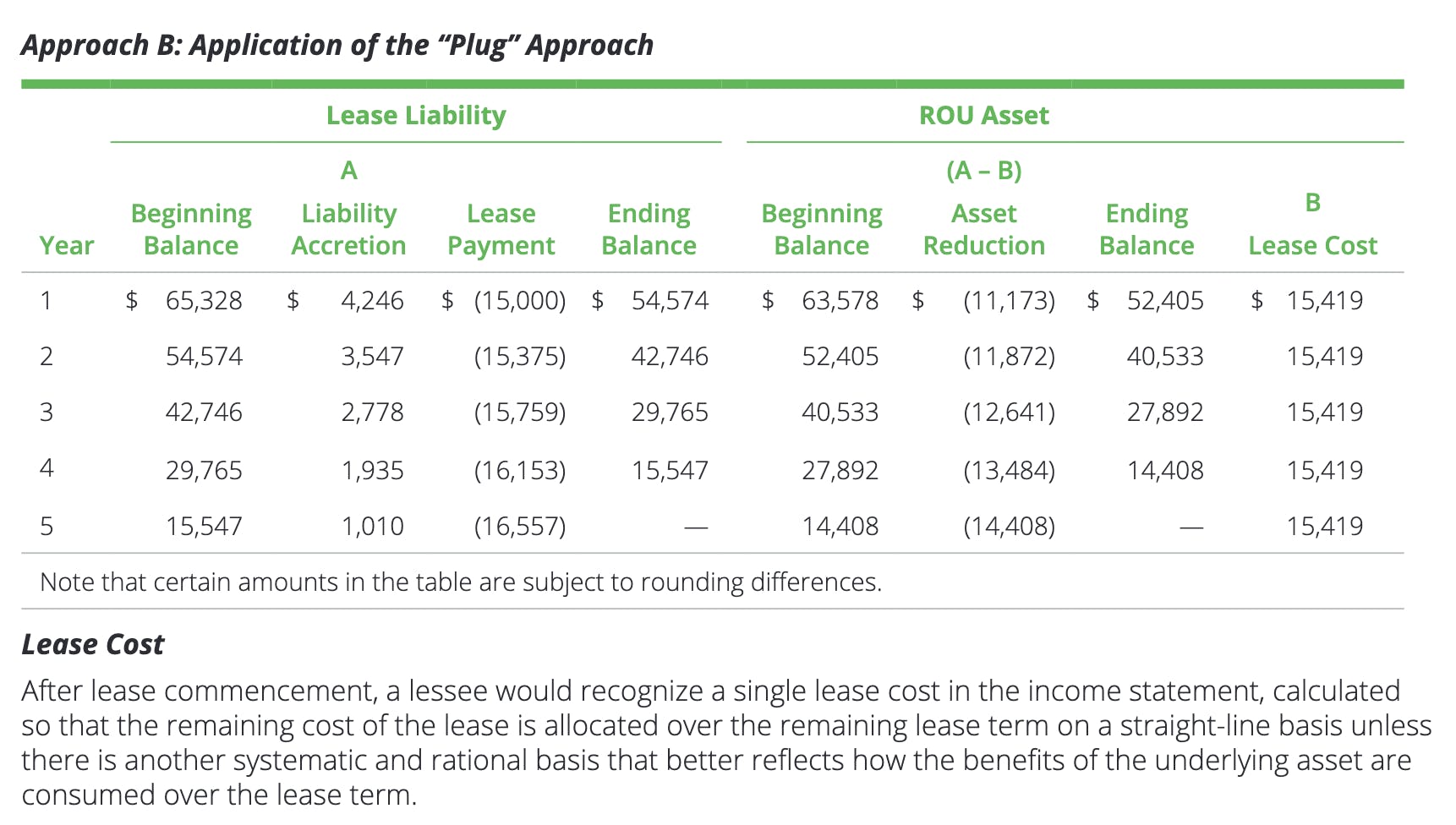

Deloitte, in their ASC 842 guide, A Roadmap to Applying the New Leasing Standard on p.340, has a great example that articulates this point:

We've also formula linked this calculation, which you can refer to here. But, again, you can see the lease payments do not equal the asset reduction, which is the lease expense for an operating lease.

Step 3 - Post a true up journal

By posting this journal entry you balances will be compliant with the new lease accounting standard as that specific point int time you choose to, for example December 31, 2022.

Scenario

In this example, we'll go through a scenario to true up non-GAAP lease accounting to comply with ASC 842. So in this example will compare non-GAAP lease accounting with ASC 842 and do the necessary journal entries.

- Transition date: 2022-1-1

- Accounting End date: 2023-12-31

- Fixed Payment Amount: $1,000

- 5% at Jan 1,2022

- Payment Timing: In Advance

- Payment Frequency: Monthly

- Lease classification: Operating Lease

- Discount rate: 7.00%

If you would like a copy of the excel calculation, which includes the ASC 842-compliant journals, please reach out to contact@cradleaccounting.com

Step 1 - Calculate the journals in compliance with ASC 842

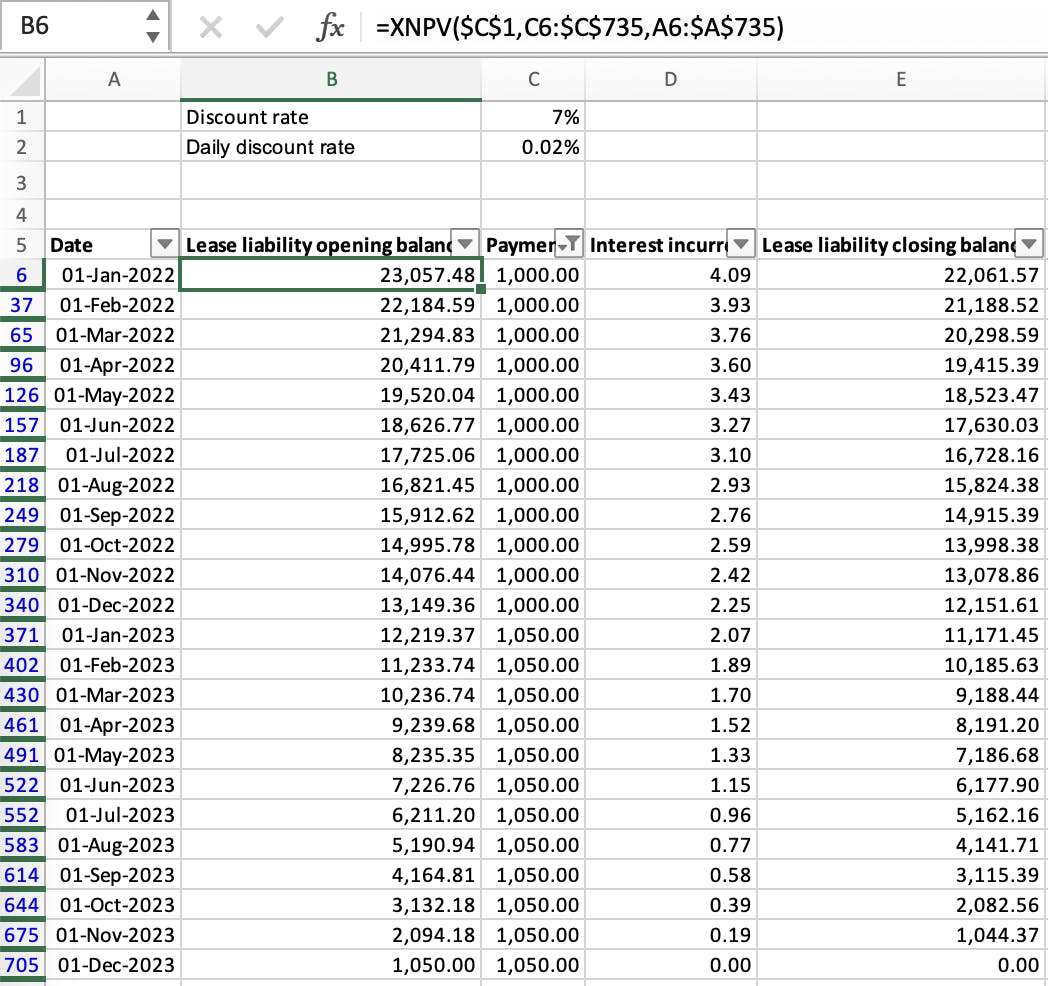

In the above example, the present value calculation uses the XNPV formula in Excel (for more information on how the XNPV formula works, refer here).

Here are the opening balances of the lease liability at the start of each month:

The two critical balances are the opening balance of $23,057.48 and the closing balance of December 31, 2022, at 12,219.37, which is the opening balance as of January 1, 2023.

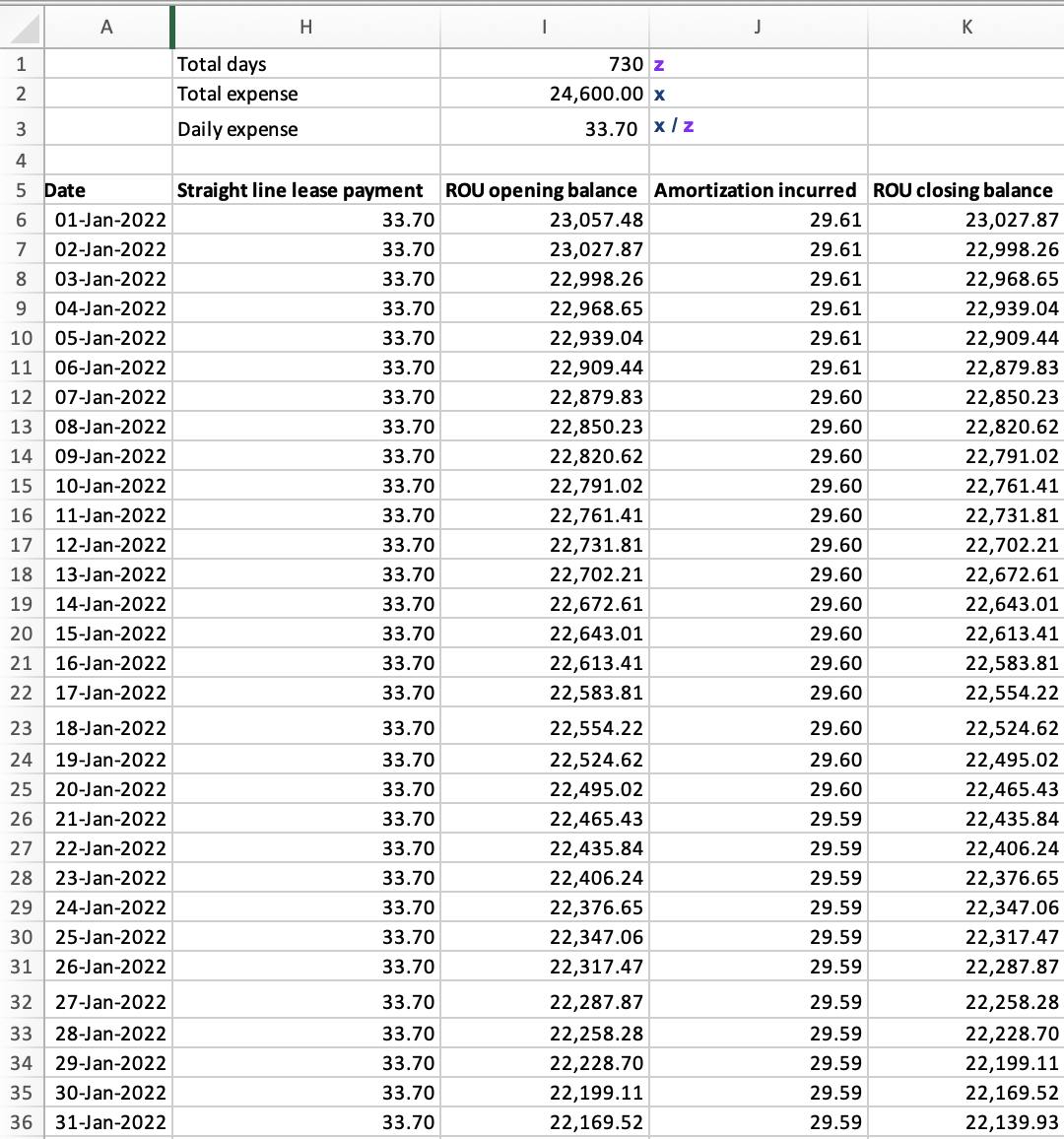

The amortization of the right-of-use asset will look like this:

This is a snapshot of the amortization calculation. For a detailed explanation of calculating the amortization expense of a right-of-use asset, refer to How to Calculate the Right-of-Use Asset Amortization and Lease Expense Under ASC 842.

The critical balance of the right-of-use asset is the closing balance on 31 December 2022 is 11,919.37.

Step 2 - Compare non GAAP accounting with ASC 842 compliant journal entries

| Non GAAP Journals | ||

|---|---|---|

| Lease expense | Dr | $12,000 |

| Cash | Cr | $12,000 |

| Lease expense incurred for 2022. | ||

| ASC 842 Journals | ||

|---|---|---|

| ROU Asset | Dr | $23,057.48 |

| Lease liability | Cr | $23,057.48 |

| Establishing the lease liability & ROU asset | ||

| Lease liability | Dr | $12,000.00 |

| Cash | Cr | $12,000.00 |

| Payment made | ||

| Lease expense | Dr | $11,138.10 |

| ROU asset | Cr | $11,138.10 |

| Amortization charge relating to the right of use asset (2022-01-01 to 2022-12-31) | ||

| Lease expense | Dr | $1,161.90 |

| Lease liability | Cr | $1,161.90 |

| Interest expense on the unwinding of the lease liability (2022-01-01 to 2022-12-31) | ||

You will notice that the ASC 842 journals are a lot more complicated. However, from a new account perspective, it's only the lease liability and right of use asset that need to be created. As a result, lease payment and lease expense are consistent across the previous lease accounting standard and ASC 842.

| Account | Non GAAP | ASC 842 |

|---|---|---|

| Cash | $12,000 | $12,000 |

| Lease liability | 0 | $12,219.38 |

| Right of use asset | 0 | $11,919.38 |

| Lease expense | $12,000 | $12,300 |

Hint

A common area of confusion with ASC 842 operating leases is the expectation that there is an interest and amortization income statement impact. That's not the lease. For an operating lease, there's only a "single lease cost" impact on the income statement.

The treatment is detailed explicitly in ASC 842-20-25-6. However, it's confusing. For example, for the lease liability calculation to work, you must calculate interest! The key is that the interest is classified as a lease expense instead of an interest expense.

On the other hand, a finance lease incurs an interest and amortization expense. If you're curious to learn more about how accounting differs between an operating and finance lease under ASC 842, refer to the article The Difference Between Calculating an Operating Lease and a Finance Lease Under ASC 842.

Step 3 - True up to ASC 842 accounting

ASC 842 closing balances as at December 31, 2022 are:

- Lease liability: $12,219.37

- Right of use asset: $11,919.37

Step 1 Recognize the lease liability and right of use asset as at December 31, 2022

| Right of use asset | Dr | $11,919.37 |

| Lease liability | Cr | $12,219.37 |

| Bringing the lease liabily and right of use asset on balance sheet at December 31, 2022. | ||

Step 2 Post balancing amount

Because the right of use asset and lease liability, does not equal which is expected, this journal entry does not balance.

As per ASC 842, an additional $300 lease expense must be incurred, which is the balancing amount. So the complete journal entry is:

| Right of use asset | Dr | $11,919.37 |

| Lease liability | Cr | $12,219.37 | Lease expense | Dr | $300 |

| Complete true-up journal for the lease to be compliant with ASC 842 at December 31, 2022 | ||

Conclusion

Getting an operating lease compliant with ASC 842 post-transition, e.g., 12 months after the adoption of the standard, results in an added complexity. The additional challenge arises when journals have been posted not in compliance with ASC 842 and the lease payments expensed to the income statement.

If that's the case, the processes follow two steps:

1) Perform the lease calculation to get the closing balances for the required period, for example, December 31.

2) Compare the ASC 842 journals to the non-GAAP expensed journals

3) Perform a true-up to correct the accounting to match ASC 842

See below for more articles that are useful when complying with ASC 842: